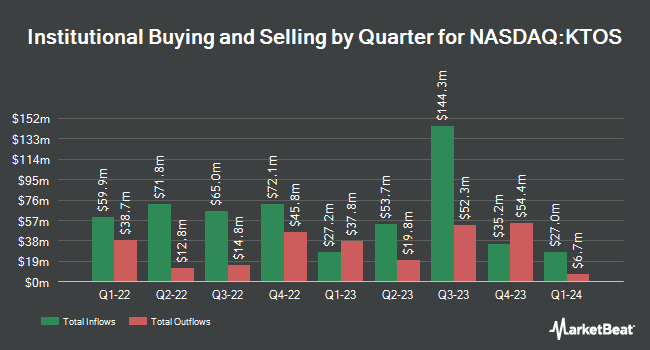

Charles Schwab Investment Management Inc. raised its stake in shares of Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS - Free Report) by 4.0% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,574,099 shares of the aerospace company's stock after acquiring an additional 60,662 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.03% of Kratos Defense & Security Solutions worth $46,735,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also bought and sold shares of KTOS. Wells Fargo & Company MN boosted its position in shares of Kratos Defense & Security Solutions by 16.3% in the 4th quarter. Wells Fargo & Company MN now owns 118,237 shares of the aerospace company's stock worth $3,119,000 after purchasing an additional 16,577 shares in the last quarter. Envestnet Asset Management Inc. boosted its position in shares of Kratos Defense & Security Solutions by 17.2% in the 4th quarter. Envestnet Asset Management Inc. now owns 241,133 shares of the aerospace company's stock worth $6,361,000 after purchasing an additional 35,433 shares in the last quarter. Sterling Capital Management LLC boosted its position in shares of Kratos Defense & Security Solutions by 653.5% in the 4th quarter. Sterling Capital Management LLC now owns 2,660 shares of the aerospace company's stock worth $70,000 after purchasing an additional 2,307 shares in the last quarter. Summit Investment Advisors Inc. boosted its position in shares of Kratos Defense & Security Solutions by 3.3% in the 4th quarter. Summit Investment Advisors Inc. now owns 15,479 shares of the aerospace company's stock worth $408,000 after purchasing an additional 490 shares in the last quarter. Finally, Barclays PLC boosted its position in shares of Kratos Defense & Security Solutions by 50.3% in the 4th quarter. Barclays PLC now owns 410,481 shares of the aerospace company's stock worth $10,828,000 after purchasing an additional 137,381 shares in the last quarter. Institutional investors own 75.92% of the company's stock.

Insiders Place Their Bets

In other news, SVP Marie Mendoza sold 2,000 shares of the firm's stock in a transaction dated Friday, August 15th. The stock was sold at an average price of $68.35, for a total transaction of $136,700.00. Following the sale, the senior vice president directly owned 63,357 shares in the company, valued at $4,330,450.95. This trade represents a 3.06% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Phillip D. Carrai sold 6,000 shares of the firm's stock in a transaction dated Friday, August 15th. The shares were sold at an average price of $67.78, for a total value of $406,680.00. Following the sale, the insider owned 264,074 shares in the company, valued at $17,898,935.72. This trade represents a 2.22% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 101,786 shares of company stock valued at $4,443,682 over the last quarter. Insiders own 2.37% of the company's stock.

Kratos Defense & Security Solutions Stock Performance

NASDAQ KTOS opened at $68.50 on Friday. The stock has a 50-day simple moving average of $51.65 and a two-hundred day simple moving average of $38.88. The firm has a market capitalization of $11.56 billion, a P/E ratio of 685.07 and a beta of 1.04. Kratos Defense & Security Solutions, Inc. has a fifty-two week low of $20.37 and a fifty-two week high of $72.70. The company has a debt-to-equity ratio of 0.12, a quick ratio of 3.88 and a current ratio of 4.43.

Kratos Defense & Security Solutions (NASDAQ:KTOS - Get Free Report) last posted its earnings results on Thursday, August 7th. The aerospace company reported $0.11 EPS for the quarter, beating analysts' consensus estimates of $0.09 by $0.02. Kratos Defense & Security Solutions had a return on equity of 3.10% and a net margin of 1.20%. The firm had revenue of $351.50 million for the quarter, compared to analysts' expectations of $305.67 million. During the same period last year, the firm earned $0.14 EPS. The company's quarterly revenue was up 17.1% on a year-over-year basis. On average, equities analysts forecast that Kratos Defense & Security Solutions, Inc. will post 0.31 earnings per share for the current year.

Wall Street Analysts Forecast Growth

KTOS has been the subject of a number of research analyst reports. Citigroup restated a "market outperform" rating on shares of Kratos Defense & Security Solutions in a research note on Tuesday, July 22nd. Royal Bank Of Canada raised their target price on Kratos Defense & Security Solutions from $50.00 to $65.00 and gave the stock an "outperform" rating in a research note on Friday, August 8th. Stifel Nicolaus raised their target price on Kratos Defense & Security Solutions from $54.00 to $70.00 and gave the stock a "buy" rating in a research note on Monday, July 21st. Truist Financial raised their target price on Kratos Defense & Security Solutions from $38.00 to $52.00 and gave the stock a "buy" rating in a research note on Friday, June 27th. Finally, B. Riley restated a "buy" rating and issued a $72.00 target price (up previously from $55.00) on shares of Kratos Defense & Security Solutions in a research note on Monday, August 11th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating, thirteen have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $57.64.

Check Out Our Latest Stock Report on KTOS

About Kratos Defense & Security Solutions

(

Free Report)

Kratos Defense & Security Solutions, Inc engages in the provision of mission critical products, services and solutions for United States national security priorities. It operates through the Kratos Government Solutions (KGS) and Unmanned Systems (US) segments. The KGS segment consists of an aggregation of KGS operating segments, including microwave electronic products, space, satellite and cyber, training solutions.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kratos Defense & Security Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kratos Defense & Security Solutions wasn't on the list.

While Kratos Defense & Security Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.