Cerity Partners LLC lifted its stake in shares of NetEase, Inc. (NASDAQ:NTES - Free Report) by 262.1% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 21,136 shares of the technology company's stock after acquiring an additional 15,299 shares during the quarter. Cerity Partners LLC's holdings in NetEase were worth $2,175,000 at the end of the most recent reporting period.

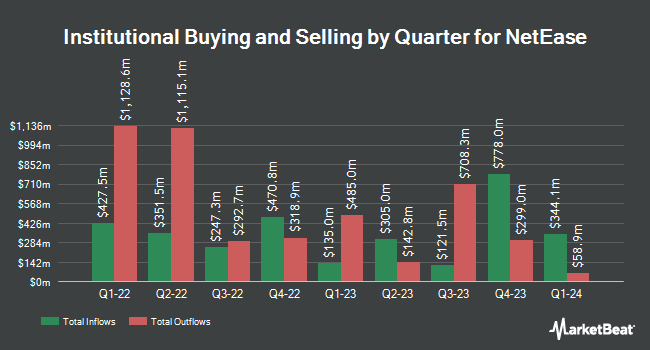

Other hedge funds have also made changes to their positions in the company. Capital World Investors grew its position in NetEase by 40.6% during the 4th quarter. Capital World Investors now owns 3,725,046 shares of the technology company's stock worth $332,311,000 after purchasing an additional 1,074,818 shares in the last quarter. Lazard Asset Management LLC grew its holdings in shares of NetEase by 2.0% during the fourth quarter. Lazard Asset Management LLC now owns 3,599,794 shares of the technology company's stock valued at $321,137,000 after buying an additional 69,789 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. grew its holdings in shares of NetEase by 7,698.2% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,817,021 shares of the technology company's stock valued at $289,928,000 after buying an additional 2,780,897 shares in the last quarter. Dodge & Cox grew its holdings in shares of NetEase by 0.6% during the fourth quarter. Dodge & Cox now owns 2,649,876 shares of the technology company's stock valued at $236,395,000 after buying an additional 15,900 shares in the last quarter. Finally, Invesco Ltd. grew its holdings in shares of NetEase by 88.0% during the fourth quarter. Invesco Ltd. now owns 2,365,464 shares of the technology company's stock valued at $211,023,000 after buying an additional 1,107,363 shares in the last quarter. Institutional investors and hedge funds own 11.07% of the company's stock.

NetEase Trading Up 0.8%

NASDAQ:NTES traded up $1.07 during mid-day trading on Wednesday, hitting $140.56. The company's stock had a trading volume of 482,694 shares, compared to its average volume of 1,452,857. NetEase, Inc. has a fifty-two week low of $75.85 and a fifty-two week high of $141.45. The company has a market capitalization of $89.06 billion, a price-to-earnings ratio of 20.22, a P/E/G ratio of 4.86 and a beta of 0.69. The stock has a fifty day moving average of $129.17 and a 200-day moving average of $110.92.

NetEase Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, June 13th. Stockholders of record on Friday, May 30th were paid a dividend of $0.675 per share. The ex-dividend date was Friday, May 30th. This represents a $2.70 annualized dividend and a dividend yield of 1.92%. NetEase's dividend payout ratio (DPR) is currently 38.71%.

Analyst Upgrades and Downgrades

Several research firms have recently commented on NTES. Barclays boosted their price target on shares of NetEase from $104.00 to $118.00 and gave the company an "equal weight" rating in a report on Friday, May 16th. Deutsche Bank Aktiengesellschaft started coverage on shares of NetEase in a research note on Monday, May 12th. They issued a "buy" rating and a $130.00 price objective for the company. Wall Street Zen raised shares of NetEase from a "buy" rating to a "strong-buy" rating in a research note on Thursday, May 22nd. Finally, JPMorgan Chase & Co. boosted their target price on shares of NetEase from $120.00 to $135.00 and gave the stock an "overweight" rating in a research report on Monday, May 19th. One investment analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Buy" and an average target price of $119.38.

Get Our Latest Stock Analysis on NetEase

About NetEase

(

Free Report)

NetEase, Inc engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally . The company operates through Games and Related Value-Added Services, Youdao, Cloud Music, and Innovative Businesses and Others segments.

Recommended Stories

Before you consider NetEase, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetEase wasn't on the list.

While NetEase currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.