KLCM Advisors Inc. trimmed its position in Citigroup Inc. (NYSE:C - Free Report) by 10.2% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 392,176 shares of the company's stock after selling 44,684 shares during the quarter. Citigroup accounts for approximately 3.3% of KLCM Advisors Inc.'s portfolio, making the stock its 3rd largest holding. KLCM Advisors Inc.'s holdings in Citigroup were worth $27,841,000 at the end of the most recent quarter.

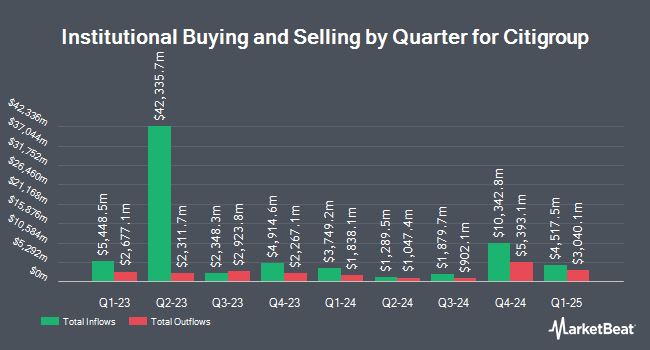

A number of other large investors also recently modified their holdings of C. Capital World Investors raised its holdings in shares of Citigroup by 455.2% during the 4th quarter. Capital World Investors now owns 31,352,582 shares of the company's stock valued at $2,206,908,000 after buying an additional 25,705,141 shares during the period. Goldman Sachs Group Inc. raised its holdings in shares of Citigroup by 179.5% during the 1st quarter. Goldman Sachs Group Inc. now owns 14,534,297 shares of the company's stock valued at $1,031,790,000 after buying an additional 9,334,038 shares during the period. Nuveen LLC purchased a new stake in shares of Citigroup during the 1st quarter valued at about $578,100,000. Capital International Investors raised its holdings in shares of Citigroup by 148.6% during the 4th quarter. Capital International Investors now owns 4,524,890 shares of the company's stock valued at $318,507,000 after buying an additional 2,704,783 shares during the period. Finally, Northern Trust Corp raised its holdings in shares of Citigroup by 13.9% during the 4th quarter. Northern Trust Corp now owns 20,232,550 shares of the company's stock valued at $1,424,169,000 after buying an additional 2,467,958 shares during the period. 71.72% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Citigroup

In other news, Director Peter B. Henry sold 3,000 shares of the company's stock in a transaction on Wednesday, July 16th. The stock was sold at an average price of $90.40, for a total value of $271,200.00. Following the completion of the sale, the director owned 2,140 shares in the company, valued at $193,456. This represents a 58.37% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. 0.08% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Several brokerages recently commented on C. Piper Sandler raised their target price on Citigroup from $84.00 to $104.00 and gave the company an "overweight" rating in a report on Wednesday, July 16th. Barclays raised their price objective on Citigroup from $95.00 to $100.00 and gave the company an "overweight" rating in a research note on Wednesday, July 16th. Dbs Bank upgraded Citigroup from a "hold" rating to a "moderate buy" rating in a research note on Thursday, July 17th. Evercore ISI set a $77.00 price objective on Citigroup in a research note on Monday, July 7th. Finally, The Goldman Sachs Group raised their price objective on Citigroup from $85.00 to $96.00 and gave the company a "buy" rating in a research note on Wednesday, July 2nd. Ten research analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $96.54.

Get Our Latest Stock Report on Citigroup

Citigroup Stock Performance

C traded down $0.5340 during trading on Tuesday, reaching $93.6860. 5,115,706 shares of the company were exchanged, compared to its average volume of 15,733,704. The stock has a market cap of $172.47 billion, a P/E ratio of 13.83, a PEG ratio of 0.81 and a beta of 1.38. The firm has a 50 day moving average of $88.15 and a 200 day moving average of $77.90. The company has a current ratio of 0.99, a quick ratio of 0.99 and a debt-to-equity ratio of 1.61. Citigroup Inc. has a 52 week low of $55.51 and a 52 week high of $96.90.

Citigroup (NYSE:C - Get Free Report) last announced its quarterly earnings results on Tuesday, July 15th. The company reported $1.96 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.61 by $0.35. Citigroup had a return on equity of 7.29% and a net margin of 8.44%.The company had revenue of $21.67 billion during the quarter, compared to analyst estimates of $20.75 billion. During the same quarter in the previous year, the firm posted $1.52 EPS. The firm's quarterly revenue was up 8.2% on a year-over-year basis. Citigroup has set its FY 2025 guidance at EPS. On average, sell-side analysts forecast that Citigroup Inc. will post 7.53 EPS for the current fiscal year.

Citigroup Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, August 22nd. Stockholders of record on Monday, August 4th will be issued a $0.60 dividend. This represents a $2.40 annualized dividend and a dividend yield of 2.6%. This is a positive change from Citigroup's previous quarterly dividend of $0.56. The ex-dividend date is Monday, August 4th. Citigroup's payout ratio is currently 35.45%.

Citigroup Profile

(

Free Report)

Citigroup Inc, a diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions worldwide. It operates through five segments: Services, Markets, Banking, U.S. Personal Banking, and Wealth. The Services segment includes Treasury and Trade Solutions, which provides cash management, trade, and working capital solutions to multinational corporations, financial institutions, and public sector organizations; and Securities Services, such as cross-border support for clients, local market expertise, post-trade technologies, data solutions, and various securities services solutions.

Featured Stories

Before you consider Citigroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Citigroup wasn't on the list.

While Citigroup currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report