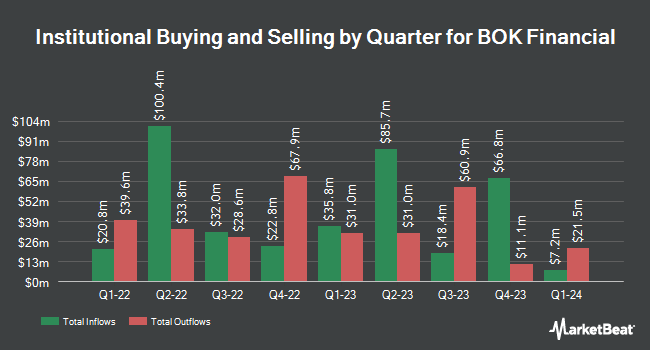

Captrust Financial Advisors purchased a new position in BOK Financial Co. (NASDAQ:BOKF - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund purchased 3,461 shares of the bank's stock, valued at approximately $368,000.

Other hedge funds have also bought and sold shares of the company. Merit Financial Group LLC bought a new stake in shares of BOK Financial in the 4th quarter worth about $256,000. SG Americas Securities LLC grew its holdings in BOK Financial by 433.0% during the 4th quarter. SG Americas Securities LLC now owns 9,216 shares of the bank's stock valued at $981,000 after purchasing an additional 7,487 shares during the last quarter. KBC Group NV grew its holdings in BOK Financial by 32.7% during the 4th quarter. KBC Group NV now owns 1,201 shares of the bank's stock valued at $128,000 after purchasing an additional 296 shares during the last quarter. Meritage Portfolio Management bought a new position in BOK Financial during the 4th quarter valued at about $444,000. Finally, Entropy Technologies LP bought a new position in BOK Financial in the 4th quarter worth about $671,000. Hedge funds and other institutional investors own 34.44% of the company's stock.

BOK Financial Stock Down 0.6%

Shares of NASDAQ:BOKF traded down $0.53 during trading on Friday, hitting $92.90. 130,250 shares of the company were exchanged, compared to its average volume of 160,310. The stock has a market capitalization of $5.97 billion, a P/E ratio of 11.43 and a beta of 0.87. The company has a debt-to-equity ratio of 0.57, a current ratio of 0.75 and a quick ratio of 0.79. BOK Financial Co. has a 12-month low of $85.08 and a 12-month high of $121.58. The firm's 50 day moving average price is $95.33 and its 200-day moving average price is $105.44.

BOK Financial (NASDAQ:BOKF - Get Free Report) last issued its quarterly earnings data on Monday, April 21st. The bank reported $1.86 earnings per share for the quarter, missing the consensus estimate of $2.01 by ($0.15). BOK Financial had a return on equity of 9.86% and a net margin of 15.32%. The company had revenue of $500.37 million for the quarter, compared to analysts' expectations of $520.86 million. On average, research analysts predict that BOK Financial Co. will post 8.83 earnings per share for the current fiscal year.

BOK Financial Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, May 28th. Investors of record on Thursday, May 15th will be given a $0.57 dividend. The ex-dividend date of this dividend is Thursday, May 15th. This represents a $2.28 annualized dividend and a yield of 2.45%. BOK Financial's dividend payout ratio (DPR) is 26.21%.

Analysts Set New Price Targets

A number of equities research analysts recently commented on BOKF shares. Raymond James set a $105.00 target price on shares of BOK Financial in a research report on Tuesday, April 22nd. Jefferies Financial Group started coverage on shares of BOK Financial in a research report on Wednesday. They set a "hold" rating and a $105.00 target price for the company. Stephens decreased their target price on shares of BOK Financial from $124.00 to $110.00 and set an "equal weight" rating for the company in a research report on Wednesday, April 23rd. Wells Fargo & Company decreased their target price on shares of BOK Financial from $120.00 to $100.00 and set an "equal weight" rating for the company in a research report on Wednesday, April 9th. Finally, Royal Bank of Canada decreased their target price on shares of BOK Financial from $119.00 to $104.00 and set a "sector perform" rating for the company in a research report on Wednesday, April 23rd. Eight analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $111.00.

Read Our Latest Stock Report on BOKF

BOK Financial Company Profile

(

Free Report)

BOK Financial Corporation operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri. It operates through three segments: Commercial Banking, Consumer Banking, and Wealth Management.

See Also

Before you consider BOK Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BOK Financial wasn't on the list.

While BOK Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.