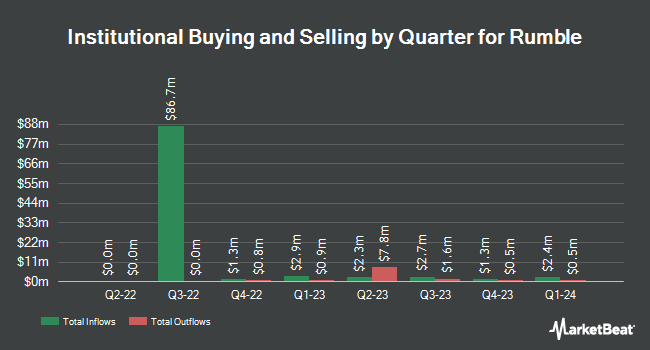

Charles Schwab Investment Management Inc. lifted its stake in shares of Rumble Inc. (NASDAQ:RUM - Free Report) by 41.7% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 698,074 shares of the company's stock after buying an additional 205,281 shares during the quarter. Charles Schwab Investment Management Inc. owned about 0.16% of Rumble worth $4,935,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds and other institutional investors also recently modified their holdings of RUM. Raymond James Financial Inc. purchased a new position in shares of Rumble during the fourth quarter valued at about $468,000. Price T Rowe Associates Inc. MD increased its position in shares of Rumble by 29.9% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 17,800 shares of the company's stock valued at $232,000 after buying an additional 4,100 shares during the period. Northern Trust Corp increased its position in shares of Rumble by 17.9% during the fourth quarter. Northern Trust Corp now owns 213,582 shares of the company's stock valued at $2,779,000 after buying an additional 32,363 shares during the period. Ameriprise Financial Inc. increased its position in shares of Rumble by 2.8% during the fourth quarter. Ameriprise Financial Inc. now owns 638,316 shares of the company's stock valued at $8,304,000 after buying an additional 17,100 shares during the period. Finally, Balyasny Asset Management L.P. purchased a new position in shares of Rumble during the fourth quarter valued at about $3,966,000. Hedge funds and other institutional investors own 26.15% of the company's stock.

Rumble Price Performance

NASDAQ:RUM traded down $0.13 during mid-day trading on Monday, hitting $7.29. 1,925,722 shares of the company's stock were exchanged, compared to its average volume of 2,721,111. Rumble Inc. has a one year low of $4.92 and a one year high of $17.40. The business has a fifty day moving average price of $8.61 and a 200 day moving average price of $8.60. The company has a market cap of $3.17 billion, a PE ratio of -5.10 and a beta of 0.71.

Rumble (NASDAQ:RUM - Get Free Report) last posted its quarterly earnings data on Sunday, August 10th. The company reported ($0.14) EPS for the quarter, missing the consensus estimate of ($0.08) by ($0.06). Rumble had a negative return on equity of 97.99% and a negative net margin of 289.37%.The business had revenue of $25.09 million for the quarter, compared to the consensus estimate of $26.78 million. Rumble's quarterly revenue was up 11.6% compared to the same quarter last year. On average, equities analysts forecast that Rumble Inc. will post -0.62 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen cut shares of Rumble from a "hold" rating to a "sell" rating in a research report on Saturday, August 16th. One investment analyst has rated the stock with a Buy rating and one has given a Hold rating to the stock. According to MarketBeat.com, Rumble currently has an average rating of "Moderate Buy" and an average target price of $14.00.

View Our Latest Stock Analysis on Rumble

Rumble Profile

(

Free Report)

Rumble Inc operates video sharing platforms in the United States, Canada, and internationally. The company operates rumble.com, a free-to-use video sharing and livestreaming platform where users can subscribe to channels to stay in touch with creators, and access video on-demand (VOD) and live content streamed by creators.

Featured Articles

Before you consider Rumble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rumble wasn't on the list.

While Rumble currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.