City Holding Co. boosted its stake in CocaCola Company (The) (NYSE:KO - Free Report) by 5.8% during the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 102,834 shares of the company's stock after purchasing an additional 5,664 shares during the quarter. CocaCola comprises approximately 1.0% of City Holding Co.'s portfolio, making the stock its 25th biggest holding. City Holding Co.'s holdings in CocaCola were worth $7,275,000 as of its most recent SEC filing.

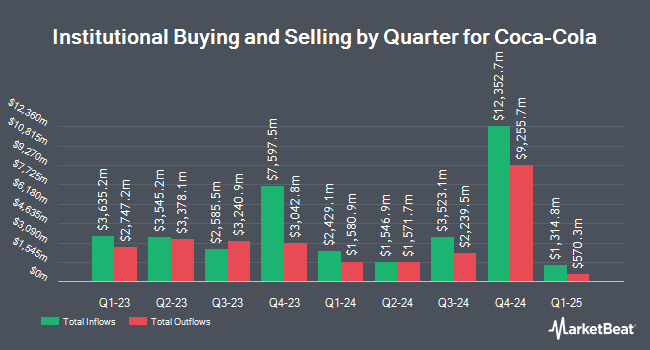

A number of other hedge funds and other institutional investors have also bought and sold shares of KO. MorganRosel Wealth Management LLC purchased a new position in CocaCola in the first quarter worth $25,000. 1248 Management LLC bought a new stake in CocaCola during the first quarter worth about $26,000. Garde Capital Inc. purchased a new position in shares of CocaCola in the 1st quarter worth about $30,000. Mizuho Securities Co. Ltd. increased its position in shares of CocaCola by 360.0% during the 1st quarter. Mizuho Securities Co. Ltd. now owns 460 shares of the company's stock valued at $33,000 after purchasing an additional 360 shares during the last quarter. Finally, Ridgewood Investments LLC increased its position in shares of CocaCola by 148.4% during the 1st quarter. Ridgewood Investments LLC now owns 477 shares of the company's stock valued at $34,000 after purchasing an additional 285 shares during the last quarter. Hedge funds and other institutional investors own 70.26% of the company's stock.

Insider Activity at CocaCola

In related news, insider Nikolaos Koumettis sold 37,396 shares of the company's stock in a transaction on Tuesday, August 5th. The stock was sold at an average price of $69.10, for a total transaction of $2,584,063.60. Following the completion of the sale, the insider owned 209,513 shares in the company, valued at approximately $14,477,348.30. This represents a 15.15% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 0.97% of the stock is owned by insiders.

Wall Street Analyst Weigh In

Several analysts have issued reports on KO shares. JPMorgan Chase & Co. upped their target price on CocaCola from $77.00 to $79.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 23rd. UBS Group reduced their target price on shares of CocaCola from $84.00 to $80.00 and set a "buy" rating on the stock in a report on Thursday, September 11th. Wells Fargo & Company cut their price target on shares of CocaCola from $78.00 to $75.00 and set an "overweight" rating for the company in a research report on Thursday. BNP Paribas reaffirmed an "outperform" rating and issued a $83.00 target price on shares of CocaCola in a research note on Monday, July 21st. Finally, Morgan Stanley reaffirmed an "overweight" rating and set a $81.00 price target on shares of CocaCola in a research report on Monday, June 9th. One analyst has rated the stock with a Strong Buy rating and fourteen have issued a Buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Buy" and a consensus price target of $76.93.

Check Out Our Latest Research Report on CocaCola

CocaCola Stock Performance

KO stock opened at $65.64 on Friday. The stock's 50 day simple moving average is $68.58 and its 200 day simple moving average is $70.05. The company has a current ratio of 1.21, a quick ratio of 0.98 and a debt-to-equity ratio of 1.49. CocaCola Company has a 12-month low of $60.62 and a 12-month high of $74.38. The stock has a market capitalization of $282.49 billion, a PE ratio of 23.28, a price-to-earnings-growth ratio of 3.42 and a beta of 0.43.

CocaCola (NYSE:KO - Get Free Report) last announced its quarterly earnings results on Tuesday, July 22nd. The company reported $0.87 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.83 by $0.04. CocaCola had a return on equity of 44.91% and a net margin of 25.89%.The firm had revenue of $12.50 billion for the quarter, compared to the consensus estimate of $12.55 billion. During the same period in the prior year, the company posted $0.84 earnings per share. The company's quarterly revenue was up 2.5% on a year-over-year basis. CocaCola has set its FY 2025 guidance at 2.970-2.970 EPS. As a group, research analysts forecast that CocaCola Company will post 2.96 earnings per share for the current fiscal year.

CocaCola Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, October 1st. Stockholders of record on Monday, September 15th will be paid a $0.51 dividend. This represents a $2.04 dividend on an annualized basis and a dividend yield of 3.1%. The ex-dividend date is Monday, September 15th. CocaCola's dividend payout ratio (DPR) is 72.34%.

CocaCola Company Profile

(

Free Report)

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks, sparkling flavors; water, sports, coffee, and tea; juice, value-added dairy, and plant-based beverages; and other beverages. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CocaCola, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CocaCola wasn't on the list.

While CocaCola currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.