Clayton Partners LLC bought a new position in shares of Acacia Research Corporation (NASDAQ:ACTG - Free Report) in the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 141,603 shares of the business services provider's stock, valued at approximately $453,000. Clayton Partners LLC owned 0.15% of Acacia Research at the end of the most recent reporting period.

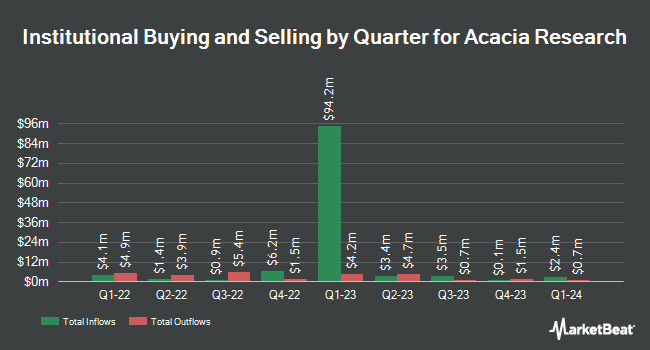

Several other large investors have also added to or reduced their stakes in ACTG. American Century Companies Inc. grew its stake in Acacia Research by 5.7% in the first quarter. American Century Companies Inc. now owns 464,416 shares of the business services provider's stock valued at $1,486,000 after acquiring an additional 24,884 shares during the period. Nuveen LLC bought a new stake in shares of Acacia Research in the first quarter valued at $224,000. Invesco Ltd. boosted its holdings in Acacia Research by 343.1% in the 1st quarter. Invesco Ltd. now owns 72,775 shares of the business services provider's stock worth $233,000 after buying an additional 56,351 shares during the period. Levin Capital Strategies L.P. boosted its holdings in Acacia Research by 49.5% in the 1st quarter. Levin Capital Strategies L.P. now owns 275,000 shares of the business services provider's stock worth $880,000 after buying an additional 91,004 shares during the period. Finally, Peapod Lane Capital LLC grew its position in shares of Acacia Research by 82.9% in the first quarter. Peapod Lane Capital LLC now owns 435,279 shares of the business services provider's stock valued at $1,393,000 after purchasing an additional 197,268 shares in the last quarter. Institutional investors and hedge funds own 86.69% of the company's stock.

Acacia Research Stock Down 1.4%

Shares of Acacia Research stock traded down $0.05 during midday trading on Wednesday, hitting $3.29. The company had a trading volume of 41,578 shares, compared to its average volume of 222,283. The company has a debt-to-equity ratio of 0.18, a quick ratio of 8.29 and a current ratio of 8.80. The stock has a market capitalization of $316.81 million, a P/E ratio of -54.74 and a beta of 0.65. The company has a 50 day moving average of $3.55 and a 200 day moving average of $3.56. Acacia Research Corporation has a 52-week low of $2.70 and a 52-week high of $5.36.

Insider Buying and Selling

In other Acacia Research news, Director Isaac T. Kohlberg sold 16,000 shares of the firm's stock in a transaction dated Wednesday, June 11th. The stock was sold at an average price of $3.84, for a total transaction of $61,440.00. Following the sale, the director directly owned 85,446 shares of the company's stock, valued at $328,112.64. This trade represents a 15.77% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 1.65% of the company's stock.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen cut Acacia Research from a "buy" rating to a "hold" rating in a research report on Saturday, August 9th.

Read Our Latest Research Report on ACTG

Acacia Research Profile

(

Free Report)

Acacia is a publicly traded Nasdaq: ACTG company that is focused on acquiring and operating businesses across the industrial, energy and technology sectors where it believes it can leverage its expertise, significant capital base, and deep industry relationships to drive value. Acacia evaluates opportunities based on the attractiveness of the underlying cash flows, without regard to a specific investment horizon.

Read More

Before you consider Acacia Research, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acacia Research wasn't on the list.

While Acacia Research currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.