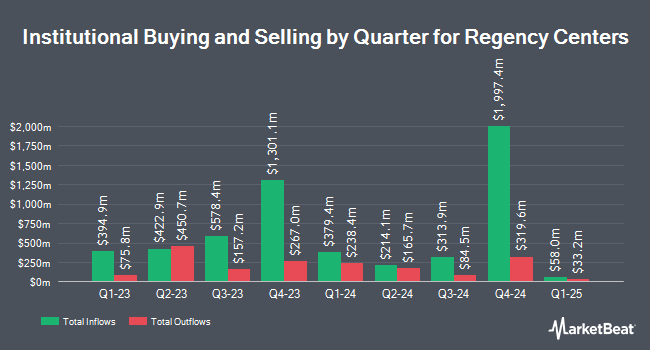

Cbre Investment Management Listed Real Assets LLC increased its stake in shares of Regency Centers Corporation (NASDAQ:REG - Free Report) by 63.5% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 2,521,633 shares of the company's stock after purchasing an additional 979,126 shares during the quarter. Regency Centers makes up 2.8% of Cbre Investment Management Listed Real Assets LLC's holdings, making the stock its 8th largest position. Cbre Investment Management Listed Real Assets LLC owned 1.39% of Regency Centers worth $185,996,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Wayfinding Financial LLC purchased a new stake in Regency Centers in the first quarter valued at about $25,000. Heck Capital Advisors LLC acquired a new position in shares of Regency Centers in the fourth quarter valued at about $26,000. TD Waterhouse Canada Inc. increased its holdings in shares of Regency Centers by 48,700.0% in the fourth quarter. TD Waterhouse Canada Inc. now owns 488 shares of the company's stock valued at $36,000 after purchasing an additional 487 shares during the period. Caitong International Asset Management Co. Ltd increased its holdings in shares of Regency Centers by 42.3% in the first quarter. Caitong International Asset Management Co. Ltd now owns 505 shares of the company's stock valued at $37,000 after purchasing an additional 150 shares during the period. Finally, Sentry Investment Management LLC acquired a new position in shares of Regency Centers in the first quarter valued at about $38,000. 96.07% of the stock is currently owned by hedge funds and other institutional investors.

Regency Centers Trading Down 1.1%

Shares of REG stock traded down $0.76 on Thursday, hitting $71.71. The stock had a trading volume of 230,178 shares, compared to its average volume of 1,100,879. The company has a debt-to-equity ratio of 0.72, a current ratio of 1.13 and a quick ratio of 1.13. The firm has a market capitalization of $13.02 billion, a P/E ratio of 33.49, a P/E/G ratio of 3.11 and a beta of 1.05. Regency Centers Corporation has a 1 year low of $63.44 and a 1 year high of $78.18. The company's 50 day moving average price is $71.06 and its 200-day moving average price is $71.81.

Regency Centers (NASDAQ:REG - Get Free Report) last issued its quarterly earnings results on Tuesday, July 29th. The company reported $1.16 earnings per share for the quarter, topping the consensus estimate of $1.12 by $0.04. Regency Centers had a return on equity of 6.05% and a net margin of 27.00%.The company had revenue of $369.85 million for the quarter, compared to the consensus estimate of $366.35 million. During the same quarter in the prior year, the business earned $1.06 EPS. Regency Centers's revenue was up 6.6% on a year-over-year basis. Regency Centers has set its FY 2025 guidance at 4.590-4.630 EPS. Analysts anticipate that Regency Centers Corporation will post 4.54 earnings per share for the current year.

Regency Centers Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, October 2nd. Shareholders of record on Thursday, September 11th will be issued a dividend of $0.705 per share. The ex-dividend date is Thursday, September 11th. This represents a $2.82 annualized dividend and a yield of 3.9%. Regency Centers's dividend payout ratio is 131.78%.

Wall Street Analyst Weigh In

REG has been the topic of a number of research reports. Wall Street Zen lowered Regency Centers from a "hold" rating to a "sell" rating in a report on Saturday, July 5th. Scotiabank raised their target price on Regency Centers from $75.00 to $76.00 and gave the stock a "sector perform" rating in a report on Thursday. Mizuho lifted their price target on Regency Centers from $74.00 to $77.00 and gave the company an "outperform" rating in a research report on Wednesday, August 20th. Evercore ISI lifted their price target on Regency Centers from $79.00 to $80.00 and gave the company an "in-line" rating in a research report on Wednesday, July 30th. Finally, Barclays lifted their price target on Regency Centers from $77.00 to $79.00 and gave the company an "equal weight" rating in a research report on Wednesday. One investment analyst has rated the stock with a Strong Buy rating, seven have issued a Buy rating and four have assigned a Hold rating to the company. Based on data from MarketBeat.com, Regency Centers has a consensus rating of "Moderate Buy" and a consensus price target of $79.00.

View Our Latest Report on REG

Regency Centers Profile

(

Free Report)

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to their neighborhoods, communities, and customers.

Further Reading

Before you consider Regency Centers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regency Centers wasn't on the list.

While Regency Centers currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.