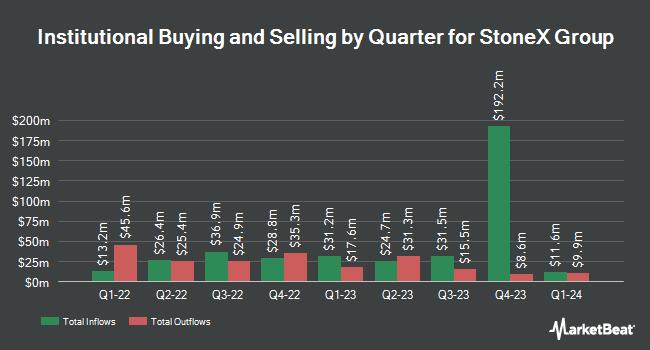

Charles Schwab Investment Management Inc. boosted its stake in StoneX Group Inc. (NASDAQ:SNEX - Free Report) by 56.2% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 441,977 shares of the company's stock after buying an additional 159,068 shares during the period. Charles Schwab Investment Management Inc. owned approximately 0.92% of StoneX Group worth $33,758,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Sequoia Financial Advisors LLC purchased a new stake in StoneX Group in the 1st quarter valued at about $251,000. Wealth Enhancement Advisory Services LLC raised its holdings in StoneX Group by 51.7% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 7,622 shares of the company's stock valued at $582,000 after buying an additional 2,598 shares during the period. Crossmark Global Holdings Inc. raised its holdings in StoneX Group by 49.7% in the 1st quarter. Crossmark Global Holdings Inc. now owns 3,351 shares of the company's stock valued at $256,000 after buying an additional 1,112 shares during the period. Illinois Municipal Retirement Fund raised its holdings in StoneX Group by 55.1% in the 1st quarter. Illinois Municipal Retirement Fund now owns 23,622 shares of the company's stock valued at $1,804,000 after buying an additional 8,390 shares during the period. Finally, Bank of New York Mellon Corp raised its holdings in StoneX Group by 47.2% in the 1st quarter. Bank of New York Mellon Corp now owns 287,633 shares of the company's stock valued at $21,969,000 after buying an additional 92,293 shares during the period. 75.93% of the stock is currently owned by hedge funds and other institutional investors.

StoneX Group Stock Up 3.0%

Shares of SNEX stock traded up $2.88 during trading hours on Friday, reaching $98.84. 451,123 shares of the stock were exchanged, compared to its average volume of 672,870. The business's fifty day moving average is $92.38 and its two-hundred day moving average is $85.30. The company has a debt-to-equity ratio of 1.30, a current ratio of 2.08 and a quick ratio of 1.48. StoneX Group Inc. has a 12-month low of $50.31 and a 12-month high of $100.40. The firm has a market capitalization of $5.16 billion, a P/E ratio of 16.84 and a beta of 0.57.

StoneX Group (NASDAQ:SNEX - Get Free Report) last released its earnings results on Tuesday, August 5th. The company reported $1.22 earnings per share for the quarter, missing analysts' consensus estimates of $1.39 by ($0.17). StoneX Group had a return on equity of 16.20% and a net margin of 0.23%.The firm had revenue of $1.02 billion for the quarter, compared to analysts' expectations of $923.10 million. As a group, research analysts expect that StoneX Group Inc. will post 8.7 EPS for the current fiscal year.

Insider Activity

In related news, CEO Philip Andrew Smith sold 7,500 shares of the company's stock in a transaction that occurred on Tuesday, June 10th. The shares were sold at an average price of $83.68, for a total transaction of $627,600.00. Following the sale, the chief executive officer directly owned 327,754 shares in the company, valued at approximately $27,426,454.72. This represents a 2.24% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Chairman John Radziwill bought 1,400 shares of the business's stock in a transaction that occurred on Thursday, June 12th. The shares were purchased at an average price of $85.00 per share, for a total transaction of $119,000.00. Following the completion of the purchase, the chairman directly owned 100,240 shares of the company's stock, valued at approximately $8,520,400. This trade represents a 1.42% increase in their position. The disclosure for this purchase can be found here. Insiders have sold a total of 45,305 shares of company stock valued at $3,859,233 over the last three months. 11.70% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Separately, Zacks Research raised StoneX Group to a "strong-buy" rating in a research report on Friday, August 8th. One analyst has rated the stock with a Strong Buy rating and one has assigned a Buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Strong Buy".

Read Our Latest Analysis on SNEX

StoneX Group Profile

(

Free Report)

StoneX Group Inc operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem worldwide. The company operates through Commercial, Institutional, Retail, and Global Payments segments. The Commercial segment provides risk management and hedging, exchange-traded and OTC products execution and clearing, voice brokerage, market intelligence, physical trading, and commodity financing and logistics services.

Further Reading

Before you consider StoneX Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneX Group wasn't on the list.

While StoneX Group currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.