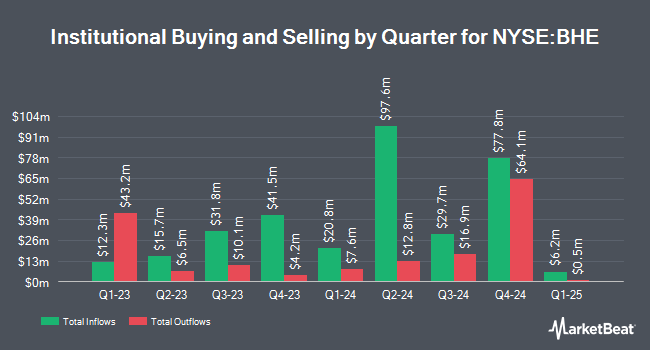

Cerity Partners LLC purchased a new stake in shares of Benchmark Electronics, Inc. (NYSE:BHE - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 12,849 shares of the technology company's stock, valued at approximately $489,000.

Other institutional investors also recently added to or reduced their stakes in the company. Versant Capital Management Inc grew its position in Benchmark Electronics by 197.5% during the first quarter. Versant Capital Management Inc now owns 2,475 shares of the technology company's stock valued at $94,000 after buying an additional 1,643 shares during the period. State of Wyoming grew its position in Benchmark Electronics by 213.4% during the fourth quarter. State of Wyoming now owns 3,563 shares of the technology company's stock valued at $162,000 after buying an additional 2,426 shares during the period. Tower Research Capital LLC TRC grew its position in Benchmark Electronics by 94.3% during the fourth quarter. Tower Research Capital LLC TRC now owns 4,693 shares of the technology company's stock valued at $213,000 after buying an additional 2,278 shares during the period. Bank of Montreal Can grew its position in Benchmark Electronics by 10.7% during the fourth quarter. Bank of Montreal Can now owns 5,100 shares of the technology company's stock valued at $232,000 after buying an additional 495 shares during the period. Finally, Bayesian Capital Management LP bought a new position in Benchmark Electronics during the fourth quarter valued at about $252,000. Institutional investors own 92.29% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on BHE. Needham & Company LLC reduced their price target on shares of Benchmark Electronics from $50.00 to $48.00 and set a "buy" rating for the company in a research report on Wednesday, April 30th. Wall Street Zen upgraded shares of Benchmark Electronics from a "hold" rating to a "buy" rating in a research report on Saturday, June 21st. Finally, Lake Street Capital cut their target price on shares of Benchmark Electronics from $52.00 to $46.00 and set a "buy" rating for the company in a research report on Wednesday, April 30th.

Check Out Our Latest Report on Benchmark Electronics

Benchmark Electronics Stock Performance

NYSE:BHE traded up $1.19 on Tuesday, reaching $40.32. 35,983 shares of the company's stock were exchanged, compared to its average volume of 323,378. The company has a debt-to-equity ratio of 0.24, a current ratio of 2.37 and a quick ratio of 1.48. The firm has a market cap of $1.46 billion, a price-to-earnings ratio of 27.81 and a beta of 0.95. Benchmark Electronics, Inc. has a 52 week low of $30.73 and a 52 week high of $52.57. The stock has a fifty day simple moving average of $38.37 and a 200-day simple moving average of $39.06.

Benchmark Electronics (NYSE:BHE - Get Free Report) last issued its earnings results on Tuesday, April 29th. The technology company reported $0.52 earnings per share for the quarter, topping analysts' consensus estimates of $0.50 by $0.02. Benchmark Electronics had a net margin of 2.03% and a return on equity of 6.37%. The firm had revenue of $631.76 million during the quarter, compared to analyst estimates of $640.00 million. During the same quarter last year, the business earned $0.55 earnings per share. The company's quarterly revenue was down 6.5% on a year-over-year basis.

Benchmark Electronics Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, July 11th. Stockholders of record on Monday, June 30th were issued a $0.17 dividend. This represents a $0.68 dividend on an annualized basis and a dividend yield of 1.69%. The ex-dividend date was Monday, June 30th. Benchmark Electronics's payout ratio is 46.90%.

About Benchmark Electronics

(

Free Report)

Benchmark Electronics, Inc, together with its subsidiaries, offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe. The company provides engineering services and technology solutions, including new product design, prototype, testing, and related engineering services; and custom testing and technology solutions, as well as automation equipment design and build services.

See Also

Before you consider Benchmark Electronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Benchmark Electronics wasn't on the list.

While Benchmark Electronics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.