Capital Fund Management S.A. trimmed its holdings in shares of Deutsche Bank Aktiengesellschaft (NYSE:DB - Free Report) by 42.1% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 71,298 shares of the bank's stock after selling 51,921 shares during the quarter. Capital Fund Management S.A.'s holdings in Deutsche Bank Aktiengesellschaft were worth $1,699,000 at the end of the most recent reporting period.

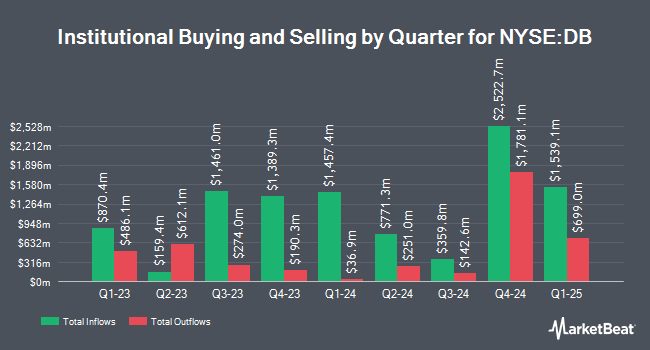

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Farther Finance Advisors LLC increased its position in shares of Deutsche Bank Aktiengesellschaft by 96.5% during the first quarter. Farther Finance Advisors LLC now owns 1,629 shares of the bank's stock valued at $39,000 after acquiring an additional 800 shares during the last quarter. Zions Bancorporation National Association UT acquired a new stake in shares of Deutsche Bank Aktiengesellschaft during the first quarter valued at about $39,000. MassMutual Private Wealth & Trust FSB increased its holdings in Deutsche Bank Aktiengesellschaft by 21.3% in the 1st quarter. MassMutual Private Wealth & Trust FSB now owns 2,412 shares of the bank's stock valued at $57,000 after purchasing an additional 424 shares during the last quarter. Federated Hermes Inc. increased its holdings in Deutsche Bank Aktiengesellschaft by 651.9% in the 1st quarter. Federated Hermes Inc. now owns 4,910 shares of the bank's stock valued at $116,000 after purchasing an additional 4,257 shares during the last quarter. Finally, GAMMA Investing LLC increased its holdings in Deutsche Bank Aktiengesellschaft by 2,319.7% in the 1st quarter. GAMMA Investing LLC now owns 6,267 shares of the bank's stock valued at $149,000 after purchasing an additional 6,008 shares during the last quarter. 27.90% of the stock is owned by institutional investors and hedge funds.

Deutsche Bank Aktiengesellschaft Stock Down 0.5%

DB traded down $0.19 on Friday, hitting $35.17. 1,827,637 shares of the company were exchanged, compared to its average volume of 2,570,104. Deutsche Bank Aktiengesellschaft has a twelve month low of $15.20 and a twelve month high of $37.54. The company has a market cap of $70.05 billion, a price-to-earnings ratio of 13.37, a price-to-earnings-growth ratio of 0.43 and a beta of 1.03. The company has a current ratio of 0.79, a quick ratio of 0.79 and a debt-to-equity ratio of 1.39. The firm has a 50-day moving average price of $32.65 and a two-hundred day moving average price of $27.58.

Deutsche Bank Aktiengesellschaft (NYSE:DB - Get Free Report) last announced its quarterly earnings data on Thursday, July 24th. The bank reported $0.54 EPS for the quarter, missing analysts' consensus estimates of $0.78 by ($0.24). Deutsche Bank Aktiengesellschaft had a return on equity of 6.01% and a net margin of 7.67%.The company had revenue of $9.21 billion for the quarter, compared to analyst estimates of $7.80 billion. On average, equities analysts predict that Deutsche Bank Aktiengesellschaft will post 2.93 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on DB. Zacks Research downgraded shares of Deutsche Bank Aktiengesellschaft from a "strong-buy" rating to a "hold" rating in a report on Friday, August 22nd. Citigroup reaffirmed a "sell" rating on shares of Deutsche Bank Aktiengesellschaft in a research note on Friday, July 25th. Kepler Capital Markets downgraded Deutsche Bank Aktiengesellschaft from a "strong-buy" rating to a "hold" rating in a research report on Monday, July 28th. Royal Bank Of Canada reaffirmed an "outperform" rating on shares of Deutsche Bank Aktiengesellschaft in a research report on Monday, July 28th. Finally, The Goldman Sachs Group downgraded Deutsche Bank Aktiengesellschaft from a "buy" rating to a "neutral" rating in a research report on Tuesday, August 26th. Four analysts have rated the stock with a Buy rating, four have given a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat, Deutsche Bank Aktiengesellschaft has an average rating of "Hold".

Get Our Latest Report on Deutsche Bank Aktiengesellschaft

Deutsche Bank Aktiengesellschaft Company Profile

(

Free Report)

Deutsche Bank Aktiengesellschaft, a stock corporation, provides corporate and investment banking, and asset management products and services to private individuals, corporate entities, and institutional clients in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Featured Stories

Before you consider Deutsche Bank Aktiengesellschaft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deutsche Bank Aktiengesellschaft wasn't on the list.

While Deutsche Bank Aktiengesellschaft currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.