Chicago Capital LLC lifted its holdings in shares of Pfizer Inc. (NYSE:PFE - Free Report) by 11.0% during the second quarter, according to its most recent disclosure with the SEC. The fund owned 108,076 shares of the biopharmaceutical company's stock after acquiring an additional 10,701 shares during the period. Chicago Capital LLC's holdings in Pfizer were worth $2,620,000 at the end of the most recent quarter.

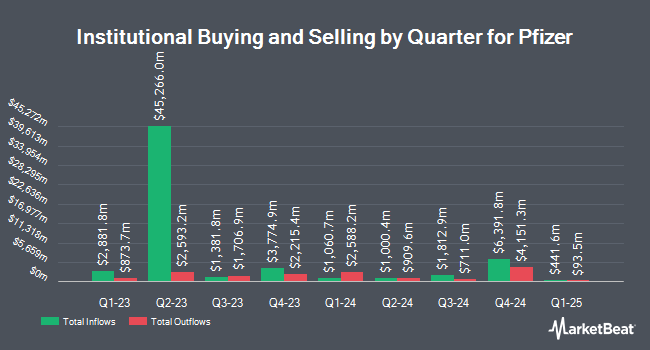

Other large investors have also modified their holdings of the company. Bessemer Group Inc. grew its stake in shares of Pfizer by 11.1% during the first quarter. Bessemer Group Inc. now owns 132,478 shares of the biopharmaceutical company's stock worth $3,358,000 after acquiring an additional 13,228 shares during the last quarter. Capital Advisors Inc. OK lifted its holdings in shares of Pfizer by 1.2% during the first quarter. Capital Advisors Inc. OK now owns 1,413,472 shares of the biopharmaceutical company's stock worth $35,817,000 after purchasing an additional 17,032 shares during the period. CHURCHILL MANAGEMENT Corp acquired a new stake in shares of Pfizer during the first quarter worth about $8,283,000. Westbourne Investments Inc. acquired a new stake in shares of Pfizer during the first quarter worth about $2,411,000. Finally, Bourne Lent Asset Management Inc. lifted its holdings in shares of Pfizer by 90.8% during the second quarter. Bourne Lent Asset Management Inc. now owns 38,255 shares of the biopharmaceutical company's stock worth $927,000 after purchasing an additional 18,200 shares during the period. Hedge funds and other institutional investors own 68.36% of the company's stock.

Analysts Set New Price Targets

A number of research firms recently commented on PFE. Morgan Stanley lifted their target price on Pfizer from $32.00 to $33.00 and gave the stock an "equal weight" rating in a report on Wednesday, August 6th. Bank of America lifted their target price on Pfizer from $27.00 to $28.00 and gave the stock a "neutral" rating in a report on Wednesday, August 6th. Citigroup lifted their target price on Pfizer from $25.00 to $26.00 and gave the stock a "neutral" rating in a report on Wednesday, August 6th. Finally, Wall Street Zen downgraded Pfizer from a "buy" rating to a "hold" rating in a report on Sunday. Two equities research analysts have rated the stock with a Strong Buy rating, four have assigned a Buy rating, eleven have given a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $28.12.

Read Our Latest Analysis on Pfizer

Pfizer Stock Up 0.3%

Shares of NYSE:PFE opened at $23.84 on Tuesday. The stock has a market cap of $135.54 billion, a P/E ratio of 12.68, a PEG ratio of 0.77 and a beta of 0.55. The company has a quick ratio of 0.85, a current ratio of 1.16 and a debt-to-equity ratio of 0.65. Pfizer Inc. has a 52-week low of $20.92 and a 52-week high of $30.43. The business has a fifty day moving average of $24.54 and a two-hundred day moving average of $24.11.

Pfizer (NYSE:PFE - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The biopharmaceutical company reported $0.78 earnings per share for the quarter, topping analysts' consensus estimates of $0.58 by $0.20. The business had revenue of $14.65 billion during the quarter, compared to analysts' expectations of $13.43 billion. Pfizer had a return on equity of 21.42% and a net margin of 16.84%.The company's revenue was up 10.3% compared to the same quarter last year. During the same period in the prior year, the business posted $0.60 EPS. Pfizer has set its FY 2025 guidance at 2.900-3.100 EPS. On average, research analysts expect that Pfizer Inc. will post 2.95 earnings per share for the current year.

Pfizer Profile

(

Free Report)

Pfizer Inc discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States, Europe, and internationally. The company offers medicines and vaccines in various therapeutic areas, including cardiovascular metabolic, migraine, and women's health under the Eliquis, Nurtec ODT/Vydura, Zavzpret, and the Premarin family brands; infectious diseases with unmet medical needs under the Prevnar family, Abrysvo, Nimenrix, FSME/IMMUN-TicoVac, and Trumenba brands; and COVID-19 prevention and treatment, and potential future mRNA and antiviral products under the Comirnaty and Paxlovid brands.

Featured Articles

Want to see what other hedge funds are holding PFE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Pfizer Inc. (NYSE:PFE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pfizer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pfizer wasn't on the list.

While Pfizer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.