Clough Capital Partners L P acquired a new position in Sable Offshore Corp. (NYSE:SOC - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 58,751 shares of the company's stock, valued at approximately $1,491,000. Clough Capital Partners L P owned approximately 0.07% of Sable Offshore as of its most recent filing with the SEC.

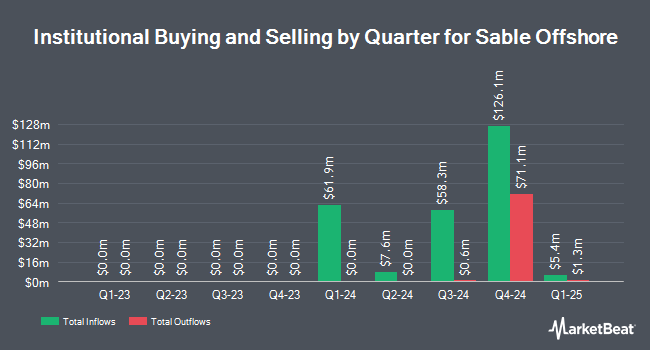

Other hedge funds and other institutional investors also recently modified their holdings of the company. SVB Wealth LLC acquired a new position in shares of Sable Offshore in the 1st quarter worth $29,000. Quantbot Technologies LP acquired a new position in shares of Sable Offshore in the 1st quarter worth $48,000. US Bancorp DE grew its holdings in shares of Sable Offshore by 62.2% in the 1st quarter. US Bancorp DE now owns 3,281 shares of the company's stock worth $83,000 after acquiring an additional 1,258 shares during the last quarter. PNC Financial Services Group Inc. grew its holdings in shares of Sable Offshore by 3,686.3% in the 1st quarter. PNC Financial Services Group Inc. now owns 4,430 shares of the company's stock worth $112,000 after acquiring an additional 4,313 shares during the last quarter. Finally, Tower Research Capital LLC TRC grew its holdings in shares of Sable Offshore by 917.0% in the 4th quarter. Tower Research Capital LLC TRC now owns 6,448 shares of the company's stock worth $148,000 after acquiring an additional 5,814 shares during the last quarter. Institutional investors own 26.19% of the company's stock.

Insider Buying and Selling

In other Sable Offshore news, major shareholder Global Icav Pilgrim sold 167,175 shares of the company's stock in a transaction that occurred on Friday, July 18th. The stock was sold at an average price of $21.98, for a total value of $3,674,506.50. Following the completion of the transaction, the insider owned 9,933,394 shares of the company's stock, valued at $218,336,000.12. This represents a 1.66% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 36.36% of the stock is currently owned by company insiders.

Sable Offshore Price Performance

SOC traded down $3.83 during trading on Tuesday, reaching $23.15. 5,256,438 shares of the stock traded hands, compared to its average volume of 2,116,245. Sable Offshore Corp. has a fifty-two week low of $16.26 and a fifty-two week high of $35.00. The stock's 50-day simple moving average is $26.72 and its two-hundred day simple moving average is $25.15.

Sable Offshore (NYSE:SOC - Get Free Report) last posted its quarterly earnings data on Tuesday, August 12th. The company reported ($1.10) earnings per share for the quarter, missing the consensus estimate of ($0.66) by ($0.44). Analysts forecast that Sable Offshore Corp. will post -6.39 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on SOC. BWS Financial restated a "sell" rating and issued a $6.00 target price on shares of Sable Offshore in a report on Tuesday, May 13th. Benchmark lifted their target price on Sable Offshore from $37.00 to $47.00 and gave the stock a "buy" rating in a report on Tuesday, May 20th. Jefferies Financial Group reiterated a "buy" rating on shares of Sable Offshore in a report on Monday, May 26th. Finally, Roth Capital set a $37.00 price target on Sable Offshore and gave the company a "buy" rating in a report on Friday, May 23rd. Six equities research analysts have rated the stock with a Buy rating and one has issued a Sell rating to the company. Based on data from MarketBeat.com, Sable Offshore has a consensus rating of "Moderate Buy" and a consensus target price of $30.33.

Read Our Latest Stock Report on Sable Offshore

Sable Offshore Company Profile

(

Free Report)

Sable Offshore Corp. engages in the oil and gas exploration and development activities in the United States. The company operates through three platforms located in federal waters offshore California. It owns and operates 16 federal leases across approximately 76,000 acres and subsea pipelines, which transport crude oil, natural gas, and produced water from the platforms to the onshore processing facilities.

Featured Stories

Before you consider Sable Offshore, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sable Offshore wasn't on the list.

While Sable Offshore currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.