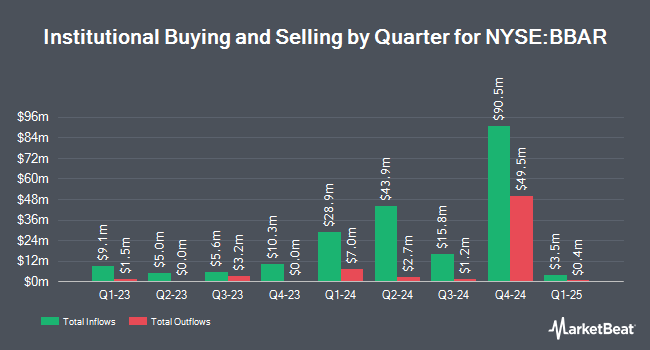

Candriam S.C.A. purchased a new position in shares of BBVA Banco Frances S.A. (NYSE:BBAR - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 67,000 shares of the bank's stock, valued at approximately $1,214,000.

Several other large investors have also modified their holdings of BBAR. GAMMA Investing LLC raised its stake in BBVA Banco Frances by 27.1% during the first quarter. GAMMA Investing LLC now owns 5,303 shares of the bank's stock worth $96,000 after acquiring an additional 1,132 shares during the period. Fox Run Management L.L.C. acquired a new stake in BBVA Banco Frances during the first quarter worth about $211,000. Private Advisor Group LLC acquired a new stake in BBVA Banco Frances during the first quarter worth about $224,000. NewEdge Advisors LLC raised its stake in BBVA Banco Frances by 1,332.9% during the fourth quarter. NewEdge Advisors LLC now owns 14,759 shares of the bank's stock worth $281,000 after acquiring an additional 13,729 shares during the period. Finally, Baader Bank Aktiengesellschaft acquired a new stake in BBVA Banco Frances during the first quarter worth about $312,000.

Analysts Set New Price Targets

BBAR has been the topic of several analyst reports. Wall Street Zen lowered shares of BBVA Banco Frances from a "buy" rating to a "hold" rating in a research note on Sunday, August 10th. Itau BBA Securities began coverage on BBVA Banco Frances in a report on Tuesday, May 20th. They set a "market perform" rating and a $18.00 price target on the stock. One analyst has rated the stock with a Buy rating and one has issued a Hold rating to the company. According to MarketBeat.com, BBVA Banco Frances presently has an average rating of "Moderate Buy" and a consensus target price of $22.50.

View Our Latest Research Report on BBVA Banco Frances

BBVA Banco Frances Price Performance

NYSE:BBAR traded down $0.07 during midday trading on Friday, hitting $12.52. 136,021 shares of the stock were exchanged, compared to its average volume of 761,289. BBVA Banco Frances S.A. has a one year low of $9.34 and a one year high of $25.01. The company has a market capitalization of $2.56 billion, a price-to-earnings ratio of 9.34 and a beta of 1.18. The business has a 50-day moving average price of $15.62 and a two-hundred day moving average price of $17.94. The company has a current ratio of 1.11, a quick ratio of 1.05 and a debt-to-equity ratio of 0.27.

BBVA Banco Frances (NYSE:BBAR - Get Free Report) last posted its quarterly earnings results on Wednesday, August 20th. The bank reported $0.24 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.37 by ($0.13). BBVA Banco Frances had a return on equity of 10.24% and a net margin of 6.65%.The business had revenue of $524.41 million during the quarter, compared to analyst estimates of $727.31 billion. Sell-side analysts predict that BBVA Banco Frances S.A. will post 1.94 EPS for the current year.

BBVA Banco Frances Dividend Announcement

The business also recently announced a monthly dividend, which was paid on Monday, August 25th. Shareholders of record on Monday, August 18th were paid a dividend of $0.0221 per share. The ex-dividend date of this dividend was Monday, August 18th. This represents a c) dividend on an annualized basis and a dividend yield of 2.1%. BBVA Banco Frances's dividend payout ratio (DPR) is 20.15%.

BBVA Banco Frances Profile

(

Free Report)

Banco BBVA Argentina SA provides various banking products and services to individuals and companies in Argentina. The company provides retail banking products and services, such as checking and savings accounts, time deposits, credit cards financing, consumer and pledge loans, mortgages, insurance, and investment products to individuals; and small and medium-sized companies products and services, including financing products, factoring, checking accounts, time deposits, transactional and payroll services, insurance, and investment products to private-sector companies.

Featured Stories

Before you consider BBVA Banco Frances, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BBVA Banco Frances wasn't on the list.

While BBVA Banco Frances currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.