Capital Advisory Group Advisory Services LLC bought a new position in shares of Renasant Co. (NASDAQ:RNST - Free Report) during the second quarter, according to the company in its most recent disclosure with the SEC. The firm bought 8,082 shares of the financial services provider's stock, valued at approximately $290,000.

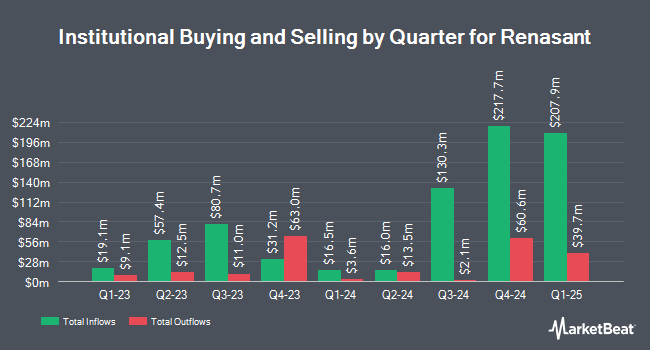

A number of other large investors also recently bought and sold shares of RNST. Ameriprise Financial Inc. lifted its holdings in Renasant by 38.9% during the 4th quarter. Ameriprise Financial Inc. now owns 209,083 shares of the financial services provider's stock worth $7,475,000 after buying an additional 58,526 shares during the last quarter. Deutsche Bank AG lifted its holdings in Renasant by 61.9% during the 4th quarter. Deutsche Bank AG now owns 50,346 shares of the financial services provider's stock worth $1,800,000 after buying an additional 19,240 shares during the last quarter. Janus Henderson Group PLC lifted its holdings in Renasant by 19.2% during the 4th quarter. Janus Henderson Group PLC now owns 29,127 shares of the financial services provider's stock worth $1,042,000 after buying an additional 4,700 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its holdings in Renasant by 5.5% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 35,546 shares of the financial services provider's stock worth $1,271,000 after buying an additional 1,862 shares during the last quarter. Finally, Nuveen Asset Management LLC lifted its holdings in Renasant by 0.6% during the 4th quarter. Nuveen Asset Management LLC now owns 395,764 shares of the financial services provider's stock worth $14,149,000 after buying an additional 2,405 shares during the last quarter. Institutional investors own 77.31% of the company's stock.

Analyst Upgrades and Downgrades

RNST has been the topic of several analyst reports. Hovde Group raised their target price on Renasant from $35.00 to $39.00 and gave the company a "market perform" rating in a research report on Wednesday, July 23rd. Raymond James Financial reiterated a "strong-buy" rating on shares of Renasant in a research report on Wednesday, July 23rd. One equities research analyst has rated the stock with a Strong Buy rating, three have assigned a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Buy" and an average target price of $42.60.

Check Out Our Latest Stock Analysis on RNST

Renasant Price Performance

Shares of RNST stock traded down $0.75 during mid-day trading on Monday, hitting $37.56. 419,481 shares of the stock traded hands, compared to its average volume of 711,841. Renasant Co. has a twelve month low of $26.97 and a twelve month high of $40.40. The firm has a market cap of $3.57 billion, a price-to-earnings ratio of 11.49 and a beta of 0.93. The company's 50-day simple moving average is $37.88 and its 200-day simple moving average is $35.32. The company has a debt-to-equity ratio of 0.16, a quick ratio of 0.94 and a current ratio of 0.96.

Renasant Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Investors of record on Tuesday, September 16th will be issued a $0.22 dividend. This represents a $0.88 dividend on an annualized basis and a dividend yield of 2.3%. The ex-dividend date is Tuesday, September 16th. Renasant's payout ratio is presently 34.65%.

About Renasant

(

Free Report)

Renasant Corporation operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers. The company operates through Community Banks, Insurance, and Wealth Management segments. The Community Banks segment offers checking and savings accounts, business and personal loans, asset-based lending, and factoring equipment leasing services, as well as safe deposit and night depository facilities.

Featured Articles

Before you consider Renasant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Renasant wasn't on the list.

While Renasant currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.