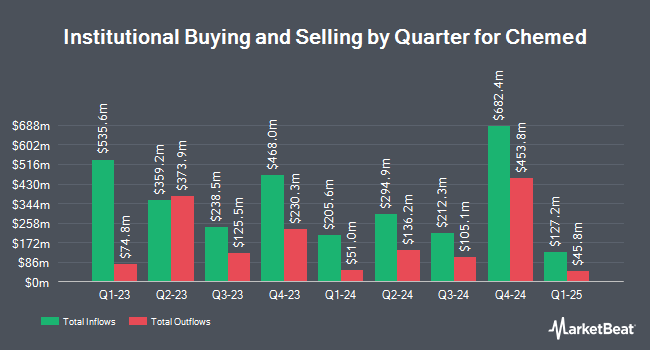

Martingale Asset Management L P decreased its position in Chemed Corporation (NYSE:CHE - Free Report) by 14.5% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 24,042 shares of the company's stock after selling 4,090 shares during the period. Martingale Asset Management L P owned about 0.16% of Chemed worth $14,794,000 as of its most recent SEC filing.

Several other large investors have also recently added to or reduced their stakes in CHE. Barclays PLC raised its holdings in Chemed by 20.2% in the 4th quarter. Barclays PLC now owns 11,778 shares of the company's stock valued at $6,240,000 after acquiring an additional 1,983 shares in the last quarter. Marshall Wace LLP acquired a new position in Chemed in the 4th quarter valued at approximately $618,000. Dimensional Fund Advisors LP raised its holdings in Chemed by 10.3% in the 4th quarter. Dimensional Fund Advisors LP now owns 199,254 shares of the company's stock valued at $105,564,000 after acquiring an additional 18,584 shares in the last quarter. MetLife Investment Management LLC raised its holdings in Chemed by 8.5% in the 4th quarter. MetLife Investment Management LLC now owns 8,511 shares of the company's stock valued at $4,509,000 after acquiring an additional 666 shares in the last quarter. Finally, Integrated Wealth Concepts LLC raised its holdings in Chemed by 25.5% in the 4th quarter. Integrated Wealth Concepts LLC now owns 8,668 shares of the company's stock valued at $4,592,000 after acquiring an additional 1,759 shares in the last quarter. Institutional investors and hedge funds own 95.85% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have recently issued reports on the company. Wall Street Zen cut Chemed from a "buy" rating to a "hold" rating in a report on Saturday, July 5th. Royal Bank Of Canada dropped their target price on Chemed from $640.00 to $589.00 and set an "outperform" rating for the company in a report on Thursday, July 31st. Jefferies Financial Group assumed coverage on Chemed in a report on Friday, July 25th. They issued a "hold" rating and a $500.00 target price for the company. Bank of America dropped their target price on Chemed from $708.00 to $650.00 and set a "buy" rating for the company in a report on Monday, June 30th. Finally, Oppenheimer dropped their target price on Chemed from $650.00 to $580.00 and set an "outperform" rating for the company in a report on Thursday, July 31st. Three research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat, Chemed presently has an average rating of "Moderate Buy" and an average target price of $579.75.

View Our Latest Research Report on Chemed

Chemed Stock Up 1.3%

CHE stock traded up $5.9150 during midday trading on Friday, reaching $460.0050. 164,599 shares of the company's stock traded hands, compared to its average volume of 190,274. The company has a 50-day simple moving average of $472.64 and a two-hundred day simple moving average of $540.75. Chemed Corporation has a 1-year low of $408.42 and a 1-year high of $623.60. The company has a market cap of $6.70 billion, a price-to-earnings ratio of 23.65, a PEG ratio of 2.53 and a beta of 0.46.

Chemed (NYSE:CHE - Get Free Report) last released its quarterly earnings results on Tuesday, July 29th. The company reported $4.27 earnings per share for the quarter, missing analysts' consensus estimates of $6.02 by ($1.75). Chemed had a net margin of 11.56% and a return on equity of 25.83%. The business had revenue of $618.80 million for the quarter, compared to analyst estimates of $650.60 million. During the same period in the prior year, the business earned $5.47 earnings per share. The company's revenue for the quarter was up 3.8% on a year-over-year basis. Chemed has set its FY 2025 guidance at 22.000-22.300 EPS. Equities research analysts forecast that Chemed Corporation will post 21.43 EPS for the current year.

Chemed Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, August 29th. Investors of record on Monday, August 11th will be issued a dividend of $0.60 per share. The ex-dividend date of this dividend is Monday, August 11th. This represents a $2.40 dividend on an annualized basis and a yield of 0.5%. This is a positive change from Chemed's previous quarterly dividend of $0.50. Chemed's payout ratio is 12.34%.

Insiders Place Their Bets

In other Chemed news, Director George J. Walsh III purchased 200 shares of the company's stock in a transaction that occurred on Monday, August 4th. The stock was purchased at an average cost of $417.10 per share, with a total value of $83,420.00. Following the acquisition, the director directly owned 3,523 shares of the company's stock, valued at approximately $1,469,443.30. This trade represents a 6.02% increase in their position. The acquisition was disclosed in a filing with the SEC, which is available through this link. Also, EVP Nicholas Michael Westfall sold 10,012 shares of the stock in a transaction on Monday, August 4th. The shares were sold at an average price of $421.91, for a total value of $4,224,162.92. The disclosure for this sale can be found here. Company insiders own 3.29% of the company's stock.

Chemed Profile

(

Free Report)

Chemed Corporation provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States. The company operates in VITAS and Roto-Rooter segments. It offers plumbing, drain cleaning, excavation, water restoration, and other related services to residential and commercial customers through company-owned branches, independent contractors, and franchisees.

Featured Articles

Before you consider Chemed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemed wasn't on the list.

While Chemed currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.