XTX Topco Ltd boosted its stake in shares of CNX Resources Corporation. (NYSE:CNX - Free Report) by 118.1% in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 67,512 shares of the oil and gas producer's stock after purchasing an additional 36,555 shares during the quarter. XTX Topco Ltd's holdings in CNX Resources were worth $2,125,000 at the end of the most recent reporting period.

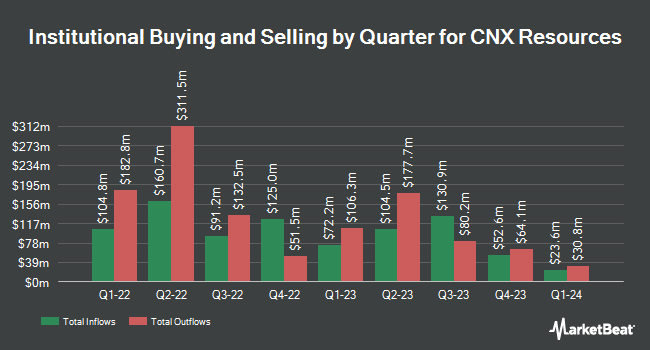

Several other institutional investors and hedge funds have also recently bought and sold shares of CNX. Woodline Partners LP acquired a new stake in shares of CNX Resources during the 4th quarter valued at $71,971,000. Arrowstreet Capital Limited Partnership acquired a new position in CNX Resources during the 4th quarter worth $37,923,000. Millennium Management LLC boosted its holdings in CNX Resources by 69.1% during the fourth quarter. Millennium Management LLC now owns 1,154,588 shares of the oil and gas producer's stock valued at $42,339,000 after acquiring an additional 471,763 shares during the period. Northern Trust Corp grew its position in shares of CNX Resources by 20.5% in the fourth quarter. Northern Trust Corp now owns 2,421,387 shares of the oil and gas producer's stock valued at $88,792,000 after purchasing an additional 411,485 shares during the last quarter. Finally, Raymond James Financial Inc. bought a new position in shares of CNX Resources in the fourth quarter worth about $14,268,000. Institutional investors own 95.16% of the company's stock.

Insider Activity

In other news, Director J. Palmer Clarkson bought 10,000 shares of CNX Resources stock in a transaction on Monday, May 12th. The stock was purchased at an average cost of $31.20 per share, with a total value of $312,000.00. Following the purchase, the director directly owned 245,433 shares of the company's stock, valued at approximately $7,657,509.60. This trade represents a 4.25% increase in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Company insiders own 4.59% of the company's stock.

CNX Resources Stock Performance

Shares of NYSE:CNX traded up $0.11 during trading on Monday, hitting $29.02. 1,079,107 shares of the company traded hands, compared to its average volume of 2,726,073. The stock has a market capitalization of $4.10 billion, a price-to-earnings ratio of 49.19, a PEG ratio of 0.28 and a beta of 0.64. CNX Resources Corporation. has a one year low of $23.85 and a one year high of $41.93. The company has a quick ratio of 0.30, a current ratio of 0.33 and a debt-to-equity ratio of 0.56. The business's fifty day moving average is $32.55 and its 200-day moving average is $31.03.

Analyst Upgrades and Downgrades

Several analysts have recently weighed in on the stock. Mizuho lifted their target price on shares of CNX Resources from $35.00 to $36.00 and gave the company an "underperform" rating in a research report on Tuesday, May 13th. Scotiabank restated a "sector perform" rating and set a $35.00 target price (up from $33.00) on shares of CNX Resources in a report on Friday, July 11th. Piper Sandler raised their target price on shares of CNX Resources from $25.00 to $26.00 and gave the company an "underweight" rating in a research note on Friday. Cowen restated a "hold" rating on shares of CNX Resources in a research note on Friday, April 25th. Finally, Barclays began coverage on shares of CNX Resources in a research report on Monday, July 7th. They set an "equal weight" rating and a $33.00 price objective for the company. Eight equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $31.92.

Check Out Our Latest Stock Report on CNX

About CNX Resources

(

Free Report)

CNX Resources Corporation, an independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin. The company operates in two segments, Shale and Coalbed Methane (CBM). It produces and sells pipeline quality natural gas primarily for gas wholesalers.

Read More

Before you consider CNX Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNX Resources wasn't on the list.

While CNX Resources currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.