Kovitz Investment Group Partners LLC trimmed its holdings in Cleanspark, Inc. (NASDAQ:CLSK - Free Report) by 95.6% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 10,357 shares of the company's stock after selling 222,672 shares during the period. Kovitz Investment Group Partners LLC's holdings in Cleanspark were worth $70,000 as of its most recent filing with the Securities and Exchange Commission.

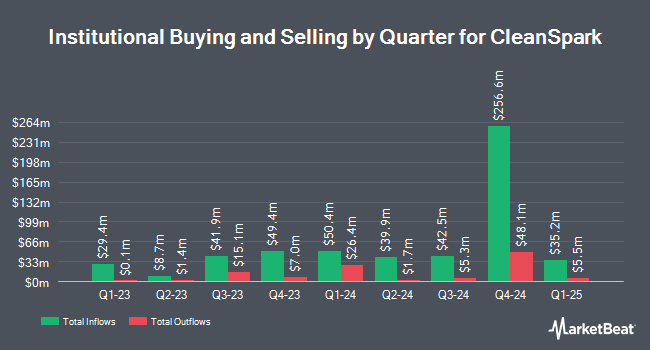

A number of other hedge funds have also bought and sold shares of CLSK. Neuberger Berman Group LLC bought a new position in shares of Cleanspark in the first quarter worth $71,000. Russell Investments Group Ltd. boosted its holdings in shares of Cleanspark by 47.6% in the first quarter. Russell Investments Group Ltd. now owns 8,647 shares of the company's stock worth $58,000 after acquiring an additional 2,788 shares during the period. Public Sector Pension Investment Board bought a new position in Cleanspark in the 1st quarter worth about $5,925,000. Nuveen LLC bought a new position in Cleanspark in the 1st quarter worth about $8,109,000. Finally, Invesco Ltd. boosted its stake in Cleanspark by 20.5% in the 1st quarter. Invesco Ltd. now owns 3,597,402 shares of the company's stock worth $24,175,000 after purchasing an additional 613,040 shares during the period. 43.12% of the stock is currently owned by hedge funds and other institutional investors.

Cleanspark Trading Down 0.9%

CLSK stock traded down $0.09 during midday trading on Wednesday, hitting $9.60. The company had a trading volume of 11,447,391 shares, compared to its average volume of 24,928,664. The stock's 50 day moving average price is $11.00 and its 200 day moving average price is $9.47. Cleanspark, Inc. has a 52 week low of $6.45 and a 52 week high of $17.97. The stock has a market cap of $2.70 billion, a price-to-earnings ratio of 11.37 and a beta of 3.72.

Cleanspark (NASDAQ:CLSK - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported $0.78 EPS for the quarter, beating analysts' consensus estimates of $0.07 by $0.71. The company had revenue of $198.64 million during the quarter, compared to analyst estimates of $191.33 million. Cleanspark had a net margin of 47.98% and a return on equity of 8.89%. The firm's revenue was up 90.8% compared to the same quarter last year. During the same period in the prior year, the business posted ($1.03) EPS. Analysts predict that Cleanspark, Inc. will post 0.58 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several research analysts have commented on the stock. B. Riley raised their price target on shares of Cleanspark from $16.00 to $17.00 and gave the company a "buy" rating in a report on Friday, August 8th. BTIG Research reissued a "buy" rating on shares of Cleanspark in a research note on Friday, June 13th. Wall Street Zen upgraded Cleanspark from a "sell" rating to a "hold" rating in a research report on Saturday, August 2nd. LADENBURG THALM/SH SH began coverage on Cleanspark in a research report on Monday, July 28th. They set a "buy" rating and a $20.25 price target for the company. Finally, Chardan Capital reiterated a "buy" rating and set a $20.00 price target on shares of Cleanspark in a research report on Friday, August 8th. Ten analysts have rated the stock with a Buy rating, According to MarketBeat.com, Cleanspark currently has an average rating of "Buy" and an average target price of $20.47.

Read Our Latest Research Report on Cleanspark

About Cleanspark

(

Free Report)

CleanSpark, Inc operates as a bitcoin miner in the Americas. It owns and operates data centers that primarily run on low-carbon power. Its infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion. The company was formerly known as Stratean Inc and changed its name to CleanSpark, Inc in November 2016.

Featured Stories

Before you consider Cleanspark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cleanspark wasn't on the list.

While Cleanspark currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.