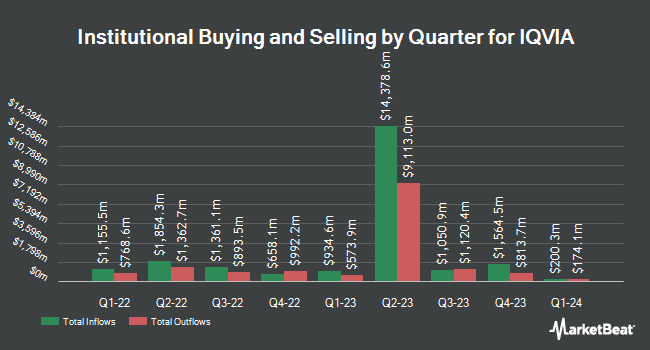

Canada Pension Plan Investment Board increased its holdings in IQVIA Holdings Inc. (NYSE:IQV - Free Report) by 7.3% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,594,831 shares of the medical research company's stock after purchasing an additional 312,807 shares during the period. IQVIA accounts for 0.8% of Canada Pension Plan Investment Board's investment portfolio, making the stock its 28th biggest position. Canada Pension Plan Investment Board owned about 2.66% of IQVIA worth $810,069,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also made changes to their positions in the company. American National Bank & Trust purchased a new stake in shares of IQVIA in the first quarter valued at $26,000. Clal Insurance Enterprises Holdings Ltd grew its position in shares of IQVIA by 436.7% in the first quarter. Clal Insurance Enterprises Holdings Ltd now owns 161 shares of the medical research company's stock valued at $28,000 after purchasing an additional 131 shares during the period. Golden State Wealth Management LLC grew its position in shares of IQVIA by 295.5% in the first quarter. Golden State Wealth Management LLC now owns 174 shares of the medical research company's stock valued at $31,000 after purchasing an additional 130 shares during the period. AllSquare Wealth Management LLC purchased a new stake in shares of IQVIA in the first quarter valued at $33,000. Finally, ST Germain D J Co. Inc. boosted its holdings in IQVIA by 66.1% in the first quarter. ST Germain D J Co. Inc. now owns 191 shares of the medical research company's stock valued at $34,000 after acquiring an additional 76 shares during the last quarter. Hedge funds and other institutional investors own 89.62% of the company's stock.

IQVIA Stock Down 0.3%

Shares of IQV traded down $0.52 during midday trading on Wednesday, reaching $183.23. 440,827 shares of the company were exchanged, compared to its average volume of 1,927,706. The stock has a 50-day moving average price of $178.24 and a 200-day moving average price of $167.60. The company has a market cap of $31.15 billion, a price-to-earnings ratio of 26.49, a P/E/G ratio of 2.09 and a beta of 1.32. IQVIA Holdings Inc. has a 1-year low of $134.65 and a 1-year high of $250.46. The company has a current ratio of 0.84, a quick ratio of 0.84 and a debt-to-equity ratio of 2.45.

IQVIA (NYSE:IQV - Get Free Report) last announced its earnings results on Tuesday, July 22nd. The medical research company reported $2.81 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.77 by $0.04. IQVIA had a return on equity of 30.05% and a net margin of 7.88%.The business had revenue of $4.02 billion for the quarter, compared to analyst estimates of $3.96 billion. During the same period in the previous year, the company earned $2.64 earnings per share. The company's revenue for the quarter was up 5.3% compared to the same quarter last year. IQVIA has set its FY 2025 guidance at 11.750-12.050 EPS. Research analysts expect that IQVIA Holdings Inc. will post 10.84 earnings per share for the current year.

Analysts Set New Price Targets

IQV has been the topic of a number of research analyst reports. Mizuho lifted their target price on IQVIA from $190.00 to $225.00 and gave the company an "outperform" rating in a report on Friday, July 25th. Barclays lifted their target price on IQVIA from $165.00 to $185.00 and gave the company an "equal weight" rating in a report on Wednesday, July 23rd. William Blair reiterated an "outperform" rating on shares of IQVIA in a report on Wednesday, July 23rd. UBS Group lifted their target price on IQVIA from $185.00 to $225.00 and gave the company a "buy" rating in a report on Wednesday, July 23rd. Finally, Truist Financial lifted their target price on IQVIA from $209.00 to $235.00 and gave the company a "buy" rating in a report on Wednesday, July 23rd. Seventeen research analysts have rated the stock with a Buy rating and six have given a Hold rating to the stock. According to MarketBeat.com, IQVIA currently has an average rating of "Moderate Buy" and a consensus target price of $229.86.

Get Our Latest Research Report on IQV

Insider Transactions at IQVIA

In other news, insider Eric Sherbet sold 5,800 shares of IQVIA stock in a transaction dated Wednesday, July 23rd. The stock was sold at an average price of $190.05, for a total transaction of $1,102,290.00. Following the sale, the insider directly owned 27,178 shares of the company's stock, valued at approximately $5,165,178.90. The trade was a 17.59% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Keriann Cherofsky sold 549 shares of IQVIA stock in a transaction dated Wednesday, July 23rd. The stock was sold at an average price of $191.53, for a total value of $105,149.97. Following the sale, the insider directly owned 2,910 shares in the company, valued at approximately $557,352.30. The trade was a 15.87% decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.60% of the stock is currently owned by insiders.

IQVIA Company Profile

(

Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Articles

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.