Charles Schwab Investment Management Inc. increased its stake in shares of GMS Inc. (NYSE:GMS - Free Report) by 2.3% during the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 623,434 shares of the company's stock after purchasing an additional 13,719 shares during the quarter. Charles Schwab Investment Management Inc. owned 1.62% of GMS worth $45,617,000 at the end of the most recent quarter.

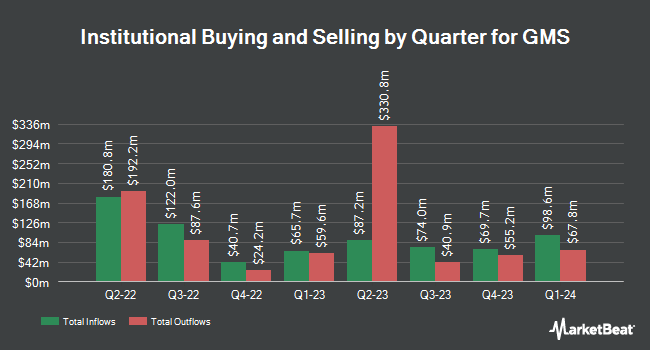

Several other large investors have also recently modified their holdings of GMS. Eukles Asset Management bought a new position in shares of GMS during the 1st quarter valued at approximately $33,000. Canada Pension Plan Investment Board bought a new position in shares of GMS during the 4th quarter valued at approximately $34,000. Versant Capital Management Inc increased its position in shares of GMS by 170.5% during the 1st quarter. Versant Capital Management Inc now owns 706 shares of the company's stock valued at $52,000 after purchasing an additional 445 shares during the last quarter. GAMMA Investing LLC increased its position in shares of GMS by 38.3% during the 1st quarter. GAMMA Investing LLC now owns 801 shares of the company's stock valued at $59,000 after purchasing an additional 222 shares during the last quarter. Finally, Jefferies Financial Group Inc. bought a new position in shares of GMS during the 1st quarter valued at approximately $252,000. Institutional investors own 95.28% of the company's stock.

Insider Transactions at GMS

In related news, major shareholder Coliseum Capital Management, L sold 54,944 shares of the firm's stock in a transaction dated Wednesday, July 16th. The stock was sold at an average price of $110.05, for a total transaction of $6,046,587.20. Following the sale, the insider owned 3,486,524 shares of the company's stock, valued at $383,691,966.20. This trade represents a 1.55% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, COO George T. Hendren sold 5,000 shares of the firm's stock in a transaction dated Monday, June 30th. The shares were sold at an average price of $108.23, for a total value of $541,150.00. Following the sale, the chief operating officer directly owned 23,950 shares in the company, valued at approximately $2,592,108.50. The trade was a 17.27% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 343,627 shares of company stock worth $37,808,097. 1.90% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

Several equities analysts have commented on the company. Stephens downgraded GMS from a "strong-buy" rating to a "hold" rating and set a $95.00 price objective on the stock. in a research report on Friday, June 27th. Barclays upped their price objective on GMS from $95.00 to $110.00 and gave the company an "equal weight" rating in a research report on Tuesday, July 1st. Baird R W downgraded GMS from a "strong-buy" rating to a "hold" rating in a research report on Monday, June 23rd. DA Davidson upped their price objective on GMS from $95.20 to $110.00 and gave the company a "neutral" rating in a research report on Tuesday, July 1st. Finally, Loop Capital upped their price objective on GMS from $95.00 to $110.00 and gave the company a "hold" rating in a research report on Tuesday, July 1st. Nine research analysts have rated the stock with a Hold rating, According to MarketBeat.com, GMS currently has an average rating of "Hold" and an average price target of $101.11.

Check Out Our Latest Research Report on GMS

GMS Stock Down 0.0%

Shares of GMS traded down $0.0250 during midday trading on Tuesday, reaching $109.4750. 481,099 shares of the stock were exchanged, compared to its average volume of 779,177. GMS Inc. has a 52 week low of $65.77 and a 52 week high of $110.28. The company has a current ratio of 1.91, a quick ratio of 1.17 and a debt-to-equity ratio of 0.85. The company's 50 day moving average is $103.24 and its two-hundred day moving average is $85.26. The company has a market capitalization of $4.17 billion, a P/E ratio of 37.88 and a beta of 1.76.

GMS (NYSE:GMS - Get Free Report) last issued its quarterly earnings data on Wednesday, June 18th. The company reported $1.29 earnings per share for the quarter, beating analysts' consensus estimates of $1.11 by $0.18. GMS had a return on equity of 16.97% and a net margin of 2.09%.The company had revenue of $1.33 billion for the quarter, compared to the consensus estimate of $1.30 billion. During the same quarter last year, the company earned $1.93 earnings per share. The firm's revenue for the quarter was down 5.6% compared to the same quarter last year. On average, sell-side analysts anticipate that GMS Inc. will post 7.26 earnings per share for the current year.

About GMS

(

Free Report)

GMS Inc distributes wallboard, ceilings, steel framing and complementary construction products in the United States and Canada. The company offers ceilings products, including suspended mineral fibers, soft fibers, and metal ceiling systems primarily used in offices, hotels, hospitals, retail facilities, schools, and various other commercial and institutional buildings.

Recommended Stories

Before you consider GMS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GMS wasn't on the list.

While GMS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.