Charles Schwab Investment Management Inc. increased its position in shares of MongoDB, Inc. (NASDAQ:MDB - Free Report) by 6.0% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 312,846 shares of the company's stock after buying an additional 17,633 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.39% of MongoDB worth $54,873,000 as of its most recent SEC filing.

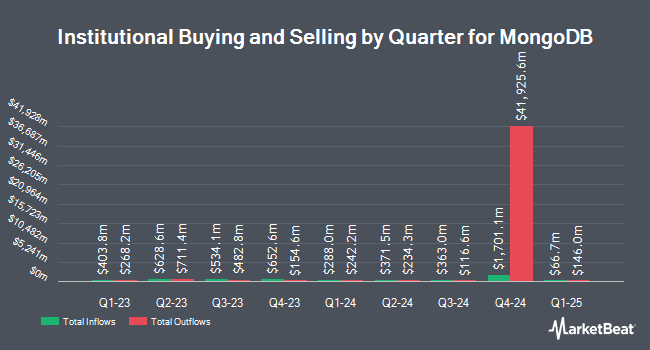

A number of other hedge funds have also modified their holdings of MDB. Summit Investment Advisors Inc. grew its holdings in shares of MongoDB by 5.7% during the fourth quarter. Summit Investment Advisors Inc. now owns 2,350 shares of the company's stock worth $547,000 after buying an additional 127 shares in the last quarter. Guggenheim Capital LLC grew its holdings in shares of MongoDB by 0.5% during the fourth quarter. Guggenheim Capital LLC now owns 20,375 shares of the company's stock worth $4,744,000 after buying an additional 94 shares in the last quarter. Jump Financial LLC grew its holdings in shares of MongoDB by 609.2% during the fourth quarter. Jump Financial LLC now owns 8,369 shares of the company's stock worth $1,948,000 after buying an additional 7,189 shares in the last quarter. Farringdon Capital Ltd. bought a new position in shares of MongoDB during the fourth quarter worth about $219,000. Finally, Strategic Investment Solutions Inc. IL acquired a new position in MongoDB during the fourth quarter valued at approximately $29,000. 89.29% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In related news, Director Dwight A. Merriman sold 1,000 shares of MongoDB stock in a transaction that occurred on Friday, July 25th. The stock was sold at an average price of $245.00, for a total transaction of $245,000.00. Following the completion of the sale, the director directly owned 1,104,316 shares of the company's stock, valued at approximately $270,557,420. This trade represents a 0.09% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director Hope F. Cochran sold 1,174 shares of the firm's stock in a transaction on Tuesday, June 17th. The stock was sold at an average price of $201.08, for a total value of $236,067.92. Following the transaction, the director owned 21,096 shares in the company, valued at approximately $4,241,983.68. This trade represents a 5.27% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 51,416 shares of company stock valued at $11,936,656. Insiders own 3.10% of the company's stock.

MongoDB Stock Performance

NASDAQ:MDB traded down $8.6910 during mid-day trading on Tuesday, hitting $218.3690. 1,128,554 shares of the stock were exchanged, compared to its average volume of 2,310,845. The stock has a market capitalization of $17.84 billion, a price-to-earnings ratio of -191.55 and a beta of 1.44. The firm's 50-day simple moving average is $215.59 and its 200 day simple moving average is $208.31. MongoDB, Inc. has a fifty-two week low of $140.78 and a fifty-two week high of $370.00.

MongoDB (NASDAQ:MDB - Get Free Report) last released its quarterly earnings results on Wednesday, June 4th. The company reported $1.00 earnings per share for the quarter, topping the consensus estimate of $0.65 by $0.35. The business had revenue of $549.01 million during the quarter, compared to analysts' expectations of $527.49 million. MongoDB had a negative return on equity of 3.16% and a negative net margin of 4.09%.The firm's revenue for the quarter was up 21.8% compared to the same quarter last year. During the same period last year, the firm posted $0.51 EPS. MongoDB has set its FY 2026 guidance at 2.940-3.120 EPS. Q2 2026 guidance at 0.620-0.660 EPS. On average, analysts predict that MongoDB, Inc. will post -1.78 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on MDB. Barclays increased their price target on MongoDB from $252.00 to $270.00 and gave the company an "overweight" rating in a research report on Thursday, June 5th. Wedbush reissued an "outperform" rating and set a $300.00 price target on shares of MongoDB in a research report on Thursday, June 5th. Zacks Research raised MongoDB to a "hold" rating in a research report on Friday, August 8th. Wolfe Research began coverage on MongoDB in a research report on Wednesday, July 9th. They set an "outperform" rating and a $280.00 price target for the company. Finally, Macquarie reissued a "neutral" rating and set a $230.00 price target (up from $215.00) on shares of MongoDB in a research report on Friday, June 6th. One investment analyst has rated the stock with a Strong Buy rating, twenty-seven have assigned a Buy rating and ten have issued a Hold rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $283.46.

Read Our Latest Stock Analysis on MongoDB

MongoDB Company Profile

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.