Clarity Capital Partners LLC raised its position in Cleanspark, Inc. (NASDAQ:CLSK - Free Report) by 6.3% during the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 290,121 shares of the company's stock after purchasing an additional 17,171 shares during the quarter. Cleanspark accounts for approximately 1.1% of Clarity Capital Partners LLC's holdings, making the stock its 19th biggest holding. Clarity Capital Partners LLC owned approximately 0.10% of Cleanspark worth $3,200,000 at the end of the most recent quarter.

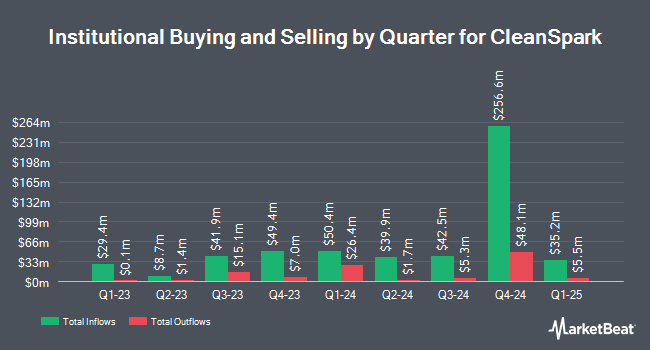

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in CLSK. Mackenzie Financial Corp raised its position in Cleanspark by 13.5% in the 4th quarter. Mackenzie Financial Corp now owns 15,916 shares of the company's stock worth $147,000 after purchasing an additional 1,898 shares during the period. California State Teachers Retirement System raised its position in Cleanspark by 7.6% in the 4th quarter. California State Teachers Retirement System now owns 236,433 shares of the company's stock worth $2,178,000 after purchasing an additional 16,789 shares during the period. GAMMA Investing LLC raised its position in Cleanspark by 207.8% in the 1st quarter. GAMMA Investing LLC now owns 12,163 shares of the company's stock worth $82,000 after purchasing an additional 8,212 shares during the period. Rhumbline Advisers raised its position in Cleanspark by 115.8% in the 1st quarter. Rhumbline Advisers now owns 720,903 shares of the company's stock worth $4,844,000 after purchasing an additional 386,809 shares during the period. Finally, Hennion & Walsh Asset Management Inc. raised its position in Cleanspark by 16.3% in the 1st quarter. Hennion & Walsh Asset Management Inc. now owns 53,860 shares of the company's stock worth $362,000 after purchasing an additional 7,537 shares during the period. 43.12% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of equities analysts have recently commented on the stock. Wall Street Zen raised shares of Cleanspark from a "sell" rating to a "hold" rating in a research report on Saturday, August 2nd. LADENBURG THALM/SH SH assumed coverage on shares of Cleanspark in a research report on Monday, July 28th. They set a "buy" rating and a $20.25 target price on the stock. BTIG Research reaffirmed a "buy" rating on shares of Cleanspark in a research report on Friday, June 13th. JPMorgan Chase & Co. reaffirmed a "neutral" rating and set a $14.00 target price (down from $15.00) on shares of Cleanspark in a research report on Friday, September 26th. Finally, Cantor Fitzgerald raised their target price on shares of Cleanspark from $25.00 to $26.00 and gave the stock an "overweight" rating in a research report on Friday, August 8th. Nine research analysts have rated the stock with a Buy rating and two have given a Hold rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $20.36.

Check Out Our Latest Stock Report on Cleanspark

Insider Buying and Selling at Cleanspark

In related news, COO Taylor Monnig sold 63,713 shares of the company's stock in a transaction on Tuesday, September 9th. The stock was sold at an average price of $9.12, for a total transaction of $581,062.56. Following the completion of the sale, the chief operating officer directly owned 120,337 shares in the company, valued at $1,097,473.44. This represents a 34.62% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this link. 2.65% of the stock is owned by company insiders.

Cleanspark Stock Up 5.3%

Shares of CLSK stock opened at $15.94 on Friday. The firm has a market cap of $4.48 billion, a price-to-earnings ratio of 18.75 and a beta of 3.88. Cleanspark, Inc. has a 52-week low of $6.45 and a 52-week high of $17.97. The company's 50 day moving average is $11.11 and its 200 day moving average is $10.02.

Cleanspark (NASDAQ:CLSK - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The company reported $0.78 earnings per share for the quarter, topping analysts' consensus estimates of $0.07 by $0.71. The firm had revenue of $198.64 million during the quarter, compared to analysts' expectations of $191.33 million. Cleanspark had a return on equity of 8.89% and a net margin of 47.98%.The firm's quarterly revenue was up 90.8% on a year-over-year basis. During the same period in the prior year, the business posted ($1.03) EPS. Analysts anticipate that Cleanspark, Inc. will post 0.58 EPS for the current fiscal year.

Cleanspark Company Profile

(

Free Report)

CleanSpark, Inc operates as a bitcoin miner in the Americas. It owns and operates data centers that primarily run on low-carbon power. Its infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion. The company was formerly known as Stratean Inc and changed its name to CleanSpark, Inc in November 2016.

Recommended Stories

Want to see what other hedge funds are holding CLSK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cleanspark, Inc. (NASDAQ:CLSK - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cleanspark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cleanspark wasn't on the list.

While Cleanspark currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.