Charles Schwab Investment Management Inc. trimmed its stake in Chatham Lodging Trust (REIT) (NYSE:CLDT - Free Report) by 22.1% during the first quarter, according to its most recent 13F filing with the SEC. The firm owned 391,037 shares of the real estate investment trust's stock after selling 111,169 shares during the period. Charles Schwab Investment Management Inc. owned about 0.80% of Chatham Lodging Trust worth $2,788,000 as of its most recent filing with the SEC.

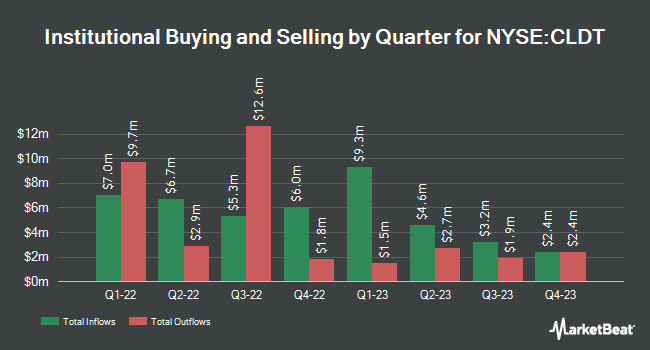

A number of other institutional investors and hedge funds have also made changes to their positions in CLDT. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its stake in Chatham Lodging Trust by 4.6% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 27,564 shares of the real estate investment trust's stock worth $247,000 after buying an additional 1,216 shares during the period. Point72 Asia Singapore Pte. Ltd. increased its stake in Chatham Lodging Trust by 7.2% during the 4th quarter. Point72 Asia Singapore Pte. Ltd. now owns 34,608 shares of the real estate investment trust's stock worth $310,000 after buying an additional 2,338 shares during the period. Wells Fargo & Company MN increased its stake in Chatham Lodging Trust by 26.7% during the 4th quarter. Wells Fargo & Company MN now owns 28,269 shares of the real estate investment trust's stock worth $253,000 after buying an additional 5,951 shares during the period. Cubist Systematic Strategies LLC increased its position in shares of Chatham Lodging Trust by 5.4% in the 4th quarter. Cubist Systematic Strategies LLC now owns 121,323 shares of the real estate investment trust's stock valued at $1,086,000 after purchasing an additional 6,234 shares during the last quarter. Finally, Lazard Asset Management LLC purchased a new stake in shares of Chatham Lodging Trust in the 4th quarter valued at approximately $56,000. 88.37% of the stock is owned by hedge funds and other institutional investors.

Chatham Lodging Trust Stock Up 0.2%

Shares of Chatham Lodging Trust stock traded up $0.01 during trading hours on Wednesday, hitting $7.54. The company had a trading volume of 62,177 shares, compared to its average volume of 304,646. The company's 50-day moving average is $7.18 and its two-hundred day moving average is $7.23. Chatham Lodging Trust has a twelve month low of $5.83 and a twelve month high of $10.00. The company has a debt-to-equity ratio of 0.27, a current ratio of 1.07 and a quick ratio of 1.07. The company has a market cap of $369.50 million, a P/E ratio of 251.30 and a beta of 1.39.

Chatham Lodging Trust (NYSE:CLDT - Get Free Report) last issued its earnings results on Wednesday, August 6th. The real estate investment trust reported $0.36 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.34 by $0.02. Chatham Lodging Trust had a net margin of 3.04% and a return on equity of 1.19%. The business had revenue of $80.29 million during the quarter, compared to analysts' expectations of $79.67 million. Analysts anticipate that Chatham Lodging Trust will post 1.07 earnings per share for the current fiscal year.

Chatham Lodging Trust declared that its Board of Directors has initiated a stock buyback program on Tuesday, May 6th that allows the company to buyback $25.00 million in outstanding shares. This buyback authorization allows the real estate investment trust to repurchase up to 7.2% of its shares through open market purchases. Shares buyback programs are generally a sign that the company's board believes its stock is undervalued.

Analysts Set New Price Targets

Separately, Alliance Global Partners reissued a "buy" rating on shares of Chatham Lodging Trust in a research report on Tuesday, May 6th. Two equities research analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the stock currently has an average rating of "Buy" and an average price target of $10.75.

Get Our Latest Analysis on CLDT

Chatham Lodging Trust Profile

(

Free Report)

Chatham Lodging Trust is a self-advised, publicly traded real estate investment trust (REIT) focused primarily on investing in upscale, extended-stay hotels and premium-branded, select-service hotels. The company owns 39 hotels totaling 5,915 rooms/suites in 16 states and the District of Columbia.

Featured Articles

Before you consider Chatham Lodging Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chatham Lodging Trust wasn't on the list.

While Chatham Lodging Trust currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.