Cetera Investment Advisers lifted its stake in shares of Blue Owl Capital Inc. (NYSE:OWL - Free Report) by 82.1% in the first quarter, according to its most recent filing with the SEC. The fund owned 80,612 shares of the company's stock after acquiring an additional 36,352 shares during the period. Cetera Investment Advisers' holdings in Blue Owl Capital were worth $1,615,000 as of its most recent SEC filing.

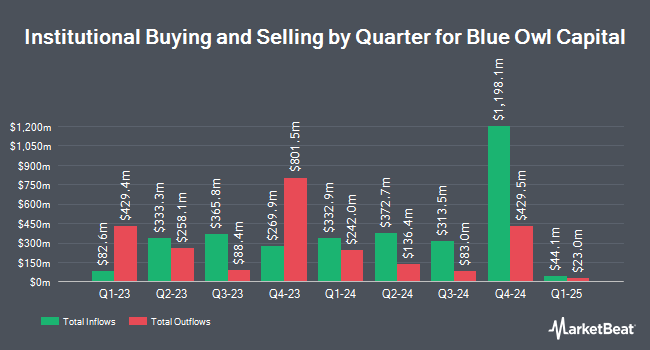

A number of other large investors have also added to or reduced their stakes in the company. LPL Financial LLC increased its holdings in shares of Blue Owl Capital by 30.2% in the fourth quarter. LPL Financial LLC now owns 114,824 shares of the company's stock worth $2,671,000 after buying an additional 26,611 shares during the period. Envestnet Asset Management Inc. raised its holdings in Blue Owl Capital by 5.2% during the 4th quarter. Envestnet Asset Management Inc. now owns 674,322 shares of the company's stock valued at $15,685,000 after buying an additional 33,568 shares during the last quarter. Russell Investments Group Ltd. boosted its position in Blue Owl Capital by 3.5% during the 4th quarter. Russell Investments Group Ltd. now owns 31,465 shares of the company's stock valued at $732,000 after buying an additional 1,064 shares during the period. Bank of Montreal Can bought a new stake in Blue Owl Capital in the 4th quarter worth $1,856,000. Finally, Invesco Ltd. increased its position in shares of Blue Owl Capital by 17.8% in the fourth quarter. Invesco Ltd. now owns 7,595,091 shares of the company's stock valued at $176,662,000 after acquiring an additional 1,145,886 shares during the period. Hedge funds and other institutional investors own 35.85% of the company's stock.

Analysts Set New Price Targets

OWL has been the topic of several recent analyst reports. Raymond James Financial assumed coverage on Blue Owl Capital in a research note on Monday, July 28th. They issued a "market perform" rating on the stock. Wells Fargo & Company raised their price target on Blue Owl Capital from $20.00 to $21.00 and gave the stock an "equal weight" rating in a research note on Friday, May 23rd. Piper Sandler boosted their price objective on shares of Blue Owl Capital from $22.50 to $23.50 and gave the company an "overweight" rating in a research report on Wednesday, July 2nd. Barclays raised their target price on shares of Blue Owl Capital from $21.00 to $23.00 and gave the stock an "overweight" rating in a research report on Thursday, July 10th. Finally, Cowen reaffirmed a "buy" rating on shares of Blue Owl Capital in a research note on Monday, August 4th. Three analysts have rated the stock with a hold rating and eleven have given a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $24.02.

Get Our Latest Analysis on Blue Owl Capital

Blue Owl Capital Trading Down 1.4%

NYSE:OWL traded down $0.29 during trading hours on Wednesday, reaching $20.03. 13,460,689 shares of the company traded hands, compared to its average volume of 7,843,529. The business's 50-day moving average price is $19.40 and its two-hundred day moving average price is $19.86. The stock has a market capitalization of $31.04 billion, a P/E ratio of 222.58, a P/E/G ratio of 1.29 and a beta of 1.16. Blue Owl Capital Inc. has a 1 year low of $14.55 and a 1 year high of $26.73.

Blue Owl Capital (NYSE:OWL - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The company reported $0.21 EPS for the quarter, hitting the consensus estimate of $0.21. Blue Owl Capital had a return on equity of 19.64% and a net margin of 2.88%. The company had revenue of $703.11 million during the quarter, compared to analyst estimates of $642.13 million. As a group, equities analysts anticipate that Blue Owl Capital Inc. will post 0.92 EPS for the current year.

Blue Owl Capital Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, August 28th. Stockholders of record on Thursday, August 14th will be paid a $0.225 dividend. The ex-dividend date of this dividend is Thursday, August 14th. This represents a $0.90 dividend on an annualized basis and a dividend yield of 4.5%. Blue Owl Capital's dividend payout ratio is 1,000.00%.

Blue Owl Capital Company Profile

(

Free Report)

Blue Owl Capital Inc operates as an asset manager in the United States. The company offers permanent capital base solutions that enables it to offer holistic framework of capital solutions to middle market companies, large alternative asset managers, and corporate real estate owners and tenants. It also provides direct lending products that offer private credit products comprising diversified, technology, first lien, and opportunistic lending to middle-market companies; liquid credit; GP strategic capital products, which offers capital solutions, including GP minority stakes, GP debt financing, and professional sports minority stakes; and real estate products that focuses on acquiring triple net lease real estate by investment grade or creditworthy tenants.

See Also

Before you consider Blue Owl Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Owl Capital wasn't on the list.

While Blue Owl Capital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.