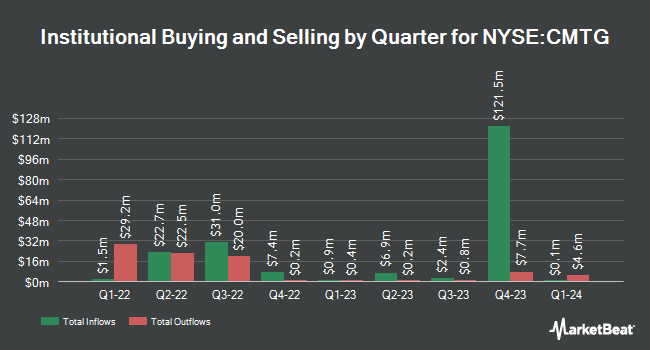

Charles Schwab Investment Management Inc. increased its position in Claros Mortgage Trust, Inc. (NYSE:CMTG - Free Report) by 31.2% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,203,104 shares of the company's stock after acquiring an additional 523,403 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.58% of Claros Mortgage Trust worth $8,218,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. AXS Investments LLC increased its holdings in Claros Mortgage Trust by 70.8% in the 1st quarter. AXS Investments LLC now owns 411,159 shares of the company's stock worth $1,534,000 after acquiring an additional 170,460 shares in the last quarter. XTX Topco Ltd increased its holdings in Claros Mortgage Trust by 43.8% in the 1st quarter. XTX Topco Ltd now owns 31,812 shares of the company's stock worth $119,000 after acquiring an additional 9,695 shares in the last quarter. GSA Capital Partners LLP increased its holdings in Claros Mortgage Trust by 95.5% in the 1st quarter. GSA Capital Partners LLP now owns 155,849 shares of the company's stock worth $581,000 after acquiring an additional 76,116 shares in the last quarter. Avantax Advisory Services Inc. purchased a new stake in Claros Mortgage Trust in the 1st quarter worth approximately $61,000. Finally, AE Wealth Management LLC purchased a new stake in Claros Mortgage Trust in the 1st quarter worth approximately $104,000. 89.53% of the stock is owned by hedge funds and other institutional investors.

Claros Mortgage Trust Trading Down 1.4%

Shares of CMTG opened at $3.46 on Tuesday. The company has a debt-to-equity ratio of 1.92, a current ratio of 30.23 and a quick ratio of 30.23. The firm has a market cap of $483.78 million, a P/E ratio of -1.16 and a beta of 1.21. Claros Mortgage Trust, Inc. has a 1 year low of $2.13 and a 1 year high of $8.60. The company has a 50 day simple moving average of $3.15 and a two-hundred day simple moving average of $2.96.

Analyst Ratings Changes

CMTG has been the subject of several analyst reports. Keefe, Bruyette & Woods increased their target price on shares of Claros Mortgage Trust from $2.75 to $3.00 and gave the stock an "underperform" rating in a report on Tuesday, August 12th. UBS Group reissued a "buy" rating and issued a $4.00 target price (up from $3.50) on shares of Claros Mortgage Trust in a report on Wednesday, May 21st. One analyst has rated the stock with a Buy rating, one has assigned a Hold rating and two have assigned a Sell rating to the stock. According to data from MarketBeat, Claros Mortgage Trust has a consensus rating of "Reduce" and a consensus price target of $4.13.

View Our Latest Stock Report on Claros Mortgage Trust

Claros Mortgage Trust Profile

(

Free Report)

Claros Mortgage Trust, Inc operates as a real estate investment trust. It focuses on originating senior and subordinate loans on transitional commercial real estate assets in the United States. The company has elected to be taxed as a real estate investment trust. As a result, it would not be subject to corporate income tax on that portion of its net income that is distributed to shareholders.

See Also

Want to see what other hedge funds are holding CMTG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Claros Mortgage Trust, Inc. (NYSE:CMTG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Claros Mortgage Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Claros Mortgage Trust wasn't on the list.

While Claros Mortgage Trust currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.