Old West Investment Management LLC decreased its stake in Canadian Natural Resources Limited (NYSE:CNQ - Free Report) TSE: CNQ by 13.4% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 342,283 shares of the oil and gas producer's stock after selling 52,878 shares during the period. Canadian Natural Resources comprises about 3.8% of Old West Investment Management LLC's investment portfolio, making the stock its 9th biggest position. Old West Investment Management LLC's holdings in Canadian Natural Resources were worth $10,542,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

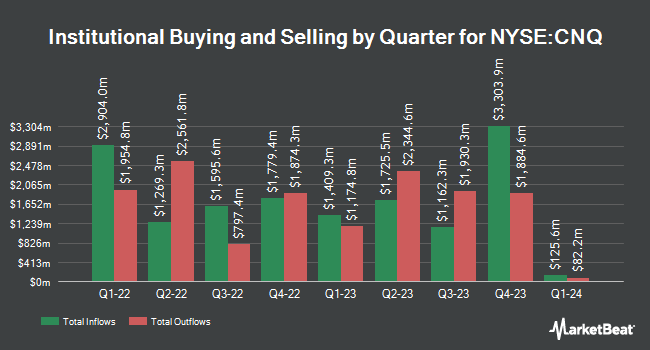

Other institutional investors have also recently made changes to their positions in the company. ICONIQ Capital LLC bought a new position in shares of Canadian Natural Resources during the 1st quarter valued at $204,000. Bahl & Gaynor Inc. grew its holdings in shares of Canadian Natural Resources by 38.4% during the 1st quarter. Bahl & Gaynor Inc. now owns 12,186 shares of the oil and gas producer's stock valued at $375,000 after purchasing an additional 3,380 shares during the last quarter. Northwestern Mutual Wealth Management Co. grew its holdings in shares of Canadian Natural Resources by 30.9% during the 1st quarter. Northwestern Mutual Wealth Management Co. now owns 97,880 shares of the oil and gas producer's stock valued at $3,015,000 after purchasing an additional 23,106 shares during the last quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp grew its holdings in shares of Canadian Natural Resources by 62.2% during the 1st quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 4,802,459 shares of the oil and gas producer's stock valued at $147,798,000 after purchasing an additional 1,842,497 shares during the last quarter. Finally, Compound Planning Inc. grew its holdings in shares of Canadian Natural Resources by 12.2% during the 1st quarter. Compound Planning Inc. now owns 17,788 shares of the oil and gas producer's stock valued at $548,000 after purchasing an additional 1,932 shares during the last quarter. Institutional investors own 74.03% of the company's stock.

Canadian Natural Resources Trading Up 0.6%

CNQ traded up $0.19 during trading on Friday, hitting $31.68. 6,081,073 shares of the stock traded hands, compared to its average volume of 5,735,944. The firm has a market capitalization of $66.17 billion, a P/E ratio of 11.23 and a beta of 1.05. The company has a debt-to-equity ratio of 0.38, a current ratio of 0.85 and a quick ratio of 0.54. The firm has a 50-day moving average of $31.17 and a 200 day moving average of $30.34. Canadian Natural Resources Limited has a 12-month low of $24.65 and a 12-month high of $37.91.

Canadian Natural Resources (NYSE:CNQ - Get Free Report) TSE: CNQ last posted its earnings results on Thursday, August 7th. The oil and gas producer reported $0.51 EPS for the quarter, topping the consensus estimate of $0.44 by $0.07. Canadian Natural Resources had a net margin of 19.00% and a return on equity of 19.67%. The firm had revenue of $6.39 billion during the quarter, compared to analysts' expectations of $8.97 billion. During the same period last year, the company posted $0.88 EPS. Equities research analysts anticipate that Canadian Natural Resources Limited will post 2.45 EPS for the current year.

Canadian Natural Resources Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, October 3rd. Stockholders of record on Friday, September 19th will be given a $0.4269 dividend. The ex-dividend date of this dividend is Friday, September 19th. This represents a $1.71 annualized dividend and a dividend yield of 5.4%. This is a positive change from Canadian Natural Resources's previous quarterly dividend of $0.42. Canadian Natural Resources's dividend payout ratio is 60.64%.

Analyst Ratings Changes

CNQ has been the topic of several recent research reports. Raymond James Financial reaffirmed an "outperform" rating on shares of Canadian Natural Resources in a report on Friday, August 8th. Scotiabank reaffirmed an "outperform" rating on shares of Canadian Natural Resources in a report on Friday, July 11th. National Bankshares reaffirmed a "sector perform" rating on shares of Canadian Natural Resources in a report on Thursday, July 17th. Zacks Research raised shares of Canadian Natural Resources from a "hold" rating to a "strong-buy" rating in a report on Tuesday. Finally, Royal Bank Of Canada dropped their price target on shares of Canadian Natural Resources from $64.00 to $62.00 and set an "outperform" rating for the company in a research report on Friday, August 8th. One analyst has rated the stock with a Strong Buy rating, four have issued a Buy rating and two have issued a Hold rating to the company. Based on data from MarketBeat.com, Canadian Natural Resources currently has an average rating of "Moderate Buy" and an average target price of $62.00.

View Our Latest Stock Report on Canadian Natural Resources

Canadian Natural Resources Profile

(

Free Report)

Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and synthetic crude oil (SCO).

Featured Articles

Before you consider Canadian Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Natural Resources wasn't on the list.

While Canadian Natural Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.