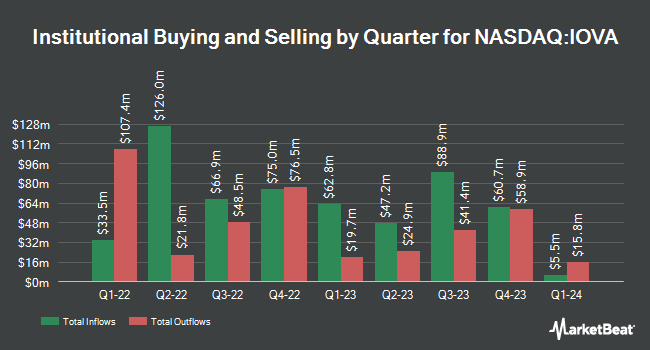

CM Management LLC boosted its position in Iovance Biotherapeutics, Inc. (NASDAQ:IOVA - Free Report) by 66.7% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 500,000 shares of the biotechnology company's stock after buying an additional 200,000 shares during the quarter. Iovance Biotherapeutics makes up approximately 1.6% of CM Management LLC's portfolio, making the stock its 27th biggest position. CM Management LLC owned about 0.15% of Iovance Biotherapeutics worth $1,665,000 at the end of the most recent quarter.

A number of other institutional investors and hedge funds have also bought and sold shares of the business. GF Fund Management CO. LTD. bought a new stake in shares of Iovance Biotherapeutics in the 4th quarter valued at about $47,000. Quarry LP purchased a new position in Iovance Biotherapeutics in the 4th quarter worth approximately $74,000. One68 Global Capital LLC bought a new stake in Iovance Biotherapeutics in the fourth quarter valued at approximately $74,000. Fullcircle Wealth LLC bought a new stake in Iovance Biotherapeutics in the fourth quarter valued at approximately $74,000. Finally, Accredited Investors Inc. purchased a new stake in shares of Iovance Biotherapeutics during the first quarter valued at approximately $33,000. 77.03% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

IOVA has been the topic of several analyst reports. Mizuho decreased their target price on shares of Iovance Biotherapeutics from $30.00 to $10.00 and set an "outperform" rating on the stock in a research note on Monday, May 12th. Baird R W cut shares of Iovance Biotherapeutics from a "strong-buy" rating to a "hold" rating in a research report on Friday, May 9th. The Goldman Sachs Group downgraded shares of Iovance Biotherapeutics from a "neutral" rating to a "sell" rating in a research note on Tuesday, July 15th. UBS Group lowered shares of Iovance Biotherapeutics from a "buy" rating to a "neutral" rating and dropped their target price for the stock from $17.00 to $2.00 in a report on Friday, May 16th. Finally, Barclays reduced their price target on Iovance Biotherapeutics from $5.00 to $4.00 and set an "overweight" rating on the stock in a report on Monday, May 12th. Two investment analysts have rated the stock with a sell rating, six have given a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $11.90.

Check Out Our Latest Stock Report on Iovance Biotherapeutics

Iovance Biotherapeutics Price Performance

IOVA stock traded down $0.53 during trading on Friday, reaching $2.11. The company had a trading volume of 43,397,610 shares, compared to its average volume of 26,313,492. Iovance Biotherapeutics, Inc. has a 52 week low of $1.64 and a 52 week high of $12.51. The business has a 50 day moving average of $2.22 and a 200 day moving average of $3.26. The company has a market cap of $704.59 million, a P/E ratio of -1.72 and a beta of 0.88.

Iovance Biotherapeutics (NASDAQ:IOVA - Get Free Report) last posted its earnings results on Thursday, August 7th. The biotechnology company reported ($0.33) earnings per share for the quarter, missing analysts' consensus estimates of ($0.29) by ($0.04). Iovance Biotherapeutics had a negative return on equity of 51.95% and a negative net margin of 161.44%. The firm had revenue of $59.95 million for the quarter, compared to analysts' expectations of $67.14 million. Research analysts expect that Iovance Biotherapeutics, Inc. will post -1.24 earnings per share for the current year.

Iovance Biotherapeutics Company Profile

(

Free Report)

Iovance Biotherapeutics, Inc, a commercial-stage biotechnology company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States. The company offers Amtagvi, a tumor-derived autologous T cell immunotherapy used to treat adult patients with unresectable or metastatic melanoma; and Proleukin, an interleukin-2 product for the treatment of patients with metastatic renal cell carcinoma.

Featured Articles

Before you consider Iovance Biotherapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iovance Biotherapeutics wasn't on the list.

While Iovance Biotherapeutics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.