Castleview Partners LLC decreased its stake in shares of Netflix, Inc. (NASDAQ:NFLX - Free Report) by 48.2% during the first quarter, according to the company in its most recent filing with the SEC. The fund owned 366 shares of the Internet television network's stock after selling 341 shares during the period. Castleview Partners LLC's holdings in Netflix were worth $341,000 as of its most recent filing with the SEC.

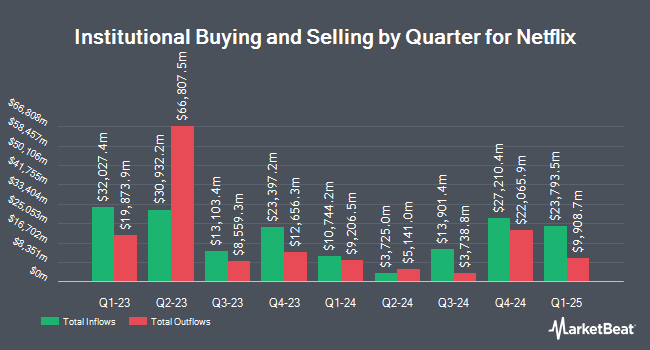

A number of other hedge funds have also made changes to their positions in the stock. Brighton Jones LLC increased its stake in shares of Netflix by 5.0% in the fourth quarter. Brighton Jones LLC now owns 5,390 shares of the Internet television network's stock worth $4,804,000 after purchasing an additional 257 shares during the period. Union Bancaire Privee UBP SA acquired a new stake in Netflix in the 4th quarter valued at approximately $12,212,000. Revolve Wealth Partners LLC increased its position in Netflix by 16.4% in the 4th quarter. Revolve Wealth Partners LLC now owns 1,023 shares of the Internet television network's stock worth $912,000 after buying an additional 144 shares during the period. Strategic Financial Concepts LLC lifted its holdings in shares of Netflix by 29.9% during the fourth quarter. Strategic Financial Concepts LLC now owns 439 shares of the Internet television network's stock worth $392,000 after buying an additional 101 shares during the last quarter. Finally, Prakash Investment Advisors LLC bought a new stake in shares of Netflix in the fourth quarter valued at approximately $8,296,000. Institutional investors and hedge funds own 80.93% of the company's stock.

Insider Buying and Selling at Netflix

In other Netflix news, CFO Spencer Adam Neumann sold 2,601 shares of the company's stock in a transaction that occurred on Tuesday, April 1st. The shares were sold at an average price of $921.72, for a total value of $2,397,393.72. Following the completion of the sale, the chief financial officer now owns 3,691 shares of the company's stock, valued at approximately $3,402,068.52. This represents a 41.34% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Chairman Reed Hastings sold 25,360 shares of Netflix stock in a transaction on Tuesday, April 1st. The stock was sold at an average price of $921.15, for a total transaction of $23,360,364.00. Following the transaction, the chairman now directly owns 394 shares in the company, valued at approximately $362,933.10. This represents a 98.47% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 184,660 shares of company stock worth $209,802,025. Insiders own 1.37% of the company's stock.

Netflix Trading Up 2.0%

Netflix stock traded up $25.57 during mid-day trading on Tuesday, hitting $1,279.11. The stock had a trading volume of 2,659,864 shares, compared to its average volume of 3,744,251. The stock has a 50-day simple moving average of $1,157.24 and a two-hundred day simple moving average of $1,014.42. The company has a current ratio of 1.20, a quick ratio of 1.20 and a debt-to-equity ratio of 0.58. The stock has a market capitalization of $544.35 billion, a PE ratio of 60.45, a P/E/G ratio of 2.38 and a beta of 1.59. Netflix, Inc. has a 12 month low of $587.04 and a 12 month high of $1,282.13.

Netflix (NASDAQ:NFLX - Get Free Report) last issued its quarterly earnings results on Thursday, April 17th. The Internet television network reported $6.61 EPS for the quarter, topping the consensus estimate of $5.74 by $0.87. Netflix had a net margin of 23.07% and a return on equity of 39.61%. The company had revenue of $10.54 billion during the quarter, compared to analysts' expectations of $10.51 billion. During the same quarter in the previous year, the company earned $8.28 EPS. As a group, sell-side analysts forecast that Netflix, Inc. will post 24.58 EPS for the current year.

Analysts Set New Price Targets

NFLX has been the topic of a number of research reports. Cfra Research raised shares of Netflix to a "strong-buy" rating in a research report on Monday, April 28th. Loop Capital restated a "hold" rating on shares of Netflix in a report on Monday, March 24th. Bank of America upped their price objective on shares of Netflix from $1,175.00 to $1,490.00 and gave the company a "buy" rating in a research report on Friday, May 30th. Wolfe Research set a $1,340.00 target price on Netflix and gave the stock an "outperform" rating in a research report on Friday, May 16th. Finally, Robert W. Baird upped their price target on Netflix from $1,200.00 to $1,300.00 and gave the company an "outperform" rating in a report on Friday, May 16th. Eleven investment analysts have rated the stock with a hold rating, twenty-five have given a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, Netflix currently has an average rating of "Moderate Buy" and an average target price of $1,172.73.

Check Out Our Latest Stock Analysis on Netflix

Netflix Profile

(

Free Report)

Netflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Featured Articles

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.