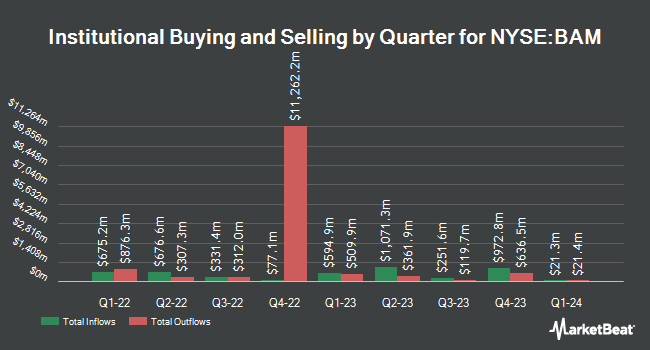

Canada Pension Plan Investment Board grew its holdings in Brookfield Asset Management Ltd. (NYSE:BAM - Free Report) TSE: BAM.A by 9.8% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 1,096,412 shares of the financial services provider's stock after acquiring an additional 97,445 shares during the quarter. Canada Pension Plan Investment Board owned 0.07% of Brookfield Asset Management worth $53,083,000 at the end of the most recent reporting period.

A number of other institutional investors also recently modified their holdings of the company. Cerity Partners LLC grew its holdings in Brookfield Asset Management by 36.6% during the first quarter. Cerity Partners LLC now owns 29,482 shares of the financial services provider's stock worth $1,428,000 after purchasing an additional 7,901 shares during the period. Teacher Retirement System of Texas grew its holdings in shares of Brookfield Asset Management by 9.9% during the 1st quarter. Teacher Retirement System of Texas now owns 68,700 shares of the financial services provider's stock valued at $3,329,000 after purchasing an additional 6,200 shares during the last quarter. Vanguard Group Inc. boosted its holdings in shares of Brookfield Asset Management by 1.8% during the 1st quarter. Vanguard Group Inc. now owns 17,204,794 shares of the financial services provider's stock valued at $832,833,000 after acquiring an additional 302,852 shares in the last quarter. Capital A Wealth Management LLC bought a new stake in Brookfield Asset Management during the 4th quarter worth approximately $412,000. Finally, BNP Paribas Financial Markets bought a new stake in shares of Brookfield Asset Management in the 4th quarter valued at about $183,000. 68.41% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

BAM has been the topic of several recent analyst reports. Piper Sandler assumed coverage on shares of Brookfield Asset Management in a research report on Monday, June 30th. They set a "neutral" rating and a $60.00 target price on the stock. CIBC boosted their price objective on shares of Brookfield Asset Management from $70.00 to $71.00 and gave the stock an "outperform" rating in a report on Thursday, August 7th. Jefferies Financial Group upped their target price on shares of Brookfield Asset Management from $55.00 to $62.00 and gave the stock a "hold" rating in a report on Wednesday, August 13th. National Bank Financial started coverage on Brookfield Asset Management in a report on Tuesday, July 29th. They issued an "outperform" rating and a $71.00 price target for the company. Finally, Scotiabank upped their price target on shares of Brookfield Asset Management from $66.00 to $67.25 and gave the company a "sector outperform" rating in a report on Thursday, August 7th. Two investment analysts have rated the stock with a Strong Buy rating, eight have issued a Buy rating, seven have issued a Hold rating and two have issued a Sell rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $63.52.

Get Our Latest Research Report on BAM

Brookfield Asset Management Stock Performance

Shares of NYSE BAM traded up $0.27 during midday trading on Thursday, hitting $58.78. The company's stock had a trading volume of 1,105,465 shares, compared to its average volume of 2,058,402. The company has a debt-to-equity ratio of 0.14, a quick ratio of 1.25 and a current ratio of 1.25. The firm's fifty day moving average price is $59.65 and its 200-day moving average price is $55.32. The firm has a market cap of $96.26 billion, a P/E ratio of 39.45, a P/E/G ratio of 2.20 and a beta of 1.44. Brookfield Asset Management Ltd. has a 1-year low of $40.44 and a 1-year high of $64.10.

Brookfield Asset Management (NYSE:BAM - Get Free Report) TSE: BAM.A last posted its quarterly earnings results on Wednesday, August 6th. The financial services provider reported $0.38 EPS for the quarter, missing the consensus estimate of $0.39 by ($0.01). The company had revenue of $1.11 billion for the quarter, compared to analyst estimates of $1.29 billion. Brookfield Asset Management had a return on equity of 41.12% and a net margin of 55.92%. On average, sell-side analysts forecast that Brookfield Asset Management Ltd. will post 1.7 EPS for the current fiscal year.

Brookfield Asset Management Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, September 29th. Stockholders of record on Friday, August 29th will be issued a dividend of $0.4375 per share. This represents a $1.75 annualized dividend and a dividend yield of 3.0%. The ex-dividend date of this dividend is Friday, August 29th. Brookfield Asset Management's dividend payout ratio is 117.45%.

Brookfield Asset Management Profile

(

Free Report)

Brookfield Asset Management Ltd. is a real estate investment firm specializing in alternative asset management services. Its renewable power and transition business includes the operates in the hydroelectric, wind, solar, distributed generation, and sustainable solution sector. The company's infrastructure business engages in the utilities, transport, midstream, and data infrastructure sectors.

See Also

Before you consider Brookfield Asset Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Asset Management wasn't on the list.

While Brookfield Asset Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.