Catalina Capital Group LLC cut its stake in shares of Tesla, Inc. (NASDAQ:TSLA - Free Report) by 41.9% during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,578 shares of the electric vehicle producer's stock after selling 1,140 shares during the period. Catalina Capital Group LLC's holdings in Tesla were worth $501,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

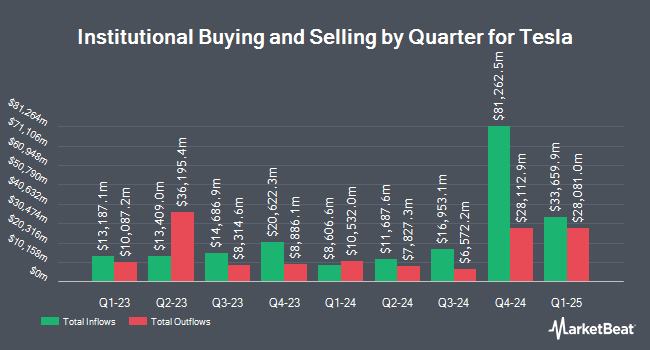

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in TSLA. Brighton Jones LLC raised its position in Tesla by 11.8% during the fourth quarter. Brighton Jones LLC now owns 87,929 shares of the electric vehicle producer's stock valued at $35,509,000 after purchasing an additional 9,293 shares during the period. Revolve Wealth Partners LLC raised its holdings in shares of Tesla by 21.2% in the fourth quarter. Revolve Wealth Partners LLC now owns 5,317 shares of the electric vehicle producer's stock worth $2,147,000 after buying an additional 931 shares during the period. Bison Wealth LLC raised its holdings in shares of Tesla by 52.2% in the fourth quarter. Bison Wealth LLC now owns 10,368 shares of the electric vehicle producer's stock worth $4,187,000 after buying an additional 3,558 shares during the period. Hennion & Walsh Asset Management Inc. raised its holdings in shares of Tesla by 3.7% in the first quarter. Hennion & Walsh Asset Management Inc. now owns 4,605 shares of the electric vehicle producer's stock worth $1,193,000 after buying an additional 165 shares during the period. Finally, Beacon Financial Group raised its holdings in shares of Tesla by 28.4% in the first quarter. Beacon Financial Group now owns 2,173 shares of the electric vehicle producer's stock worth $563,000 after buying an additional 480 shares during the period. 66.20% of the stock is currently owned by hedge funds and other institutional investors.

Tesla Stock Performance

Shares of TSLA opened at $429.83 on Friday. The stock has a 50-day moving average of $364.02 and a two-hundred day moving average of $321.39. The stock has a market cap of $1.43 trillion, a P/E ratio of 248.46, a P/E/G ratio of 15.15 and a beta of 2.08. Tesla, Inc. has a one year low of $212.11 and a one year high of $488.54. The company has a debt-to-equity ratio of 0.07, a quick ratio of 1.55 and a current ratio of 2.04.

Tesla (NASDAQ:TSLA - Get Free Report) last released its quarterly earnings data on Wednesday, July 23rd. The electric vehicle producer reported $0.40 earnings per share for the quarter, missing analysts' consensus estimates of $0.43 by ($0.03). The company had revenue of $22.50 billion for the quarter, compared to analysts' expectations of $23.18 billion. Tesla had a net margin of 6.54% and a return on equity of 7.98%. The business's quarterly revenue was down 11.8% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.52 EPS. As a group, research analysts predict that Tesla, Inc. will post 2.56 EPS for the current year.

Analyst Upgrades and Downgrades

Several equities research analysts have recently weighed in on the company. Stifel Nicolaus set a $440.00 price target on Tesla in a report on Friday, September 5th. William Blair reiterated a "market perform" rating on shares of Tesla in a report on Friday, September 5th. Canaccord Genuity Group increased their price target on Tesla from $333.00 to $490.00 and gave the stock a "buy" rating in a report on Tuesday. Weiss Ratings restated a "hold (c)" rating on shares of Tesla in a report on Saturday, September 27th. Finally, Glj Research restated a "sell" rating on shares of Tesla in a report on Thursday, July 24th. Two analysts have rated the stock with a Strong Buy rating, nineteen have assigned a Buy rating, thirteen have issued a Hold rating and eight have assigned a Sell rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $343.43.

Read Our Latest Report on Tesla

Insider Activity at Tesla

In related news, SVP Xiaotong Zhu sold 20,000 shares of Tesla stock in a transaction dated Thursday, September 11th. The stock was sold at an average price of $363.75, for a total value of $7,275,000.00. Following the completion of the transaction, the senior vice president owned 47,600 shares in the company, valued at $17,314,500. The trade was a 29.59% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director James R. Murdoch sold 120,000 shares of the business's stock in a transaction that occurred on Tuesday, August 26th. The stock was sold at an average price of $350.29, for a total value of $42,034,800.00. Following the sale, the director owned 697,031 shares of the company's stock, valued at approximately $244,162,988.99. This trade represents a 14.69% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 208,606 shares of company stock worth $77,360,462 in the last 90 days. Corporate insiders own 19.90% of the company's stock.

About Tesla

(

Free Report)

Tesla, Inc designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.