Charles Schwab Investment Management Inc. raised its position in shares of Nomura Holdings Inc ADR (NYSE:NMR - Free Report) by 21.1% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 462,647 shares of the financial services provider's stock after acquiring an additional 80,540 shares during the period. Charles Schwab Investment Management Inc.'s holdings in Nomura were worth $2,845,000 at the end of the most recent quarter.

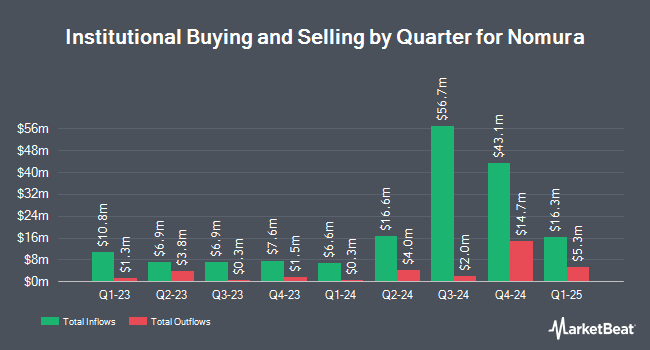

Other large investors also recently made changes to their positions in the company. Abel Hall LLC bought a new stake in Nomura in the 1st quarter valued at $62,000. Adero Partners LLC lifted its holdings in shares of Nomura by 18.2% during the first quarter. Adero Partners LLC now owns 12,006 shares of the financial services provider's stock worth $74,000 after buying an additional 1,848 shares in the last quarter. Baader Bank Aktiengesellschaft acquired a new stake in shares of Nomura during the first quarter worth $81,000. Campbell Deegan Wealth Management LLC bought a new stake in shares of Nomura in the fourth quarter valued at about $84,000. Finally, Cubist Systematic Strategies LLC acquired a new position in shares of Nomura in the fourth quarter valued at about $84,000. Institutional investors own 15.14% of the company's stock.

Nomura Stock Performance

NYSE:NMR traded up $0.10 during mid-day trading on Thursday, reaching $7.17. 294,556 shares of the company's stock were exchanged, compared to its average volume of 436,677. The company has a debt-to-equity ratio of 7.58, a quick ratio of 1.13 and a current ratio of 1.13. The firm has a market capitalization of $21.18 billion, a PE ratio of 8.63, a price-to-earnings-growth ratio of 6.69 and a beta of 0.77. Nomura Holdings Inc ADR has a one year low of $4.86 and a one year high of $7.46. The business's fifty day simple moving average is $6.84 and its two-hundred day simple moving average is $6.30.

Nomura (NYSE:NMR - Get Free Report) last released its earnings results on Tuesday, July 29th. The financial services provider reported $0.24 earnings per share for the quarter, missing analysts' consensus estimates of $0.25 by ($0.01). Nomura had a net margin of 8.06% and a return on equity of 10.58%. The company had revenue of $3.53 billion for the quarter, compared to the consensus estimate of $3.04 billion. Analysts anticipate that Nomura Holdings Inc ADR will post 0.76 earnings per share for the current fiscal year.

About Nomura

(

Free Report)

Nomura Holdings, Inc provides various financial services to individuals, corporations, financial institutions, governments, and governmental agencies worldwide. It operates through three segments: Retail, Investment Management, and Wholesale. The Retail segment offers various financial products and investment consultation services.

Further Reading

Before you consider Nomura, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nomura wasn't on the list.

While Nomura currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.