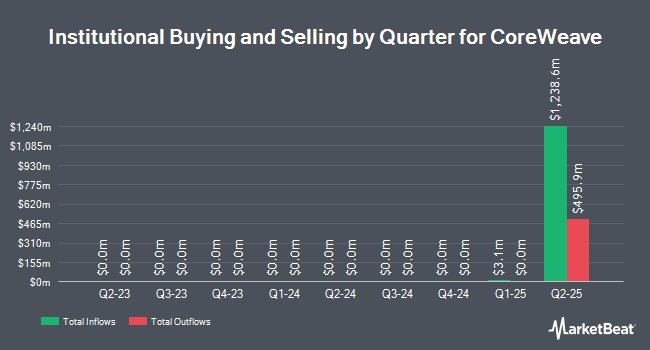

Cisco Systems Inc. acquired a new position in CoreWeave Inc. (NASDAQ:CRWV - Free Report) during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund acquired 1,063,980 shares of the company's stock, valued at approximately $173,493,000. CoreWeave comprises approximately 39.1% of Cisco Systems Inc.'s portfolio, making the stock its 2nd biggest holding. Cisco Systems Inc. owned 0.22% of CoreWeave as of its most recent filing with the Securities and Exchange Commission.

Other large investors have also added to or reduced their stakes in the company. Webster Bank N. A. bought a new stake in CoreWeave in the 2nd quarter worth approximately $82,000. Western Pacific Wealth Management LP bought a new stake in CoreWeave in the 2nd quarter worth approximately $82,000. Thurston Springer Miller Herd & Titak Inc. bought a new stake in CoreWeave in the 2nd quarter worth approximately $117,000. Wesbanco Bank Inc. bought a new stake in CoreWeave in the 2nd quarter worth approximately $212,000. Finally, McAlister Sweet & Associates Inc. bought a new stake in CoreWeave in the 2nd quarter worth approximately $277,000.

Analysts Set New Price Targets

A number of analysts have issued reports on CRWV shares. Moffett Nathanson lifted their price objective on CoreWeave from $56.00 to $65.00 and gave the stock a "neutral" rating in a research note on Tuesday, August 19th. Citizens Jmp upgraded CoreWeave from a "market perform" rating to an "outperform" rating and set a $180.00 target price for the company in a report on Tuesday, September 16th. Northland Securities lifted their target price on CoreWeave from $85.00 to $165.00 and gave the stock an "outperform" rating in a report on Friday, July 18th. Needham & Company LLC reiterated a "hold" rating on shares of CoreWeave in a report on Wednesday, August 13th. Finally, Mizuho reiterated a "neutral" rating and issued a $150.00 target price (up previously from $70.00) on shares of CoreWeave in a report on Tuesday, July 8th. Two investment analysts have rated the stock with a Strong Buy rating, twelve have given a Buy rating, fourteen have given a Hold rating and two have given a Sell rating to the stock. According to data from MarketBeat, CoreWeave has an average rating of "Hold" and a consensus price target of $116.12.

Check Out Our Latest Analysis on CoreWeave

CoreWeave Price Performance

CRWV traded up $8.37 during trading hours on Monday, reaching $133.23. 40,215,185 shares of the company's stock traded hands, compared to its average volume of 28,773,254. The company's 50-day moving average price is $111.41. CoreWeave Inc. has a 52-week low of $33.51 and a 52-week high of $187.00. The company has a quick ratio of 0.52, a current ratio of 0.52 and a debt-to-equity ratio of 2.79.

CoreWeave (NASDAQ:CRWV - Get Free Report) last posted its quarterly earnings data on Tuesday, August 12th. The company reported ($0.27) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.20) by ($0.07). The company had revenue of $1.21 million during the quarter. The company's revenue was up 206.7% on a year-over-year basis. CoreWeave has set its Q3 2025 guidance at EPS. FY 2025 guidance at EPS.

Insider Buying and Selling at CoreWeave

In other news, insider Brian M. Venturo sold 281,250 shares of the business's stock in a transaction on Wednesday, September 17th. The stock was sold at an average price of $118.68, for a total value of $33,378,750.00. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, major shareholder Magnetar Financial Llc sold 734,110 shares of the business's stock in a transaction on Monday, September 22nd. The stock was sold at an average price of $132.42, for a total value of $97,210,846.20. Following the completion of the transaction, the insider directly owned 360,900 shares of the company's stock, valued at approximately $47,790,378. The trade was a 67.04% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 17,826,137 shares of company stock valued at $1,965,482,165 over the last quarter.

About CoreWeave

(

Free Report)

CoreWeave, Inc engages in the powers of the creation and delivery of the intelligence that drives innovation. It offers a solution used by organizations of all sizes that require sophisticated AI computing, from the largest of enterprises to small, well-funded start-ups. The company was founded by Michael Intrator, Brian Venturo, and Brannin McBee on September 21, 2017 and is headquartered in Livingston, NJ.

Featured Stories

Before you consider CoreWeave, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoreWeave wasn't on the list.

While CoreWeave currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.