Charles Schwab Investment Management Inc. lifted its holdings in shares of A-Mark Precious Metals, Inc. (NASDAQ:AMRK - Free Report) by 33.9% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 330,145 shares of the company's stock after buying an additional 83,635 shares during the period. Charles Schwab Investment Management Inc. owned about 1.43% of A-Mark Precious Metals worth $8,376,000 at the end of the most recent quarter.

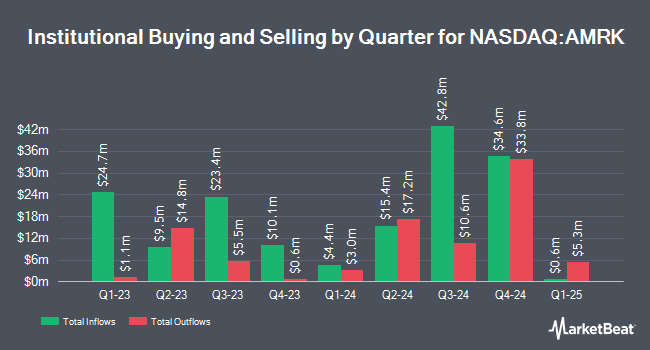

Other large investors also recently modified their holdings of the company. New York State Teachers Retirement System bought a new position in A-Mark Precious Metals during the first quarter worth about $41,000. CWM LLC grew its holdings in A-Mark Precious Metals by 1,192.3% during the first quarter. CWM LLC now owns 2,184 shares of the company's stock worth $55,000 after purchasing an additional 2,015 shares during the period. NBC Securities Inc. bought a new position in A-Mark Precious Metals during the first quarter worth about $70,000. GAMMA Investing LLC grew its holdings in A-Mark Precious Metals by 11,170.5% during the first quarter. GAMMA Investing LLC now owns 6,875 shares of the company's stock worth $174,000 after purchasing an additional 6,814 shares during the period. Finally, Ancora Advisors LLC grew its holdings in A-Mark Precious Metals by 2,013.1% during the fourth quarter. Ancora Advisors LLC now owns 7,121 shares of the company's stock worth $195,000 after purchasing an additional 6,784 shares during the period. 75.25% of the stock is currently owned by institutional investors and hedge funds.

A-Mark Precious Metals Stock Performance

AMRK stock traded up $0.44 during mid-day trading on Friday, hitting $23.41. 127,484 shares of the company were exchanged, compared to its average volume of 181,095. The business has a 50 day simple moving average of $22.48 and a 200-day simple moving average of $23.49. The company has a current ratio of 1.56, a quick ratio of 0.39 and a debt-to-equity ratio of 0.46. The stock has a market capitalization of $576.35 million, a PE ratio of 15.82 and a beta of 0.16. A-Mark Precious Metals, Inc. has a 1-year low of $19.39 and a 1-year high of $47.39.

A-Mark Precious Metals Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, August 1st. Shareholders of record on Friday, July 18th were given a dividend of $0.20 per share. The ex-dividend date was Friday, July 18th. This represents a $0.80 annualized dividend and a yield of 3.4%. A-Mark Precious Metals's dividend payout ratio (DPR) is 54.05%.

Analyst Upgrades and Downgrades

A number of equities analysts recently commented on the company. Wall Street Zen upgraded A-Mark Precious Metals from a "sell" rating to a "hold" rating in a report on Saturday, May 17th. DA Davidson reduced their price target on A-Mark Precious Metals from $35.00 to $29.00 and set a "buy" rating for the company in a report on Thursday, May 8th. One equities research analyst has rated the stock with a Buy rating and two have given a Hold rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $33.00.

View Our Latest Stock Analysis on A-Mark Precious Metals

Insider Transactions at A-Mark Precious Metals

In other A-Mark Precious Metals news, CFO Kathleen Taylor-Simpson sold 5,000 shares of the firm's stock in a transaction that occurred on Monday, June 2nd. The shares were sold at an average price of $20.68, for a total transaction of $103,400.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. 48.64% of the stock is owned by company insiders.

A-Mark Precious Metals Profile

(

Free Report)

A-Mark Precious Metals, Inc, together with its subsidiaries, operates as a precious metals trading company. It operates through three segments: Wholesale Sales & Ancillary Services, Direct-to-Consumer, and Secured Lending. The Wholesale Sales & Ancillary Services segment sells gold, silver, platinum, and palladium in the form of bars, plates, powders, wafers, grains, ingots, and coins.

Featured Stories

Before you consider A-Mark Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A-Mark Precious Metals wasn't on the list.

While A-Mark Precious Metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.