King Luther Capital Management Corp trimmed its stake in shares of Celsius Holdings Inc. (NASDAQ:CELH - Free Report) by 19.4% in the first quarter, according to the company in its most recent filing with the SEC. The firm owned 40,305 shares of the company's stock after selling 9,716 shares during the quarter. King Luther Capital Management Corp's holdings in Celsius were worth $1,436,000 as of its most recent SEC filing.

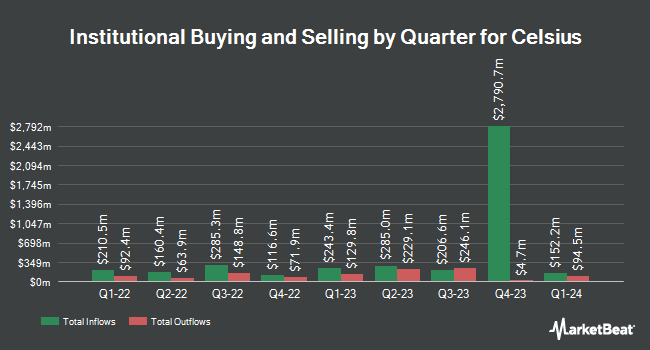

A number of other hedge funds also recently made changes to their positions in CELH. Spire Wealth Management lifted its position in Celsius by 12.0% during the first quarter. Spire Wealth Management now owns 2,677 shares of the company's stock valued at $95,000 after purchasing an additional 287 shares in the last quarter. Wealthcare Advisory Partners LLC lifted its holdings in Celsius by 3.2% in the first quarter. Wealthcare Advisory Partners LLC now owns 9,718 shares of the company's stock valued at $346,000 after acquiring an additional 301 shares during the last quarter. TD Private Client Wealth LLC increased its position in shares of Celsius by 8.8% during the first quarter. TD Private Client Wealth LLC now owns 4,071 shares of the company's stock worth $145,000 after acquiring an additional 328 shares during the period. GAMMA Investing LLC boosted its stake in shares of Celsius by 19.7% during the first quarter. GAMMA Investing LLC now owns 2,052 shares of the company's stock worth $73,000 after buying an additional 338 shares during the period. Finally, Moody National Bank Trust Division increased its stake in shares of Celsius by 1.3% during the 1st quarter. Moody National Bank Trust Division now owns 27,170 shares of the company's stock worth $968,000 after purchasing an additional 344 shares in the last quarter. 60.95% of the stock is currently owned by institutional investors.

Celsius Stock Performance

Shares of NASDAQ CELH traded up $0.59 during trading on Friday, reaching $57.26. 4,026,890 shares of the company traded hands, compared to its average volume of 8,247,222. Celsius Holdings Inc. has a 52-week low of $21.10 and a 52-week high of $57.79. The stock has a market capitalization of $14.77 billion, a PE ratio of 154.76, a P/E/G ratio of 1.28 and a beta of 1.40. The firm has a 50 day simple moving average of $45.79 and a 200-day simple moving average of $36.88. The company has a quick ratio of 1.76, a current ratio of 2.11 and a debt-to-equity ratio of 0.68.

Celsius (NASDAQ:CELH - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported $0.47 earnings per share for the quarter, topping analysts' consensus estimates of $0.23 by $0.24. Celsius had a net margin of 7.91% and a return on equity of 36.88%. The company had revenue of $739.30 million during the quarter, compared to analyst estimates of $632.13 million. During the same period in the prior year, the firm earned $0.28 earnings per share. The firm's revenue for the quarter was up 83.9% compared to the same quarter last year. Equities research analysts anticipate that Celsius Holdings Inc. will post 0.89 earnings per share for the current year.

Insider Buying and Selling

In other news, CFO Jarrod Langhans sold 5,000 shares of the business's stock in a transaction dated Thursday, August 7th. The stock was sold at an average price of $51.18, for a total transaction of $255,900.00. Following the completion of the transaction, the chief financial officer directly owned 109,227 shares of the company's stock, valued at approximately $5,590,237.86. The trade was a 4.38% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, major shareholder William H. Milmoe sold 300,000 shares of the business's stock in a transaction that occurred on Tuesday, July 1st. The shares were sold at an average price of $47.27, for a total value of $14,181,000.00. Following the completion of the sale, the insider owned 18,017,770 shares of the company's stock, valued at approximately $851,699,987.90. This represents a 1.64% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 1,111,141 shares of company stock worth $52,241,605 in the last quarter. 2.55% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

A number of research analysts have issued reports on the stock. Roth Capital reissued a "buy" rating and set a $52.00 target price (up from $46.00) on shares of Celsius in a research note on Thursday, June 26th. Stifel Nicolaus boosted their target price on shares of Celsius from $50.00 to $56.00 and gave the stock a "buy" rating in a report on Friday, August 8th. Truist Financial set a $65.00 target price on shares of Celsius and gave the stock a "buy" rating in a report on Monday. TD Cowen raised shares of Celsius from a "hold" rating to a "buy" rating and lifted their price objective for the stock from $37.00 to $55.00 in a report on Monday, June 16th. Finally, Needham & Company LLC boosted their price objective on Celsius from $55.00 to $60.00 and gave the stock a "buy" rating in a report on Thursday, August 7th. One analyst has rated the stock with a sell rating, three have assigned a hold rating and sixteen have issued a buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $52.28.

Read Our Latest Stock Report on CELH

About Celsius

(

Free Report)

Celsius Holdings, Inc develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally. The company offers CELSIUS, a fitness drink or supplement designed to accelerate metabolism and burn body fat; various flavors and carbonated and non-carbonated functional energy drinks under the CELSIUS Originals and Vibe name, as well as functional energy drink under the CELSIUS Essentials and CELSIUS On-the-Go Powder names; and CELSIUS ready-to drink products.

Featured Stories

Before you consider Celsius, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celsius wasn't on the list.

While Celsius currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.