Charles Schwab Investment Management Inc. lowered its stake in Pitney Bowes Inc. (NYSE:PBI - Free Report) by 24.8% during the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 1,726,734 shares of the technology company's stock after selling 569,531 shares during the period. Charles Schwab Investment Management Inc. owned 0.94% of Pitney Bowes worth $15,627,000 as of its most recent filing with the Securities & Exchange Commission.

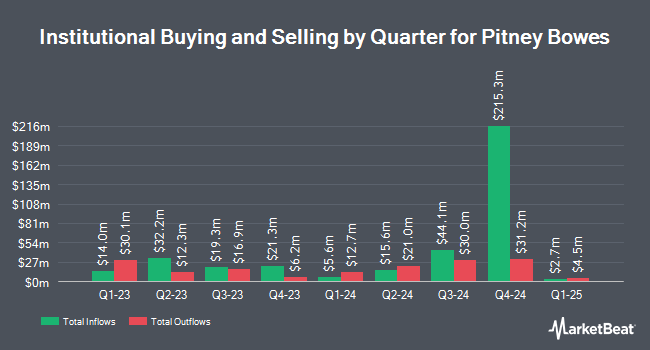

Other hedge funds and other institutional investors also recently made changes to their positions in the company. KBC Group NV purchased a new stake in shares of Pitney Bowes in the 1st quarter worth approximately $65,000. Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in shares of Pitney Bowes in the 1st quarter worth approximately $98,000. PFG Investments LLC grew its stake in shares of Pitney Bowes by 14.6% in the 1st quarter. PFG Investments LLC now owns 12,884 shares of the technology company's stock worth $117,000 after buying an additional 1,644 shares during the last quarter. Wealth Enhancement Advisory Services LLC purchased a new stake in shares of Pitney Bowes in the 1st quarter worth approximately $124,000. Finally, PharVision Advisers LLC purchased a new stake in shares of Pitney Bowes in the 4th quarter worth approximately $107,000. Hedge funds and other institutional investors own 67.88% of the company's stock.

Wall Street Analyst Weigh In

Several analysts recently weighed in on PBI shares. Wall Street Zen downgraded Pitney Bowes from a "strong-buy" rating to a "buy" rating in a research note on Friday, August 22nd. Sidoti upgraded Pitney Bowes to a "hold" rating in a research note on Monday, May 5th. One equities research analyst has rated the stock with a Hold rating, Based on data from MarketBeat, Pitney Bowes currently has a consensus rating of "Hold".

Read Our Latest Stock Report on Pitney Bowes

Pitney Bowes Trading Down 2.0%

PBI traded down $0.24 during trading on Thursday, hitting $12.06. 1,882,376 shares of the company's stock traded hands, compared to its average volume of 4,155,713. The company's 50 day simple moving average is $11.47 and its two-hundred day simple moving average is $10.16. Pitney Bowes Inc. has a 12-month low of $6.22 and a 12-month high of $13.11. The stock has a market capitalization of $2.08 billion, a price-to-earnings ratio of -20.09, a PEG ratio of 0.63 and a beta of 1.54.

Pitney Bowes (NYSE:PBI - Get Free Report) last issued its earnings results on Wednesday, July 30th. The technology company reported $0.27 EPS for the quarter, meeting the consensus estimate of $0.27. Pitney Bowes had a negative return on equity of 38.01% and a negative net margin of 5.60%.The business had revenue of $461.91 million for the quarter, compared to the consensus estimate of $475.92 million. During the same period last year, the business posted $0.03 EPS. The company's revenue was down 5.7% compared to the same quarter last year. Pitney Bowes has set its FY 2025 guidance at 1.200-1.400 EPS. On average, equities analysts expect that Pitney Bowes Inc. will post 1.21 EPS for the current year.

Pitney Bowes Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, September 8th. Stockholders of record on Monday, August 11th will be issued a dividend of $0.08 per share. This represents a $0.32 annualized dividend and a dividend yield of 2.7%. The ex-dividend date of this dividend is Monday, August 11th. This is a positive change from Pitney Bowes's previous quarterly dividend of $0.07. Pitney Bowes's payout ratio is currently -53.33%.

Pitney Bowes declared that its board has authorized a stock repurchase plan on Wednesday, July 30th that permits the company to buyback $400.00 million in outstanding shares. This buyback authorization permits the technology company to purchase up to 18.9% of its shares through open market purchases. Shares buyback plans are generally a sign that the company's board of directors believes its shares are undervalued.

Insider Buying and Selling at Pitney Bowes

In other news, EVP Deborah Pfeiffer sold 35,000 shares of the stock in a transaction on Monday, July 14th. The stock was sold at an average price of $12.14, for a total transaction of $424,900.00. Following the transaction, the executive vice president directly owned 115,405 shares of the company's stock, valued at $1,401,016.70. This represents a 23.27% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 9.00% of the stock is owned by insiders.

About Pitney Bowes

(

Free Report)

Pitney Bowes Inc, a shipping and mailing company, provides technology, logistics, and financial services to small and medium-sized businesses, large enterprises, retailers, and government clients in the United States and internationally. It operates through Global Ecommerce, Presort Services, and SendTech Solutions segments.

Read More

Before you consider Pitney Bowes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pitney Bowes wasn't on the list.

While Pitney Bowes currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.