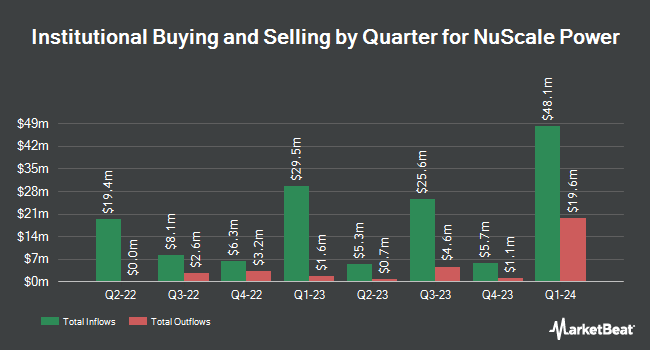

Cetera Investment Advisers lifted its position in NuScale Power Corporation (NYSE:SMR - Free Report) by 137.0% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 130,352 shares of the company's stock after acquiring an additional 75,354 shares during the period. Cetera Investment Advisers' holdings in NuScale Power were worth $1,846,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also bought and sold shares of the company. Farther Finance Advisors LLC increased its stake in NuScale Power by 6.9% in the first quarter. Farther Finance Advisors LLC now owns 12,902 shares of the company's stock valued at $189,000 after purchasing an additional 833 shares in the last quarter. Summit Investment Advisors Inc. grew its holdings in shares of NuScale Power by 16.6% in the 4th quarter. Summit Investment Advisors Inc. now owns 8,863 shares of the company's stock valued at $159,000 after buying an additional 1,260 shares during the period. Barclays PLC increased its position in shares of NuScale Power by 1.0% in the 4th quarter. Barclays PLC now owns 152,237 shares of the company's stock valued at $2,730,000 after buying an additional 1,446 shares in the last quarter. CoreCap Advisors LLC acquired a new stake in NuScale Power during the 4th quarter worth $33,000. Finally, Rakuten Securities Inc. raised its stake in NuScale Power by 36.4% during the 1st quarter. Rakuten Securities Inc. now owns 10,213 shares of the company's stock worth $145,000 after buying an additional 2,723 shares during the period. Institutional investors own 78.37% of the company's stock.

NuScale Power Stock Down 11.6%

NYSE SMR opened at $39.49 on Friday. The company has a market capitalization of $11.23 billion, a PE ratio of -33.18 and a beta of 2.06. NuScale Power Corporation has a 12-month low of $6.88 and a 12-month high of $53.50. The firm's 50 day moving average is $40.81 and its 200-day moving average is $26.99.

NuScale Power (NYSE:SMR - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported ($0.13) earnings per share for the quarter, missing analysts' consensus estimates of ($0.12) by ($0.01). The company had revenue of $8.05 million during the quarter, compared to the consensus estimate of $10.49 million. NuScale Power had a negative net margin of 221.07% and a positive return on equity of 2.86%. As a group, sell-side analysts expect that NuScale Power Corporation will post -0.73 EPS for the current year.

Insider Activity

In other NuScale Power news, COO Carl M. Fisher sold 18,206 shares of the company's stock in a transaction that occurred on Tuesday, August 5th. The stock was sold at an average price of $44.39, for a total value of $808,164.34. Following the sale, the chief operating officer owned 90,864 shares in the company, valued at $4,033,452.96. This represents a 16.69% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO John Lawrence Hopkins sold 26,345 shares of the firm's stock in a transaction on Thursday, May 15th. The shares were sold at an average price of $23.66, for a total value of $623,322.70. The disclosure for this sale can be found here. Company insiders own 1.27% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have issued reports on SMR shares. Northland Capmk raised NuScale Power to a "hold" rating in a research note on Monday, July 7th. Citigroup started coverage on NuScale Power in a research report on Monday, June 23rd. They issued a "neutral" rating and a $46.00 price objective for the company. UBS Group increased their target price on NuScale Power from $17.00 to $34.00 and gave the stock a "neutral" rating in a research note on Thursday, May 29th. Northland Securities started coverage on shares of NuScale Power in a report on Monday, July 7th. They set a "market perform" rating and a $35.00 target price on the stock. Finally, BTIG Research cut shares of NuScale Power from a "buy" rating to a "neutral" rating in a report on Wednesday, June 25th. Eight analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, NuScale Power currently has a consensus rating of "Hold" and a consensus target price of $33.00.

Read Our Latest Research Report on SMR

NuScale Power Profile

(

Free Report)

NuScale Power Corporation engages in the development and sale of modular light water reactor nuclear power plants to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications. It offers NuScale Power Module (NPM), a water reactor that can generate 77 megawatts of electricity (MWe); and VOYGR power plant designs for three facility sizes that are capable of housing from one to four and six or twelve NPMs.

Recommended Stories

Want to see what other hedge funds are holding SMR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for NuScale Power Corporation (NYSE:SMR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NuScale Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NuScale Power wasn't on the list.

While NuScale Power currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.