Castleark Management LLC trimmed its position in shares of Kyndryl Holdings, Inc. (NYSE:KD - Free Report) by 40.1% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 202,550 shares of the company's stock after selling 135,420 shares during the period. Castleark Management LLC owned 0.09% of Kyndryl worth $7,008,000 at the end of the most recent quarter.

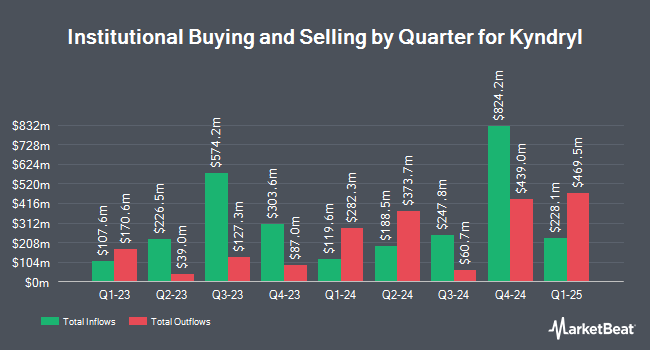

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Marshall & Sterling Wealth Advisors Inc. purchased a new stake in Kyndryl in the 4th quarter worth approximately $30,000. True Wealth Design LLC raised its holdings in Kyndryl by 150.6% in the 4th quarter. True Wealth Design LLC now owns 872 shares of the company's stock worth $30,000 after acquiring an additional 524 shares during the period. Millstone Evans Group LLC acquired a new position in shares of Kyndryl during the 4th quarter worth about $35,000. Picton Mahoney Asset Management bought a new stake in shares of Kyndryl in the fourth quarter valued at approximately $38,000. Finally, EverSource Wealth Advisors LLC grew its position in Kyndryl by 35.9% in the 4th quarter. EverSource Wealth Advisors LLC now owns 1,124 shares of the company's stock worth $39,000 after purchasing an additional 297 shares during the last quarter. 71.53% of the stock is owned by institutional investors.

Kyndryl Stock Performance

Shares of KD traded down $0.48 during trading hours on Monday, hitting $38.87. The company had a trading volume of 1,089,385 shares, compared to its average volume of 2,019,559. The company has a quick ratio of 1.09, a current ratio of 1.09 and a debt-to-equity ratio of 2.55. The firm has a market cap of $9.04 billion, a price-to-earnings ratio of 70.67, a PEG ratio of 10.84 and a beta of 1.91. The business has a fifty day moving average of $33.43 and a 200-day moving average of $35.15. Kyndryl Holdings, Inc. has a 12 month low of $21.34 and a 12 month high of $43.61.

Kyndryl (NYSE:KD - Get Free Report) last posted its earnings results on Wednesday, May 7th. The company reported $0.52 earnings per share for the quarter, hitting analysts' consensus estimates of $0.52. The company had revenue of $3.80 billion for the quarter, compared to analyst estimates of $3.77 billion. Kyndryl had a net margin of 0.91% and a return on equity of 7.22%. The firm's revenue was down 1.3% compared to the same quarter last year. During the same quarter in the prior year, the business posted ($0.01) EPS. Equities analysts anticipate that Kyndryl Holdings, Inc. will post 0.73 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on KD. Wall Street Zen downgraded shares of Kyndryl from a "strong-buy" rating to a "buy" rating in a report on Saturday. Susquehanna cut their price target on Kyndryl from $46.00 to $43.00 and set a "positive" rating for the company in a report on Wednesday, April 23rd. Finally, Oppenheimer lifted their target price on Kyndryl from $43.00 to $47.00 and gave the company an "outperform" rating in a research note on Tuesday, May 13th.

Check Out Our Latest Report on KD

Kyndryl Profile

(

Free Report)

Kyndryl Holdings, Inc operates as a technology services company and IT infrastructure services provider worldwide. The company offers cloud services; core enterprise and zCloud services; application, data, and artificial intelligence services; digital workplace services; security and resiliency services; and network services and edge services.

Read More

Before you consider Kyndryl, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kyndryl wasn't on the list.

While Kyndryl currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.