Citigroup Inc. boosted its position in SolarEdge Technologies, Inc. (NASDAQ:SEDG - Free Report) by 18.3% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 515,182 shares of the semiconductor company's stock after acquiring an additional 79,673 shares during the period. Citigroup Inc. owned 0.87% of SolarEdge Technologies worth $8,336,000 as of its most recent SEC filing.

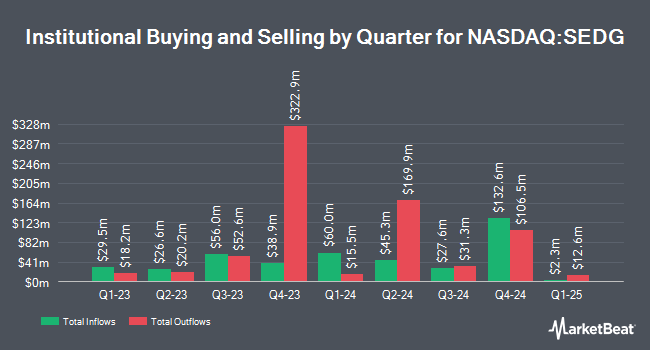

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Fifth Third Bancorp boosted its holdings in SolarEdge Technologies by 93.7% in the first quarter. Fifth Third Bancorp now owns 1,633 shares of the semiconductor company's stock worth $26,000 after acquiring an additional 790 shares in the last quarter. Banque Cantonale Vaudoise bought a new position in SolarEdge Technologies in the first quarter worth approximately $35,000. US Bancorp DE boosted its holdings in SolarEdge Technologies by 25.2% in the first quarter. US Bancorp DE now owns 4,560 shares of the semiconductor company's stock worth $74,000 after acquiring an additional 918 shares in the last quarter. PNC Financial Services Group Inc. boosted its holdings in SolarEdge Technologies by 32.4% in the first quarter. PNC Financial Services Group Inc. now owns 7,851 shares of the semiconductor company's stock worth $127,000 after acquiring an additional 1,921 shares in the last quarter. Finally, GAMMA Investing LLC boosted its holdings in SolarEdge Technologies by 71.9% in the first quarter. GAMMA Investing LLC now owns 9,047 shares of the semiconductor company's stock worth $146,000 after acquiring an additional 3,783 shares in the last quarter. Institutional investors own 95.10% of the company's stock.

SolarEdge Technologies Stock Performance

Shares of SEDG traded down $1.85 on Thursday, reaching $30.21. 4,033,118 shares of the company's stock traded hands, compared to its average volume of 4,707,910. The company has a current ratio of 1.94, a quick ratio of 1.42 and a debt-to-equity ratio of 0.72. The stock's 50 day simple moving average is $25.02 and its two-hundred day simple moving average is $19.11. SolarEdge Technologies, Inc. has a 52-week low of $10.24 and a 52-week high of $33.30. The stock has a market cap of $1.79 billion, a PE ratio of -1.01 and a beta of 1.56.

SolarEdge Technologies (NASDAQ:SEDG - Get Free Report) last released its earnings results on Thursday, August 7th. The semiconductor company reported ($0.81) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.81). SolarEdge Technologies had a negative return on equity of 191.53% and a negative net margin of 177.64%.The business had revenue of $289.43 million during the quarter, compared to the consensus estimate of $270.03 million. During the same period last year, the business posted ($1.79) earnings per share. The business's revenue for the quarter was up 9.0% on a year-over-year basis. SolarEdge Technologies has set its Q3 2025 guidance at EPS. On average, analysts forecast that SolarEdge Technologies, Inc. will post -4.54 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of research analysts have recently weighed in on the company. Northland Securities upgraded SolarEdge Technologies from an "under perform" rating to a "market perform" rating and set a $15.50 target price on the stock in a report on Friday, May 23rd. Northland Capmk upgraded SolarEdge Technologies from a "strong sell" rating to a "hold" rating in a report on Friday, May 23rd. Morgan Stanley restated an "underweight" rating and issued a $10.00 target price on shares of SolarEdge Technologies in a report on Wednesday, April 23rd. BNP Paribas Exane lowered SolarEdge Technologies from a "neutral" rating to an "underperform" rating and set a $17.00 target price on the stock. in a report on Wednesday, July 16th. Finally, Mizuho raised their target price on SolarEdge Technologies from $18.00 to $29.00 and gave the company a "neutral" rating in a report on Monday, July 14th. Eighteen investment analysts have rated the stock with a Hold rating and ten have assigned a Sell rating to the company's stock. According to MarketBeat, SolarEdge Technologies currently has a consensus rating of "Reduce" and a consensus price target of $18.12.

Read Our Latest Report on SEDG

SolarEdge Technologies Profile

(

Free Report)

SolarEdge Technologies, Inc, together with its subsidiaries, designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally. It operates in two segments, Solar and Energy Storage.

See Also

Before you consider SolarEdge Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SolarEdge Technologies wasn't on the list.

While SolarEdge Technologies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.