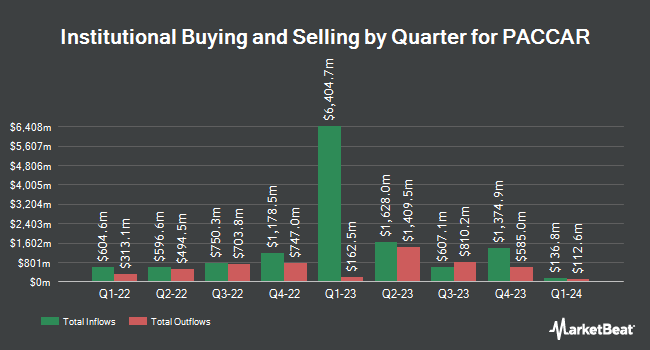

Charles Schwab Investment Management Inc. boosted its position in shares of PACCAR Inc. (NASDAQ:PCAR - Free Report) by 1.9% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,208,080 shares of the company's stock after acquiring an additional 58,684 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.61% of PACCAR worth $312,371,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH increased its position in PACCAR by 15.1% during the first quarter. MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH now owns 794,946 shares of the company's stock worth $77,404,000 after acquiring an additional 104,281 shares during the period. Cambridge Investment Research Advisors Inc. boosted its stake in shares of PACCAR by 62.1% in the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 36,289 shares of the company's stock valued at $3,533,000 after purchasing an additional 13,904 shares in the last quarter. China Universal Asset Management Co. Ltd. boosted its stake in shares of PACCAR by 51.9% in the 1st quarter. China Universal Asset Management Co. Ltd. now owns 12,962 shares of the company's stock valued at $1,262,000 after purchasing an additional 4,429 shares in the last quarter. Moran Wealth Management LLC boosted its position in PACCAR by 28.8% during the 1st quarter. Moran Wealth Management LLC now owns 235,167 shares of the company's stock worth $22,898,000 after buying an additional 52,525 shares during the period. Finally, Stack Financial Management Inc acquired a new stake in PACCAR during the 1st quarter worth approximately $20,585,000. 64.90% of the stock is owned by institutional investors.

Insider Buying and Selling

In other PACCAR news, CEO R Preston Feight sold 39,965 shares of the stock in a transaction that occurred on Tuesday, July 29th. The shares were sold at an average price of $99.52, for a total transaction of $3,977,316.80. Following the transaction, the chief executive officer directly owned 223,190 shares in the company, valued at $22,211,868.80. This trade represents a 15.19% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CFO Brice J. Poplawski sold 5,000 shares of the stock in a transaction that occurred on Friday, July 25th. The shares were sold at an average price of $100.94, for a total value of $504,700.00. Following the sale, the chief financial officer directly owned 468 shares of the company's stock, valued at approximately $47,239.92. This trade represents a 91.44% decrease in their position. The disclosure for this sale can be found here. 2.02% of the stock is owned by company insiders.

Analyst Ratings Changes

Several research analysts have issued reports on the stock. Morgan Stanley lowered shares of PACCAR from an "overweight" rating to an "equal weight" rating and set a $96.00 price target for the company. in a report on Wednesday, April 16th. Truist Financial lowered their price objective on shares of PACCAR from $102.00 to $98.00 and set a "hold" rating for the company in a research note on Wednesday, July 23rd. Royal Bank Of Canada reduced their price objective on shares of PACCAR from $106.00 to $97.00 and set a "sector perform" rating for the company in a report on Thursday, May 8th. Evercore ISI cut their price objective on shares of PACCAR from $127.00 to $115.00 and set an "outperform" rating on the stock in a report on Monday, May 19th. Finally, Argus raised shares of PACCAR from a "hold" rating to a "buy" rating and set a $121.00 price objective on the stock in a report on Monday, July 28th. Nine equities research analysts have rated the stock with a hold rating, four have given a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $107.77.

Check Out Our Latest Analysis on PCAR

PACCAR Stock Performance

Shares of PCAR traded up $1.80 during trading hours on Tuesday, hitting $98.95. The company's stock had a trading volume of 2,459,424 shares, compared to its average volume of 2,915,644. The company has a market cap of $51.96 billion, a price-to-earnings ratio of 16.94, a PEG ratio of 3.91 and a beta of 0.91. The company has a debt-to-equity ratio of 0.57, a current ratio of 3.02 and a quick ratio of 2.80. The business has a 50 day simple moving average of $95.83 and a two-hundred day simple moving average of $97.32. PACCAR Inc. has a 52-week low of $84.65 and a 52-week high of $118.81.

PACCAR (NASDAQ:PCAR - Get Free Report) last announced its quarterly earnings results on Tuesday, July 22nd. The company reported $1.37 earnings per share for the quarter, beating the consensus estimate of $1.28 by $0.09. The firm had revenue of $6.96 billion for the quarter, compared to analysts' expectations of $7.02 billion. PACCAR had a return on equity of 18.25% and a net margin of 9.88%. The company's revenue was down 15.7% on a year-over-year basis. During the same period in the prior year, the business posted $2.13 earnings per share. On average, equities analysts expect that PACCAR Inc. will post 7.57 earnings per share for the current fiscal year.

PACCAR Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, September 4th. Shareholders of record on Thursday, August 14th will be given a dividend of $0.33 per share. This represents a $1.32 dividend on an annualized basis and a yield of 1.3%. The ex-dividend date is Thursday, August 14th. PACCAR's dividend payout ratio (DPR) is presently 22.60%.

About PACCAR

(

Free Report)

PACCAR Inc designs, manufactures, and distributes light, medium, and heavy-duty commercial trucks in the United States, Canada, Europe, Mexico, South America, Australia, and internationally. It operates through three segments: Truck, Parts, and Financial Services. The Truck segment designs, manufactures, and distributes trucks for the over-the-road and off-highway hauling of commercial and consumer goods.

Featured Stories

Before you consider PACCAR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PACCAR wasn't on the list.

While PACCAR currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report