Carderock Capital Management Inc. trimmed its position in shares of Quanta Services, Inc. (NYSE:PWR - Free Report) by 17.5% during the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 23,379 shares of the construction company's stock after selling 4,948 shares during the period. Quanta Services makes up approximately 2.3% of Carderock Capital Management Inc.'s holdings, making the stock its 16th biggest holding. Carderock Capital Management Inc.'s holdings in Quanta Services were worth $8,839,000 at the end of the most recent quarter.

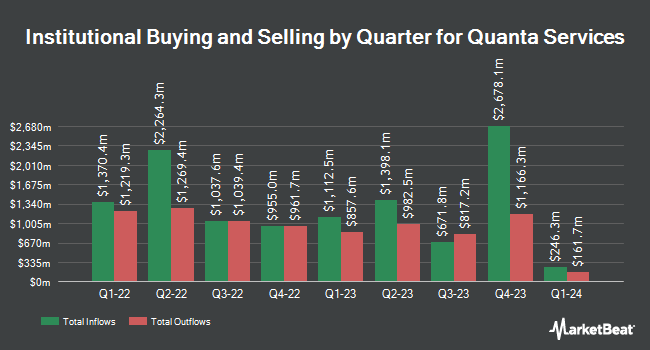

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Cullen Frost Bankers Inc. purchased a new stake in Quanta Services during the 1st quarter valued at $25,000. WPG Advisers LLC bought a new position in Quanta Services in the 1st quarter valued at $31,000. AlphaQuest LLC bought a new position in Quanta Services in the 1st quarter valued at $35,000. Zions Bancorporation National Association UT bought a new position in Quanta Services in the 1st quarter valued at $40,000. Finally, OLD Second National Bank of Aurora bought a new position in Quanta Services in the 1st quarter valued at $42,000. Hedge funds and other institutional investors own 90.49% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on PWR. Citigroup increased their price target on Quanta Services from $432.00 to $492.00 and gave the stock a "buy" rating in a research report on Monday, July 28th. Roth Capital reissued a "buy" rating and set a $450.00 price target (up previously from $350.00) on shares of Quanta Services in a research report on Tuesday, July 29th. Piper Sandler reissued an "overweight" rating and set a $370.00 price target (up previously from $360.00) on shares of Quanta Services in a research report on Tuesday, May 27th. TD Cowen raised their price objective on Quanta Services from $355.00 to $425.00 and gave the company a "buy" rating in a research report on Tuesday, August 5th. Finally, Stifel Nicolaus raised their price target on Quanta Services from $411.00 to $432.00 and gave the stock a "buy" rating in a report on Monday, August 4th. Twelve investment analysts have rated the stock with a Buy rating and twelve have given a Hold rating to the stock. According to MarketBeat.com, Quanta Services has a consensus rating of "Moderate Buy" and a consensus target price of $401.19.

Get Our Latest Stock Analysis on Quanta Services

Quanta Services Stock Performance

NYSE:PWR traded down $3.64 during mid-day trading on Tuesday, reaching $392.38. 165,335 shares of the stock were exchanged, compared to its average volume of 1,343,004. The company has a 50 day simple moving average of $388.08 and a 200-day simple moving average of $341.07. The stock has a market capitalization of $58.47 billion, a P/E ratio of 60.74, a P/E/G ratio of 2.31 and a beta of 1.01. The company has a quick ratio of 1.32, a current ratio of 1.37 and a debt-to-equity ratio of 0.59. Quanta Services, Inc. has a 1 year low of $227.08 and a 1 year high of $424.94.

Quanta Services (NYSE:PWR - Get Free Report) last announced its earnings results on Thursday, July 31st. The construction company reported $2.48 earnings per share for the quarter, beating the consensus estimate of $2.44 by $0.04. Quanta Services had a return on equity of 18.41% and a net margin of 3.73%.The company had revenue of $6.77 billion for the quarter, compared to the consensus estimate of $6.55 billion. During the same period last year, the business posted $1.90 EPS. The company's revenue was up 21.1% on a year-over-year basis. Quanta Services has set its FY 2025 guidance at 10.280-10.880 EPS. Analysts anticipate that Quanta Services, Inc. will post 9.34 earnings per share for the current fiscal year.

Quanta Services Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, October 10th. Stockholders of record on Wednesday, October 1st will be given a $0.10 dividend. The ex-dividend date of this dividend is Wednesday, October 1st. This represents a $0.40 dividend on an annualized basis and a dividend yield of 0.1%. Quanta Services's payout ratio is currently 6.19%.

About Quanta Services

(

Free Report)

Quanta Services, Inc provides infrastructure solutions for the electric and gas utility, renewable energy, communications, and pipeline and energy industries in the United States, Canada, Australia, and internationally. The company's Electric Power Infrastructure Solutions segment engages in the design, procurement, construction, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure and substation facilities; installation, maintenance, and upgrade of electric power infrastructure projects; installation of smart grid technologies on electric power networks; and design, installation, maintenance, and repair of commercial and industrial wirings.

Further Reading

Before you consider Quanta Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quanta Services wasn't on the list.

While Quanta Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.