Canada Pension Plan Investment Board lessened its position in Prologis, Inc. (NYSE:PLD - Free Report) by 41.5% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 2,892,759 shares of the real estate investment trust's stock after selling 2,054,186 shares during the quarter. Canada Pension Plan Investment Board owned 0.31% of Prologis worth $323,382,000 at the end of the most recent reporting period.

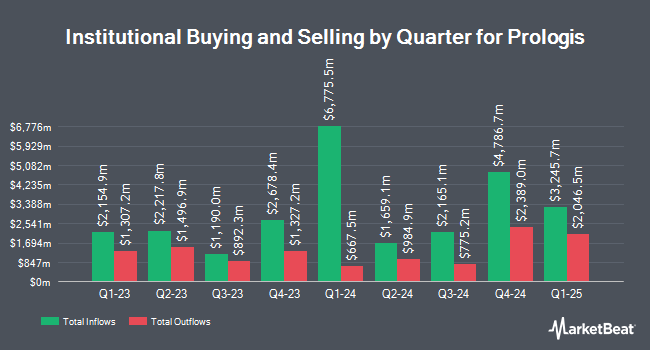

Other large investors have also recently made changes to their positions in the company. Brighton Jones LLC raised its holdings in shares of Prologis by 629.0% in the fourth quarter. Brighton Jones LLC now owns 17,475 shares of the real estate investment trust's stock valued at $1,847,000 after acquiring an additional 15,078 shares in the last quarter. AQR Capital Management LLC boosted its position in Prologis by 49.9% in the fourth quarter. AQR Capital Management LLC now owns 358,298 shares of the real estate investment trust's stock valued at $37,836,000 after buying an additional 119,297 shares during the last quarter. Keel Point LLC boosted its position in Prologis by 7.7% in the fourth quarter. Keel Point LLC now owns 2,986 shares of the real estate investment trust's stock valued at $316,000 after buying an additional 213 shares during the last quarter. Mercer Global Advisors Inc. ADV boosted its position in Prologis by 67.4% in the 4th quarter. Mercer Global Advisors Inc. ADV now owns 181,620 shares of the real estate investment trust's stock worth $19,197,000 after purchasing an additional 73,138 shares in the last quarter. Finally, South Plains Financial Inc. purchased a new stake in Prologis in the 4th quarter worth approximately $379,000. 93.50% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In related news, CAO Lori A. Palazzolo sold 25,000 shares of the firm's stock in a transaction dated Tuesday, August 26th. The stock was sold at an average price of $111.33, for a total transaction of $2,783,250.00. Following the completion of the transaction, the chief accounting officer directly owned 414 shares in the company, valued at $46,090.62. This trade represents a 98.37% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. 0.57% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

PLD has been the topic of a number of recent analyst reports. Mizuho set a $118.00 target price on Prologis and gave the company an "outperform" rating in a research report on Tuesday, August 19th. Scotiabank set a $114.00 target price on Prologis and gave the stock a "sector perform" rating in a research note on Wednesday, August 27th. Wells Fargo & Company set a $137.00 target price on shares of Prologis and gave the stock an "overweight" rating in a research note on Sunday, July 13th. UBS Group raised their price objective on Prologis from $106.00 to $120.00 and gave the stock a "buy" rating in a research report on Tuesday, July 8th. Finally, Truist Financial cut their price objective on Prologis from $123.00 to $120.00 and set a "buy" rating for the company in a research report on Monday, May 5th. Two investment analysts have rated the stock with a Strong Buy rating, eleven have issued a Buy rating and six have assigned a Hold rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $121.83.

Read Our Latest Research Report on PLD

Prologis Trading Up 1.1%

Shares of NYSE:PLD traded up $1.29 during midday trading on Monday, reaching $113.93. 2,827,596 shares of the company's stock were exchanged, compared to its average volume of 3,019,988. The firm's 50 day simple moving average is $107.91 and its two-hundred day simple moving average is $108.44. The company has a debt-to-equity ratio of 0.61, a current ratio of 0.65 and a quick ratio of 0.65. The stock has a market cap of $105.76 billion, a price-to-earnings ratio of 30.88, a P/E/G ratio of 2.85 and a beta of 1.26. Prologis, Inc. has a fifty-two week low of $85.35 and a fifty-two week high of $132.57.

Prologis (NYSE:PLD - Get Free Report) last announced its earnings results on Wednesday, July 16th. The real estate investment trust reported $1.46 EPS for the quarter, beating analysts' consensus estimates of $1.41 by $0.05. Prologis had a return on equity of 5.96% and a net margin of 40.29%.The company had revenue of $2.03 billion during the quarter, compared to analysts' expectations of $2.03 billion. During the same period last year, the business posted $1.34 EPS. Prologis's revenue for the quarter was up 8.8% on a year-over-year basis. Prologis has set its FY 2025 guidance at 5.750-5.800 EPS. As a group, sell-side analysts forecast that Prologis, Inc. will post 5.73 EPS for the current fiscal year.

Prologis Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Investors of record on Tuesday, September 16th will be issued a dividend of $1.01 per share. This represents a $4.04 dividend on an annualized basis and a yield of 3.5%. Prologis's dividend payout ratio (DPR) is 109.49%.

About Prologis

(

Free Report)

Prologis, Inc is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At March 31, 2024, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (115 million square meters) in 19 countries.

Featured Stories

Before you consider Prologis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prologis wasn't on the list.

While Prologis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.