Bessemer Group Inc. reduced its position in shares of Cognex Corporation (NASDAQ:CGNX - Free Report) by 61.2% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 33,474 shares of the scientific and technical instruments company's stock after selling 52,697 shares during the period. Bessemer Group Inc.'s holdings in Cognex were worth $998,000 at the end of the most recent reporting period.

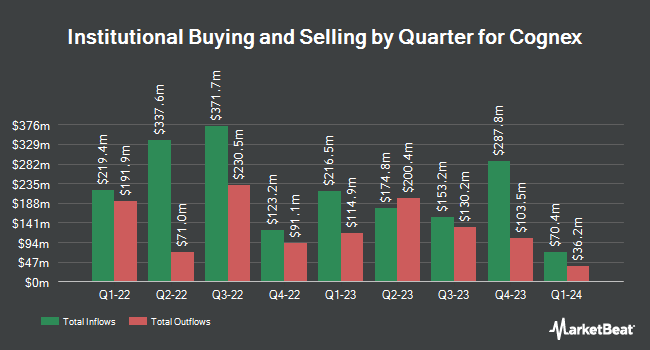

Several other large investors have also modified their holdings of the company. Golden State Equity Partners bought a new stake in Cognex in the 1st quarter valued at $379,000. Lecap Asset Management Ltd. boosted its holdings in Cognex by 115.0% in the 1st quarter. Lecap Asset Management Ltd. now owns 52,336 shares of the scientific and technical instruments company's stock valued at $1,561,000 after purchasing an additional 27,992 shares during the period. Oppenheimer Asset Management Inc. boosted its holdings in Cognex by 31.6% in the 1st quarter. Oppenheimer Asset Management Inc. now owns 275,103 shares of the scientific and technical instruments company's stock valued at $8,206,000 after purchasing an additional 66,137 shares during the period. Covea Finance boosted its holdings in Cognex by 17.0% in the 1st quarter. Covea Finance now owns 86,000 shares of the scientific and technical instruments company's stock valued at $2,565,000 after purchasing an additional 12,500 shares during the period. Finally, Global X Japan Co. Ltd. bought a new stake in Cognex in the 1st quarter valued at $38,000. 88.12% of the stock is owned by institutional investors.

Cognex Stock Performance

CGNX traded down $0.28 during midday trading on Friday, hitting $32.50. The company had a trading volume of 1,385,894 shares, compared to its average volume of 1,633,320. The company has a market capitalization of $5.46 billion, a PE ratio of 47.79 and a beta of 1.47. Cognex Corporation has a twelve month low of $22.67 and a twelve month high of $53.13. The firm's 50-day simple moving average is $30.23 and its 200-day simple moving average is $32.13.

Cognex Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, May 29th. Stockholders of record on Thursday, May 15th were given a dividend of $0.08 per share. This represents a $0.32 annualized dividend and a dividend yield of 0.98%. The ex-dividend date was Thursday, May 15th. Cognex's dividend payout ratio is 47.06%.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on CGNX. Needham & Company LLC increased their price target on shares of Cognex from $33.00 to $36.00 and gave the company a "buy" rating in a report on Wednesday, June 11th. DA Davidson restated a "neutral" rating and issued a $32.00 price objective on shares of Cognex in a research note on Monday, June 16th. Robert W. Baird increased their price objective on shares of Cognex from $30.00 to $32.00 and gave the company a "neutral" rating in a research note on Monday, June 16th. TD Cowen upgraded shares of Cognex from a "hold" rating to a "buy" rating and set a $35.00 price objective for the company in a research note on Monday, April 28th. Finally, Citigroup dropped their price objective on shares of Cognex from $37.00 to $26.00 and set a "neutral" rating for the company in a research note on Monday, April 14th. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating, six have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Cognex presently has an average rating of "Hold" and an average price target of $39.17.

View Our Latest Research Report on Cognex

About Cognex

(

Free Report)

Cognex Corporation provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide. Its machine vision products are used to automate the manufacturing and tracking of discrete items, including mobile phones, electric vehicle batteries, and e-commerce packages by locating, identifying, inspecting, and measuring them during the manufacturing or distribution process.

Read More

Before you consider Cognex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognex wasn't on the list.

While Cognex currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.