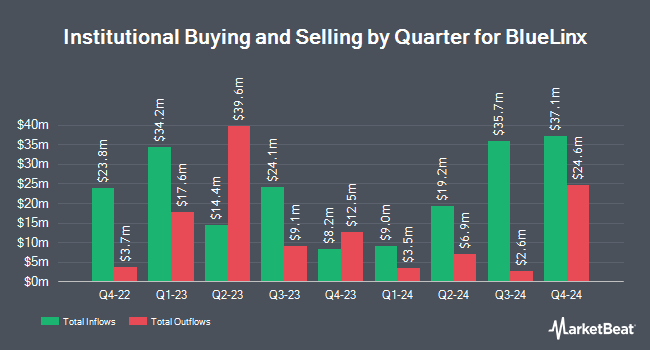

Charles Schwab Investment Management Inc. lifted its stake in shares of BlueLinx Holdings Inc. (NYSE:BXC - Free Report) by 19.6% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 239,037 shares of the construction company's stock after buying an additional 39,166 shares during the period. Charles Schwab Investment Management Inc. owned approximately 2.98% of BlueLinx worth $17,923,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also made changes to their positions in the company. Exchange Traded Concepts LLC lifted its stake in shares of BlueLinx by 14.9% during the first quarter. Exchange Traded Concepts LLC now owns 3,113 shares of the construction company's stock worth $233,000 after buying an additional 404 shares during the period. GAMMA Investing LLC lifted its stake in shares of BlueLinx by 42,890.0% during the first quarter. GAMMA Investing LLC now owns 12,897 shares of the construction company's stock worth $967,000 after buying an additional 12,867 shares during the period. SG Americas Securities LLC lifted its stake in shares of BlueLinx by 63.7% during the first quarter. SG Americas Securities LLC now owns 3,992 shares of the construction company's stock worth $299,000 after buying an additional 1,554 shares during the period. Tower Research Capital LLC TRC lifted its stake in shares of BlueLinx by 352.0% during the fourth quarter. Tower Research Capital LLC TRC now owns 1,469 shares of the construction company's stock worth $150,000 after buying an additional 1,144 shares during the period. Finally, Bank of America Corp DE lifted its stake in shares of BlueLinx by 18.6% during the fourth quarter. Bank of America Corp DE now owns 39,527 shares of the construction company's stock worth $4,038,000 after buying an additional 6,209 shares during the period. 90.83% of the stock is currently owned by institutional investors and hedge funds.

BlueLinx Stock Performance

BXC traded up $1.08 on Thursday, reaching $82.96. The stock had a trading volume of 64,160 shares, compared to its average volume of 119,132. BlueLinx Holdings Inc. has a 12-month low of $63.13 and a 12-month high of $134.79. The company has a current ratio of 4.55, a quick ratio of 2.94 and a debt-to-equity ratio of 0.96. The business's 50-day moving average price is $78.38 and its two-hundred day moving average price is $76.09. The company has a market cap of $654.58 million, a P/E ratio of 24.62 and a beta of 1.74.

BlueLinx declared that its board has authorized a share repurchase plan on Tuesday, July 29th that permits the company to repurchase $50.00 million in shares. This repurchase authorization permits the construction company to buy up to 8% of its shares through open market purchases. Shares repurchase plans are usually a sign that the company's board believes its shares are undervalued.

Wall Street Analyst Weigh In

Several equities research analysts have recently commented on the stock. Wall Street Zen downgraded shares of BlueLinx from a "hold" rating to a "sell" rating in a research note on Friday, July 18th. Benchmark decreased their target price on shares of BlueLinx from $110.00 to $83.00 and set a "buy" rating for the company in a research report on Friday, August 1st. Finally, DA Davidson set a $75.00 target price on shares of BlueLinx and gave the company a "neutral" rating in a research report on Monday, August 4th. Two analysts have rated the stock with a Buy rating and one has given a Hold rating to the company's stock. Based on data from MarketBeat, BlueLinx currently has a consensus rating of "Moderate Buy" and an average target price of $91.00.

Get Our Latest Report on BlueLinx

About BlueLinx

(

Free Report)

BlueLinx Holdings Inc, together with its subsidiaries, engages in the distribution of residential and commercial building products in the United States. It distributes specialty products, including engineered wood, siding, millwork, outdoor living, specialty lumber and panels, and industrial products; and structural products, such as lumber, plywood, oriented strand boards, rebars and remesh, as well as other wood products that are used for structural support in construction projects.

Featured Articles

Before you consider BlueLinx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlueLinx wasn't on the list.

While BlueLinx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.