Bank of New York Mellon Corp increased its holdings in Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report) by 182.0% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 627,489 shares of the technology company's stock after acquiring an additional 404,958 shares during the quarter. Bank of New York Mellon Corp owned approximately 0.57% of Check Point Software Technologies worth $143,017,000 as of its most recent SEC filing.

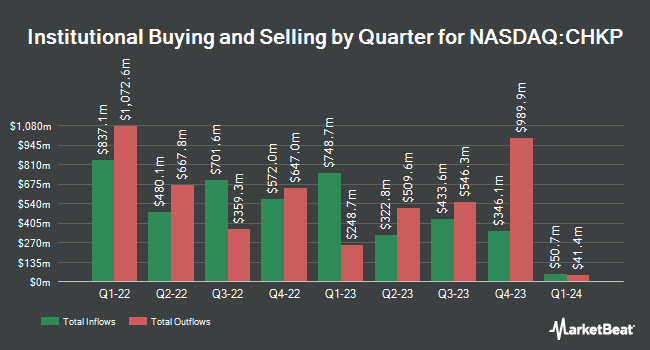

A number of other hedge funds also recently added to or reduced their stakes in CHKP. Nemes Rush Group LLC purchased a new stake in Check Point Software Technologies in the fourth quarter worth about $25,000. Capital A Wealth Management LLC purchased a new stake in shares of Check Point Software Technologies during the fourth quarter valued at about $29,000. Quarry LP lifted its position in shares of Check Point Software Technologies by 100.0% during the fourth quarter. Quarry LP now owns 206 shares of the technology company's stock valued at $38,000 after buying an additional 103 shares during the last quarter. Menard Financial Group LLC purchased a new stake in shares of Check Point Software Technologies during the fourth quarter valued at about $41,000. Finally, Bernard Wealth Management Corp. purchased a new stake in shares of Check Point Software Technologies during the fourth quarter valued at about $76,000. 98.51% of the stock is owned by hedge funds and other institutional investors.

Check Point Software Technologies Stock Performance

Shares of NASDAQ:CHKP traded down $3.48 during midday trading on Thursday, reaching $227.75. 224,495 shares of the company's stock traded hands, compared to its average volume of 784,817. Check Point Software Technologies Ltd. has a 1 year low of $167.88 and a 1 year high of $234.36. The company has a market cap of $25.05 billion, a P/E ratio of 29.99, a PEG ratio of 3.23 and a beta of 0.64. The company has a fifty day simple moving average of $222.41 and a two-hundred day simple moving average of $214.55.

Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) last announced its earnings results on Wednesday, April 23rd. The technology company reported $2.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.19 by $0.02. The firm had revenue of $637.80 million for the quarter, compared to analyst estimates of $635.80 million. Check Point Software Technologies had a return on equity of 32.88% and a net margin of 32.75%. The business's revenue was up 6.5% on a year-over-year basis. During the same quarter last year, the firm posted $2.04 EPS. As a group, research analysts forecast that Check Point Software Technologies Ltd. will post 8.61 EPS for the current fiscal year.

Analysts Set New Price Targets

Several analysts have commented on the stock. Wells Fargo & Company decreased their price target on shares of Check Point Software Technologies from $280.00 to $265.00 and set an "overweight" rating for the company in a research report on Thursday, April 24th. Mizuho upped their price objective on shares of Check Point Software Technologies from $230.00 to $240.00 and gave the company a "neutral" rating in a report on Monday, June 16th. Morgan Stanley cut their price objective on shares of Check Point Software Technologies from $235.00 to $220.00 and set an "equal weight" rating on the stock in a report on Wednesday, April 16th. Stephens cut their price objective on shares of Check Point Software Technologies from $255.00 to $229.00 and set an "equal weight" rating on the stock in a report on Thursday, April 24th. Finally, Scotiabank cut their price objective on shares of Check Point Software Technologies from $250.00 to $240.00 and set a "sector outperform" rating on the stock in a report on Thursday, April 24th. Sixteen investment analysts have rated the stock with a hold rating, twelve have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $232.44.

Get Our Latest Research Report on CHKP

Check Point Software Technologies Company Profile

(

Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Read More

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.