Cumberland Partners Ltd decreased its position in shares of Carrier Global Corporation (NYSE:CARR - Free Report) by 66.2% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 22,095 shares of the company's stock after selling 43,370 shares during the period. Cumberland Partners Ltd's holdings in Carrier Global were worth $1,401,000 at the end of the most recent quarter.

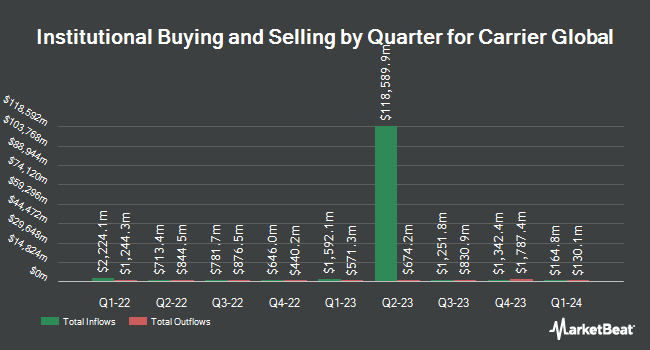

A number of other hedge funds and other institutional investors also recently bought and sold shares of the company. Syon Capital LLC raised its holdings in Carrier Global by 2.2% in the fourth quarter. Syon Capital LLC now owns 7,089 shares of the company's stock valued at $484,000 after acquiring an additional 155 shares in the last quarter. Lindbrook Capital LLC grew its stake in shares of Carrier Global by 1.3% during the first quarter. Lindbrook Capital LLC now owns 12,294 shares of the company's stock worth $779,000 after purchasing an additional 156 shares in the last quarter. Code Waechter LLC increased its holdings in Carrier Global by 5.1% in the first quarter. Code Waechter LLC now owns 3,383 shares of the company's stock valued at $214,000 after buying an additional 164 shares during the last quarter. Essex Financial Services Inc. raised its stake in Carrier Global by 0.4% in the first quarter. Essex Financial Services Inc. now owns 41,778 shares of the company's stock valued at $2,649,000 after buying an additional 173 shares in the last quarter. Finally, Beck Mack & Oliver LLC lifted its holdings in Carrier Global by 1.9% during the 4th quarter. Beck Mack & Oliver LLC now owns 9,124 shares of the company's stock worth $623,000 after buying an additional 174 shares during the last quarter. 91.00% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on CARR shares. The Goldman Sachs Group restated a "buy" rating on shares of Carrier Global in a research note on Wednesday, May 21st. Northcoast Research upgraded shares of Carrier Global from a "neutral" rating to a "buy" rating and set a $85.00 target price for the company in a report on Friday, May 9th. Royal Bank Of Canada dropped their target price on shares of Carrier Global from $89.00 to $87.00 and set an "outperform" rating on the stock in a research report on Wednesday, July 30th. Melius initiated coverage on shares of Carrier Global in a research report on Tuesday, July 1st. They issued a "hold" rating and a $90.00 price target for the company. Finally, Barclays dropped their price objective on Carrier Global from $84.00 to $82.00 and set an "overweight" rating on the stock in a report on Wednesday, July 30th. Seven analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $84.47.

Read Our Latest Research Report on CARR

Insider Transactions at Carrier Global

In other Carrier Global news, Director Maximilian Viessmann sold 4,267,425 shares of the business's stock in a transaction on Thursday, June 5th. The shares were sold at an average price of $70.30, for a total transaction of $299,999,977.50. Following the sale, the director directly owned 54,341,534 shares in the company, valued at approximately $3,820,209,840.20. The trade was a 7.28% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 7.20% of the company's stock.

Carrier Global Stock Performance

Shares of NYSE:CARR traded down $0.29 during midday trading on Wednesday, hitting $66.10. The stock had a trading volume of 2,412,652 shares, compared to its average volume of 5,335,979. Carrier Global Corporation has a 1 year low of $54.22 and a 1 year high of $83.32. The company has a current ratio of 1.17, a quick ratio of 0.80 and a debt-to-equity ratio of 0.76. The stock has a 50 day moving average price of $73.14 and a two-hundred day moving average price of $68.28. The company has a market capitalization of $56.25 billion, a PE ratio of 14.40, a P/E/G ratio of 1.83 and a beta of 1.25.

Carrier Global (NYSE:CARR - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The company reported $0.92 EPS for the quarter, beating analysts' consensus estimates of $0.90 by $0.02. Carrier Global had a net margin of 18.33% and a return on equity of 17.83%. The firm had revenue of $6.11 billion during the quarter, compared to the consensus estimate of $6.08 billion. As a group, equities analysts predict that Carrier Global Corporation will post 2.99 earnings per share for the current fiscal year.

Carrier Global Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, August 8th. Shareholders of record on Monday, July 21st will be given a $0.225 dividend. The ex-dividend date is Monday, July 21st. This represents a $0.90 annualized dividend and a yield of 1.4%. Carrier Global's dividend payout ratio is presently 19.61%.

Carrier Global Company Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

See Also

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.