Clear Creek Financial Management LLC raised its holdings in Applied Digital Corporation (NASDAQ:APLD - Free Report) by 56.1% in the 2nd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 78,383 shares of the company's stock after buying an additional 28,177 shares during the period. Clear Creek Financial Management LLC's holdings in Applied Digital were worth $789,000 as of its most recent SEC filing.

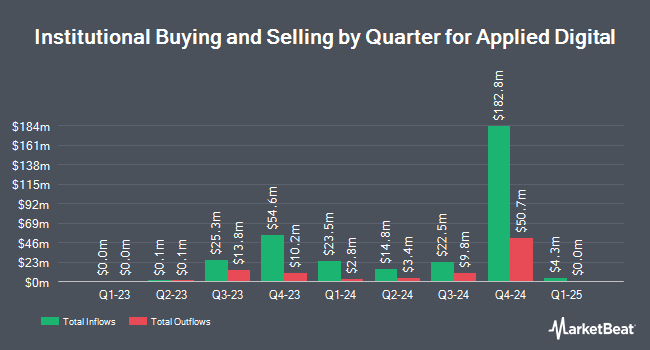

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Ameriflex Group Inc. purchased a new position in Applied Digital in the 2nd quarter valued at approximately $42,000. PNC Financial Services Group Inc. purchased a new stake in shares of Applied Digital during the 1st quarter worth $28,000. Geneos Wealth Management Inc. lifted its position in shares of Applied Digital by 113.3% during the 1st quarter. Geneos Wealth Management Inc. now owns 6,667 shares of the company's stock worth $37,000 after purchasing an additional 3,542 shares during the last quarter. ORG Wealth Partners LLC purchased a new stake in shares of Applied Digital during the 2nd quarter worth $66,000. Finally, Ameritas Advisory Services LLC purchased a new stake in shares of Applied Digital during the 2nd quarter worth $69,000. Hedge funds and other institutional investors own 65.67% of the company's stock.

Applied Digital Price Performance

Shares of NASDAQ:APLD opened at $33.99 on Friday. The company's fifty day moving average price is $18.93 and its 200 day moving average price is $11.81. Applied Digital Corporation has a 12 month low of $3.31 and a 12 month high of $39.07. The company has a debt-to-equity ratio of 1.36, a current ratio of 0.77 and a quick ratio of 0.77. The firm has a market capitalization of $9.31 billion, a P/E ratio of -30.08 and a beta of 6.77.

Applied Digital (NASDAQ:APLD - Get Free Report) last announced its quarterly earnings results on Thursday, October 9th. The company reported ($0.03) EPS for the quarter, topping the consensus estimate of ($0.11) by $0.08. The firm had revenue of $38.01 million for the quarter, compared to analyst estimates of $52.25 million. Applied Digital had a negative net margin of 111.29% and a negative return on equity of 48.82%. Applied Digital's revenue for the quarter was up 84.3% compared to the same quarter last year. During the same period last year, the business earned ($0.15) EPS. As a group, sell-side analysts predict that Applied Digital Corporation will post -0.96 earnings per share for the current fiscal year.

Analyst Ratings Changes

APLD has been the subject of several recent analyst reports. Citigroup reaffirmed an "outperform" rating on shares of Applied Digital in a research report on Thursday. Lake Street Capital lifted their price objective on shares of Applied Digital from $18.00 to $37.00 and gave the stock a "buy" rating in a research report on Friday. Craig Hallum lifted their price objective on shares of Applied Digital from $12.00 to $23.00 and gave the stock a "buy" rating in a research report on Monday, August 18th. HC Wainwright lifted their price objective on shares of Applied Digital from $20.00 to $40.00 and gave the stock a "buy" rating in a research report on Friday. Finally, Northland Securities lifted their price objective on shares of Applied Digital to $40.00 and gave the stock an "outperform" rating in a research report on Friday. One equities research analyst has rated the stock with a Strong Buy rating, eleven have assigned a Buy rating and one has given a Sell rating to the company. According to data from MarketBeat.com, Applied Digital currently has an average rating of "Moderate Buy" and an average target price of $22.10.

View Our Latest Research Report on Applied Digital

Insider Buying and Selling at Applied Digital

In other Applied Digital news, CFO Mohammad Saidal Lavanw Mohmand sold 75,000 shares of Applied Digital stock in a transaction on Wednesday, September 3rd. The shares were sold at an average price of $15.26, for a total value of $1,144,500.00. Following the transaction, the chief financial officer directly owned 201,800 shares in the company, valued at approximately $3,079,468. The trade was a 27.10% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Wes Cummins sold 400,000 shares of Applied Digital stock in a transaction on Wednesday, September 3rd. The shares were sold at an average price of $15.26, for a total transaction of $6,104,000.00. Following the completion of the transaction, the chief executive officer owned 2,659,379 shares in the company, valued at approximately $40,582,123.54. This represents a 13.07% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 506,250 shares of company stock worth $7,713,675. 9.50% of the stock is owned by company insiders.

Applied Digital Profile

(

Free Report)

Applied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.