Cetera Investment Advisers raised its position in shares of Ally Financial Inc. (NYSE:ALLY - Free Report) by 192.7% in the 4th quarter, according to the company in its most recent disclosure with the SEC. The fund owned 53,364 shares of the financial services provider's stock after buying an additional 35,130 shares during the quarter. Cetera Investment Advisers' holdings in Ally Financial were worth $1,922,000 at the end of the most recent reporting period.

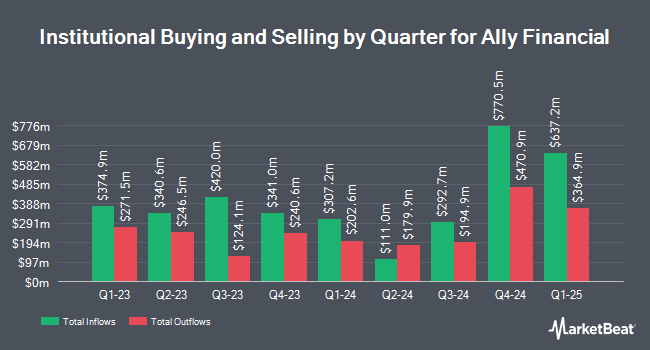

Several other hedge funds have also modified their holdings of ALLY. Principal Securities Inc. increased its holdings in shares of Ally Financial by 89.4% during the fourth quarter. Principal Securities Inc. now owns 1,051 shares of the financial services provider's stock valued at $38,000 after acquiring an additional 496 shares in the last quarter. Kestra Investment Management LLC acquired a new position in Ally Financial in the 4th quarter worth approximately $43,000. UMB Bank n.a. increased its holdings in Ally Financial by 218.8% in the 4th quarter. UMB Bank n.a. now owns 1,546 shares of the financial services provider's stock worth $56,000 after buying an additional 1,061 shares during the period. Harbour Investments Inc. increased its holdings in Ally Financial by 38.5% in the 4th quarter. Harbour Investments Inc. now owns 2,142 shares of the financial services provider's stock worth $77,000 after buying an additional 595 shares during the period. Finally, Aster Capital Management DIFC Ltd acquired a new position in Ally Financial in the 4th quarter worth approximately $78,000. 88.76% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other news, CFO Russell E. Hutchinson bought 8,200 shares of the stock in a transaction on Tuesday, April 22nd. The shares were bought at an average price of $30.81 per share, with a total value of $252,642.00. Following the completion of the acquisition, the chief financial officer now owns 236,421 shares of the company's stock, valued at approximately $7,284,131.01. This trade represents a 3.59% increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Stephanie N. Richard sold 8,000 shares of the company's stock in a transaction on Wednesday, April 30th. The shares were sold at an average price of $32.14, for a total value of $257,120.00. Following the completion of the sale, the insider now directly owns 90,387 shares in the company, valued at $2,905,038.18. This trade represents a 8.13% decrease in their position. The disclosure for this sale can be found here. 0.67% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

Several brokerages recently weighed in on ALLY. Wells Fargo & Company cut their price target on shares of Ally Financial from $34.00 to $32.00 and set an "underweight" rating on the stock in a report on Monday, April 21st. Truist Financial lowered their price objective on Ally Financial from $45.00 to $41.00 and set a "buy" rating on the stock in a research report on Tuesday, April 22nd. Morgan Stanley lowered their price objective on Ally Financial from $45.00 to $39.00 and set an "outperform" rating on the stock in a research report on Monday, April 7th. For consumer lenders, the Trump Administration’s hardline approach to tariffs is “difficult to ignore” and there’s clearly more downside to the group if tariffs remain near current levels. If tariffs remain in place, risks to growth would skew meaningfully to the downside and risks to inflation to the upside, adds the analyst, who is downgrading the firm’s Consumer Finance industry view to Cautious from Attractive. Bank of America decreased their target price on Ally Financial from $42.00 to $38.00 and set a "buy" rating on the stock in a research report on Monday, April 7th. Finally, Wall Street Zen upgraded Ally Financial from a "sell" rating to a "hold" rating in a research report on Friday. Two analysts have rated the stock with a sell rating, seven have assigned a hold rating and ten have given a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $41.69.

Get Our Latest Stock Report on ALLY

Ally Financial Stock Performance

Shares of NYSE:ALLY traded down $0.30 during trading on Friday, reaching $33.63. The company had a trading volume of 2,828,361 shares, compared to its average volume of 3,580,396. The firm has a market capitalization of $10.33 billion, a price-to-earnings ratio of 12.93, a price-to-earnings-growth ratio of 0.32 and a beta of 1.14. The company has a debt-to-equity ratio of 1.51, a current ratio of 0.93 and a quick ratio of 0.93. The stock's fifty day moving average price is $33.97 and its 200 day moving average price is $35.93. Ally Financial Inc. has a fifty-two week low of $29.52 and a fifty-two week high of $45.46.

Ally Financial (NYSE:ALLY - Get Free Report) last released its earnings results on Thursday, April 17th. The financial services provider reported $0.58 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.43 by $0.15. Ally Financial had a return on equity of 9.31% and a net margin of 11.29%. The business had revenue of $1.54 billion for the quarter, compared to analyst estimates of $2.04 billion. During the same quarter in the previous year, the company posted $0.45 earnings per share. As a group, equities research analysts predict that Ally Financial Inc. will post 3.57 EPS for the current year.

Ally Financial Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, May 15th. Investors of record on Thursday, May 1st were issued a dividend of $0.30 per share. This represents a $1.20 dividend on an annualized basis and a yield of 3.57%. The ex-dividend date of this dividend was Thursday, May 1st. Ally Financial's dividend payout ratio is presently 88.24%.

Ally Financial Company Profile

(

Free Report)

Ally Financial Inc, a digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda. The company operates through Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations segments.

Further Reading

Before you consider Ally Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ally Financial wasn't on the list.

While Ally Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.