Cary Street Partners Financial LLC bought a new position in shares of Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm bought 2,370 shares of the mining company's stock, valued at approximately $257,000.

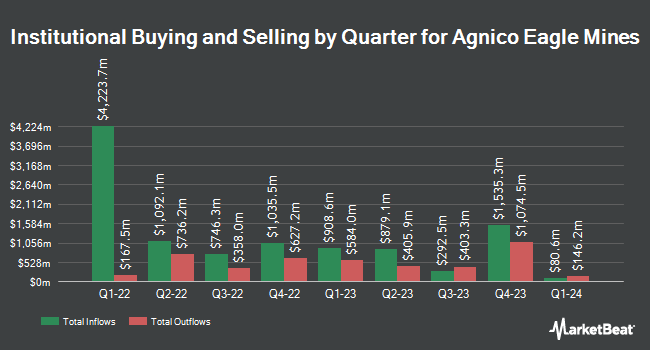

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Capital World Investors lifted its position in shares of Agnico Eagle Mines by 41.9% in the 4th quarter. Capital World Investors now owns 13,952,061 shares of the mining company's stock worth $1,091,550,000 after purchasing an additional 4,121,164 shares during the period. TD Asset Management Inc lifted its position in shares of Agnico Eagle Mines by 42.8% in the 1st quarter. TD Asset Management Inc now owns 9,033,296 shares of the mining company's stock worth $978,553,000 after purchasing an additional 2,709,005 shares during the period. Caisse DE Depot ET Placement DU Quebec lifted its position in shares of Agnico Eagle Mines by 304.5% in the 4th quarter. Caisse DE Depot ET Placement DU Quebec now owns 913,936 shares of the mining company's stock worth $71,465,000 after purchasing an additional 687,971 shares during the period. Raymond James Financial Inc. acquired a new position in shares of Agnico Eagle Mines in the 4th quarter worth approximately $52,503,000. Finally, Public Employees Retirement System of Ohio acquired a new position in shares of Agnico Eagle Mines in the 4th quarter worth approximately $46,799,000. 68.34% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of brokerages have recently issued reports on AEM. Bank of America boosted their price target on shares of Agnico Eagle Mines from $170.00 to $173.00 and gave the stock a "buy" rating in a research report on Monday, June 23rd. National Bankshares reiterated an "outperform" rating on shares of Agnico Eagle Mines in a research report on Tuesday, June 24th. Cfra Research upgraded Agnico Eagle Mines to a "strong-buy" rating in a research note on Friday, April 25th. Scotiabank reissued an "outperform" rating on shares of Agnico Eagle Mines in a research report on Monday, April 14th. Finally, Royal Bank Of Canada boosted their target price on shares of Agnico Eagle Mines from $115.00 to $145.00 and gave the stock an "outperform" rating in a research report on Wednesday, June 4th. Two analysts have rated the stock with a hold rating, eight have given a buy rating and five have assigned a strong buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Buy" and an average price target of $136.90.

View Our Latest Stock Report on Agnico Eagle Mines

Agnico Eagle Mines Stock Performance

NYSE AEM traded down $0.06 during trading on Tuesday, hitting $135.40. 1,936,868 shares of the company's stock traded hands, compared to its average volume of 2,983,786. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.16 and a current ratio of 2.03. Agnico Eagle Mines Limited has a 12-month low of $75.17 and a 12-month high of $137.81. The stock has a market capitalization of $68.08 billion, a price-to-earnings ratio of 23.03, a PEG ratio of 0.94 and a beta of 0.44. The business has a 50 day moving average of $123.00 and a 200-day moving average of $112.28.

Agnico Eagle Mines (NYSE:AEM - Get Free Report) TSE: AEM last posted its earnings results on Wednesday, July 30th. The mining company reported $1.94 EPS for the quarter, topping the consensus estimate of $1.83 by $0.11. The business had revenue of $2.86 billion during the quarter, compared to analysts' expectations of $2.46 billion. Agnico Eagle Mines had a return on equity of 13.79% and a net margin of 30.63%. The firm's revenue was up 35.6% on a year-over-year basis. During the same period in the previous year, the business earned $1.07 earnings per share. As a group, equities research analysts anticipate that Agnico Eagle Mines Limited will post 4.63 earnings per share for the current fiscal year.

Agnico Eagle Mines Dividend Announcement

The business also recently disclosed a dividend, which was paid on Monday, June 16th. Stockholders of record on Monday, June 2nd were paid a dividend of $0.40 per share. This represents a dividend yield of 136.0%. The ex-dividend date of this dividend was Friday, May 30th. Agnico Eagle Mines's dividend payout ratio (DPR) is 27.21%.

Agnico Eagle Mines Company Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

Further Reading

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.