City National Bank of Florida MSD purchased a new position in shares of ServiceNow, Inc. (NYSE:NOW - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm purchased 388 shares of the information technology services provider's stock, valued at approximately $411,000.

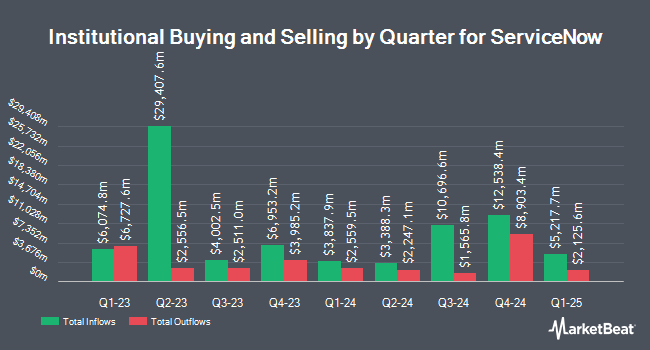

A number of other hedge funds and other institutional investors have also modified their holdings of NOW. Vanguard Group Inc. raised its holdings in ServiceNow by 1.0% in the 4th quarter. Vanguard Group Inc. now owns 19,199,258 shares of the information technology services provider's stock valued at $20,353,517,000 after acquiring an additional 190,430 shares during the last quarter. Price T Rowe Associates Inc. MD increased its stake in ServiceNow by 6.8% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 7,955,924 shares of the information technology services provider's stock valued at $8,434,235,000 after purchasing an additional 509,467 shares during the last quarter. FMR LLC lifted its position in ServiceNow by 4.9% during the fourth quarter. FMR LLC now owns 5,878,900 shares of the information technology services provider's stock worth $6,232,339,000 after buying an additional 272,506 shares during the period. Geode Capital Management LLC boosted its stake in ServiceNow by 2.4% in the 4th quarter. Geode Capital Management LLC now owns 4,312,571 shares of the information technology services provider's stock worth $4,560,890,000 after buying an additional 100,670 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in ServiceNow by 3.4% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 2,654,825 shares of the information technology services provider's stock valued at $2,814,433,000 after buying an additional 87,876 shares during the period. 87.18% of the stock is currently owned by hedge funds and other institutional investors.

ServiceNow Price Performance

Shares of NYSE NOW opened at $1,016.08 on Thursday. The company has a current ratio of 1.10, a quick ratio of 1.10 and a debt-to-equity ratio of 0.15. The company has a market capitalization of $210.33 billion, a price-to-earnings ratio of 148.77, a price-to-earnings-growth ratio of 4.51 and a beta of 0.97. ServiceNow, Inc. has a twelve month low of $637.99 and a twelve month high of $1,198.09. The business has a 50 day simple moving average of $874.78 and a 200-day simple moving average of $974.74.

ServiceNow (NYSE:NOW - Get Free Report) last released its earnings results on Wednesday, April 23rd. The information technology services provider reported $4.04 earnings per share for the quarter, beating the consensus estimate of $3.78 by $0.26. ServiceNow had a net margin of 12.97% and a return on equity of 17.11%. The firm had revenue of $3.09 billion during the quarter, compared to analyst estimates of $3.09 billion. During the same quarter in the previous year, the firm earned $3.41 earnings per share. The firm's revenue for the quarter was up 18.6% compared to the same quarter last year. As a group, equities research analysts expect that ServiceNow, Inc. will post 8.93 earnings per share for the current year.

ServiceNow announced that its board has approved a stock repurchase plan on Wednesday, January 29th that allows the company to repurchase $3.00 billion in outstanding shares. This repurchase authorization allows the information technology services provider to repurchase up to 1.3% of its stock through open market purchases. Stock repurchase plans are often an indication that the company's board of directors believes its shares are undervalued.

Wall Street Analysts Forecast Growth

NOW has been the topic of several recent analyst reports. Wells Fargo & Company increased their price objective on shares of ServiceNow from $1,100.00 to $1,150.00 and gave the stock an "overweight" rating in a report on Thursday, April 24th. Truist Financial upgraded shares of ServiceNow from a "hold" rating to a "buy" rating and lifted their price target for the company from $950.00 to $1,200.00 in a report on Thursday, May 1st. Raymond James dropped their price objective on ServiceNow from $1,200.00 to $1,000.00 and set an "outperform" rating for the company in a report on Tuesday, April 8th. Scotiabank set a $1,100.00 target price on ServiceNow and gave the stock an "outperform" rating in a research report on Wednesday, May 7th. Finally, Morgan Stanley boosted their price target on ServiceNow from $881.00 to $950.00 and gave the company an "equal weight" rating in a research report on Thursday, April 24th. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating, twenty-nine have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $1,062.50.

View Our Latest Stock Report on NOW

Insider Buying and Selling

In other ServiceNow news, Director Jonathan Chadwick sold 770 shares of the company's stock in a transaction dated Monday, April 28th. The shares were sold at an average price of $931.62, for a total value of $717,347.40. Following the completion of the transaction, the director now owns 3,205 shares in the company, valued at approximately $2,985,842.10. This represents a 19.37% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CFO Gina Mastantuono sold 4,442 shares of the firm's stock in a transaction that occurred on Friday, February 21st. The shares were sold at an average price of $964.70, for a total transaction of $4,285,197.40. Following the completion of the sale, the chief financial officer now owns 11,126 shares in the company, valued at $10,733,252.20. The trade was a 28.53% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 10,061 shares of company stock worth $9,515,766 over the last quarter. 0.38% of the stock is owned by company insiders.

ServiceNow Company Profile

(

Free Report)

ServiceNow, Inc provides end to-end intelligent workflow automation platform solutions for digital businesses in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally. The company operates the Now platform for end-to-end digital transformation, artificial intelligence, machine learning, robotic process automation, process mining, performance analytics, and collaboration and development tools.

Further Reading

Want to see what other hedge funds are holding NOW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for ServiceNow, Inc. (NYSE:NOW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ServiceNow, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ServiceNow wasn't on the list.

While ServiceNow currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report