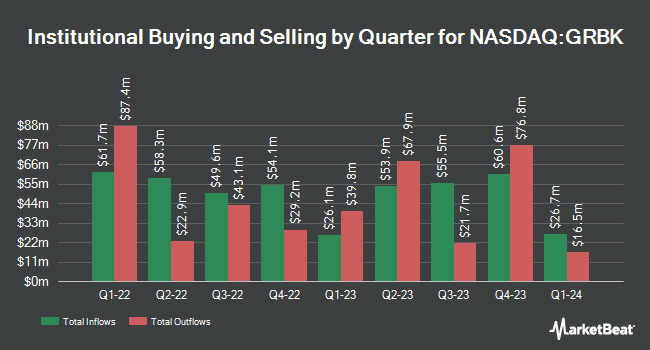

Charles Schwab Investment Management Inc. grew its stake in shares of Green Brick Partners, Inc. (NASDAQ:GRBK - Free Report) by 10.3% during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 438,707 shares of the financial services provider's stock after acquiring an additional 41,083 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.00% of Green Brick Partners worth $25,581,000 as of its most recent SEC filing.

Several other institutional investors have also recently made changes to their positions in the business. Sterling Capital Management LLC raised its position in shares of Green Brick Partners by 758.8% during the fourth quarter. Sterling Capital Management LLC now owns 730 shares of the financial services provider's stock valued at $41,000 after buying an additional 645 shares during the last quarter. Byrne Asset Management LLC grew its holdings in shares of Green Brick Partners by 50.7% in the first quarter. Byrne Asset Management LLC now owns 2,170 shares of the financial services provider's stock valued at $127,000 after purchasing an additional 730 shares in the last quarter. GAMMA Investing LLC grew its holdings in shares of Green Brick Partners by 36.8% in the first quarter. GAMMA Investing LLC now owns 2,400 shares of the financial services provider's stock valued at $140,000 after purchasing an additional 646 shares in the last quarter. CWM LLC boosted its stake in Green Brick Partners by 13.5% during the first quarter. CWM LLC now owns 2,958 shares of the financial services provider's stock worth $172,000 after buying an additional 352 shares during the period. Finally, Wealthedge Investment Advisors LLC purchased a new position in Green Brick Partners during the fourth quarter worth $200,000. Institutional investors own 78.24% of the company's stock.

Analyst Ratings Changes

Separately, B. Riley started coverage on shares of Green Brick Partners in a research note on Monday, June 30th. They set a "neutral" rating and a $62.00 price objective for the company. Three investment analysts have rated the stock with a Hold rating, According to data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $66.00.

Read Our Latest Analysis on GRBK

Insider Activity

In other news, COO Jed Dolson sold 15,000 shares of the business's stock in a transaction on Wednesday, August 13th. The shares were sold at an average price of $68.76, for a total transaction of $1,031,400.00. Following the completion of the sale, the chief operating officer directly owned 258,605 shares of the company's stock, valued at approximately $17,781,679.80. The trade was a 5.48% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Corporate insiders own 29.70% of the company's stock.

Green Brick Partners Trading Down 0.7%

Shares of GRBK traded down $0.46 during trading hours on Tuesday, reaching $69.74. 172,444 shares of the company traded hands, compared to its average volume of 290,109. The firm has a market cap of $3.04 billion, a price-to-earnings ratio of 9.06 and a beta of 1.83. Green Brick Partners, Inc. has a 12-month low of $50.57 and a 12-month high of $84.66. The company has a current ratio of 7.57, a quick ratio of 0.63 and a debt-to-equity ratio of 0.20. The stock's fifty day moving average price is $65.48 and its 200 day moving average price is $61.18.

Green Brick Partners (NASDAQ:GRBK - Get Free Report) last issued its earnings results on Wednesday, July 30th. The financial services provider reported $1.85 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.94 by ($0.09). Green Brick Partners had a net margin of 17.70% and a return on equity of 25.35%. The firm's revenue was down 2.1% on a year-over-year basis. During the same quarter in the previous year, the business earned $2.32 EPS. Sell-side analysts forecast that Green Brick Partners, Inc. will post 8.34 earnings per share for the current year.

Green Brick Partners Company Profile

(

Free Report)

Green Brick Partners, Inc is a diversified homebuilding and land development company in the United States. The company operates through three segments: Builder operations Central, Builder operations Southeast, and Land Development. The Builder operations Central segment operates builders in Texas; and the closing and delivery of homes.

Featured Stories

Before you consider Green Brick Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Green Brick Partners wasn't on the list.

While Green Brick Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.